Meme coins dominate 35% of Bitcoin transactions as BTC eyes $70,000 target

- Meme coins account for 35% of over 99 million transactions on Bitcoin blockchain since January 1, per Galaxy Research data.

- Runes, meme coins on Bitcoin failed to boost activity on the chain, after two years of positive price action, monthly active users lags behind.

- Bitcoin could sweep liquidity at $58,500 before another leg up, towards the $70,000 target.

Bitcoin (BTC) on-chain activity lags despite meme coins, Runes, dominating 35% of the transactions on the chain. Data from Bitcoin Magazine shows that even with Bitcoin rallying towards new all-time high with two years of positive price action, the monthly active users on the Bitcoin network are at levels comparable to when the price was $4,000.

Bitcoin on-chain activity lags, fails to catalyze gains in BTC

Bitcoin network notes 35% transactions from Runes, or meme coins on its chain. Runes is a protocol that allows the creation of fungible tokens on the BTC blockchain. Unlike the BRC-20 and SRC-20 token standard, Runes do not rely on Bitcoin Ordinals protocol.

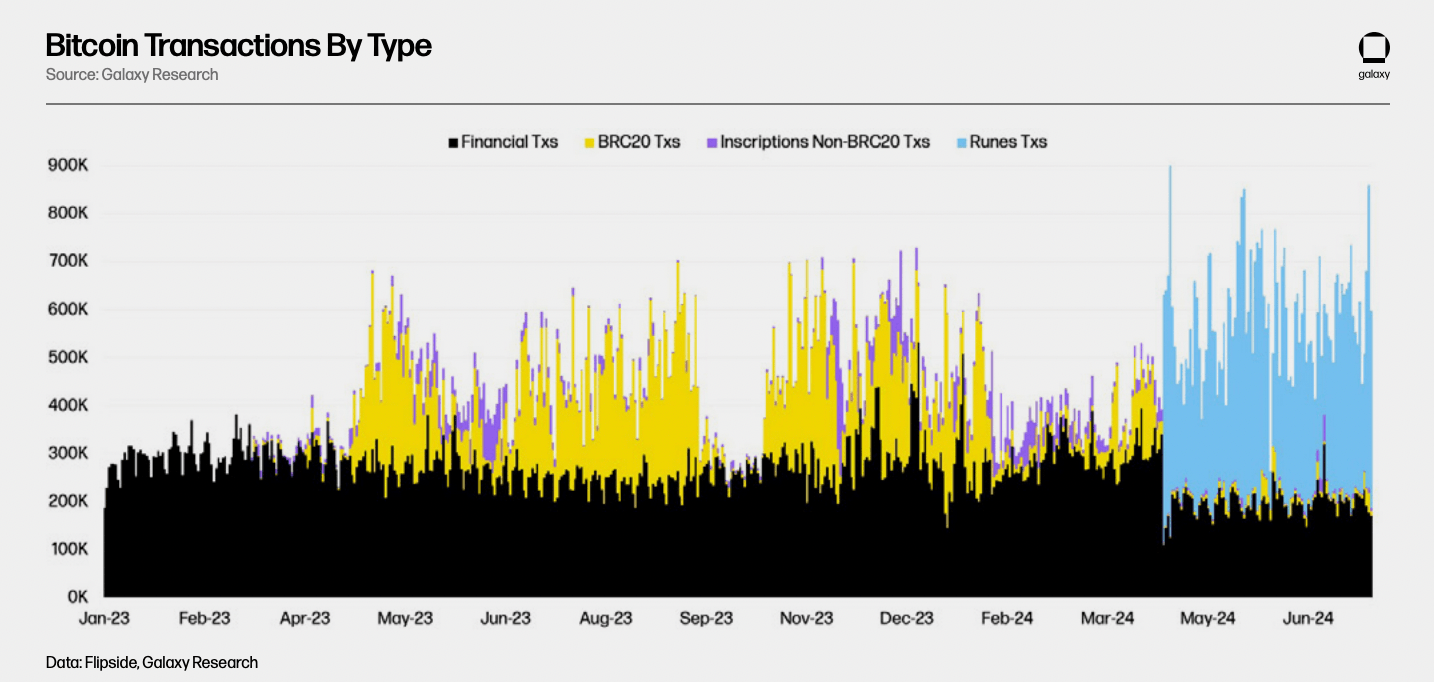

These assets dominated the on-chain activity, transaction count and volume on the Bitcoin network in April/May 2024. Since then their contribution to the Bitcoin blockchain has reduced.

Runes now account for 35% of over 99 million transactions on the chain since January 1, per Galaxy Research data.

Of the remaining transactions, financial transactions and the BRC-20 token standard account for 60%, 4% can be attributed to Ordinals trading.

Bitcoin transactions by type per Galaxy Research

Data from Bitcoin Magazine shows that even as the largest cryptocurrency has two years of positive price action and rallies towards its new all-time high, the level of monthly active users corresponds with BTC from the time when price was under $4,000. This shows a lag between Bitcoin price rally and its on-chain activity.

Active addresses growth trend of Bitcoin

Bitcoin could sweep the $58,500 low before rallying higher

Bitcoin is currently in a multi-month upward trend. BTC is likely to sweep liquidity at the support at $58,526, the July 12 high for the largest asset by market capitalization. Bitcoin could extend gains towards the resistance zone, imbalance between $69,582 to $70,117.

The target for Bitcoin is the $70,000 level.

The momentum indicator Moving Average Convergence Divergence (MACD) indicator shows the signal line crossing above the MACD line, signaling Bitcoin’s underlying trend is negative. BTC is likely to sweep liquidity at its support, MACD supports this thesis.

BTC/USDT daily chart

Bitcoin could find support at the $53,485 level, in the event of further correction.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.