- Meme coins have emerged as the most profitable sector in 2024, averaging returns of over 2,400%.

- AI tokens and RWA are two other key narratives driving profitability for holders.

- Meme coins WIF, BONK, BOME, AI tokens NEAR, FET, and RWA’s ONDO and PENDLE pose a buy-the-dip opportunity to traders.

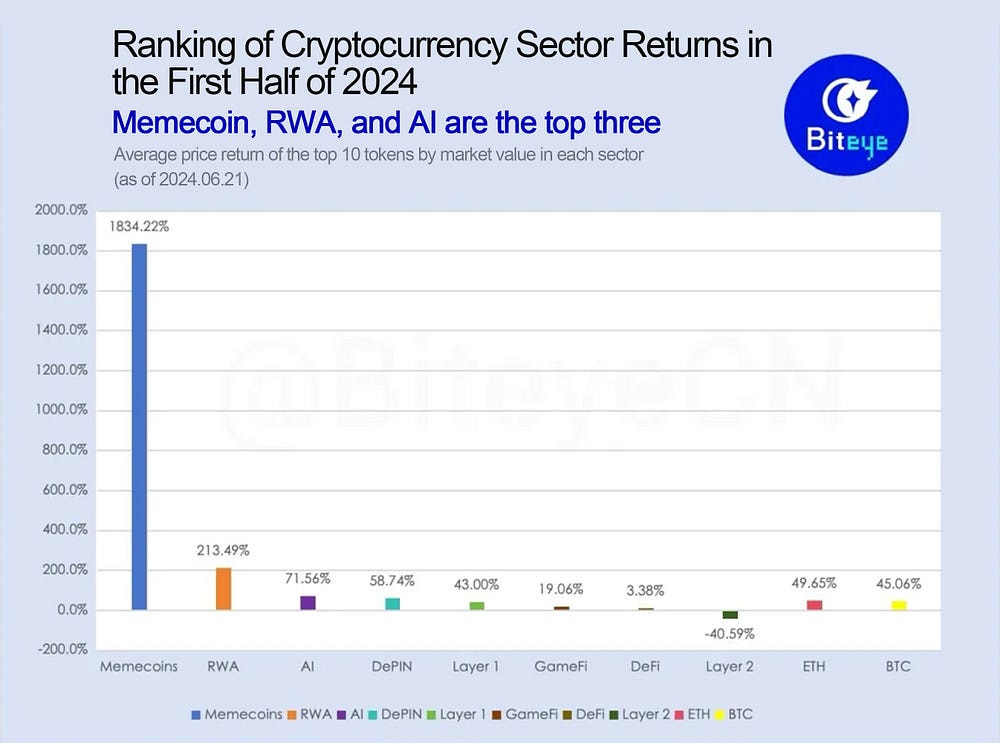

Meme coins, Artificial Intelligence (AI) and Real World Asset tokenization (RWA) are the dominant narratives as the first half of 2024 draws to a close. A report by analysts at Biteye shows that the three sectors have emerged as the most profitable ones in 2024.

According to the average year-till-date return rate of the top 10 tokens in each of the three sectors, the performance is as follows:

Ranking of crypto sector returns in the first half of 2024

Most profitable sector in H1 2024 is meme coins

The shift in narrative from value investing to going “all-in” on meme coins happened in the first half of 2024. This gradual shift made the meme coin sector one of the most profitable compared to Layer 1, Gaming Finance, DeFi, Layer 2, Ethereum, Bitcoin, Real World Assets (RWA) and Artificial Intelligence (AI).

As of June 19, three of the top 10 meme coins ranked by market capitalization were launched in March or April 2024: Brett (BRETT), Book of MEME (BOME), and Dog go to the moon (DOG).

The report shows that BRETT had the highest return at 14,353% from its issuance price, WIF rallied over 933% year-to-date (YTD), and meme coin profitability is over 500 times that of the least profitable sector, DeFi.

Among top meme coins, Dogwifhat (WIF), BOME, and Bonk (BONK) are down between 2% and 4% in the 24-hour timeframe, and their market capitalization is upwards of $625 million. The top three meme tokens offer a “buy the dip” opportunity to traders before the next imoulse in the narrative.

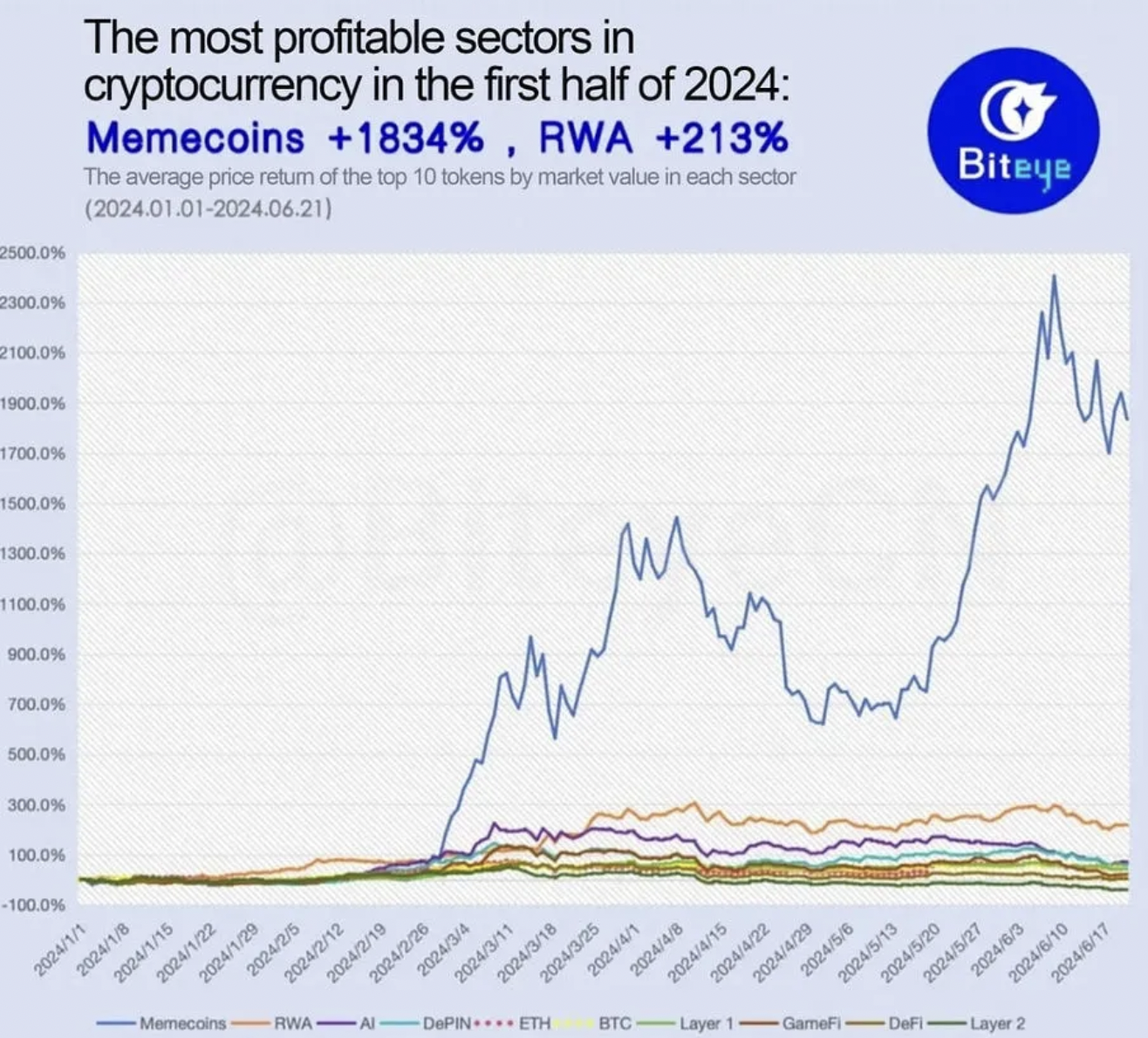

Average returns of the top 10 tokens by market value in each sector

AI and RWA tokens among top-gaining sectors in 2024

The second most profitable sector, RWA, has offered traders 213% returns in 2024. The concept of RWA has made headlines, and institutional investors like BlackRock have discussed the narrative in H1 2024.

In February 2024, RWA was briefly the most profitable sector among the three, but meme tokens and AI surpassed it after that.

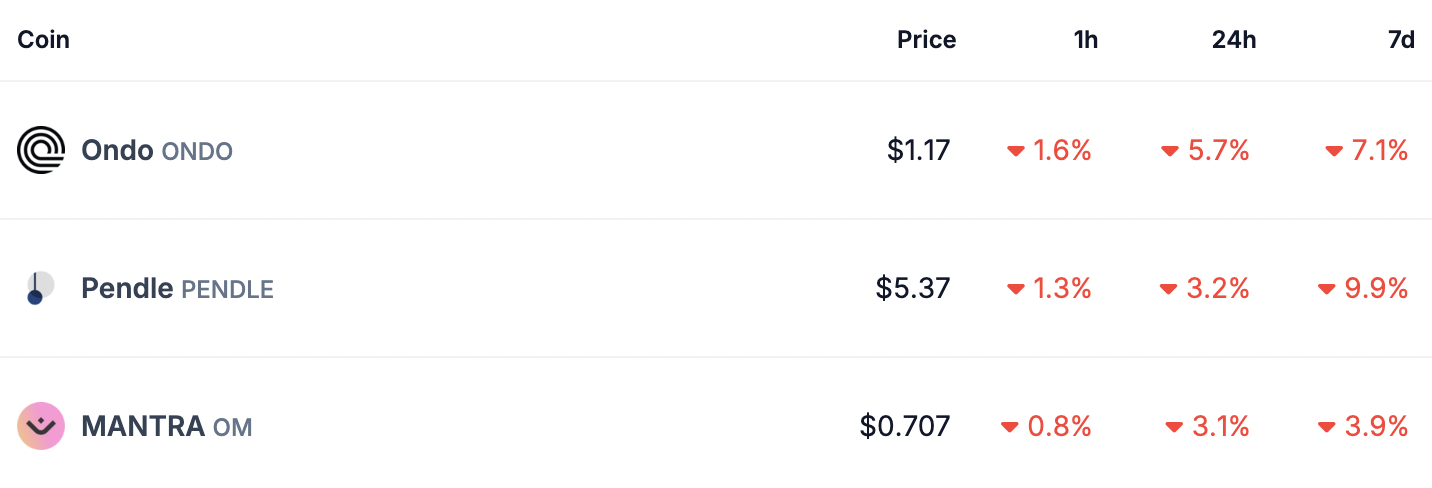

The top token in the RWA narrative is Ondo Finance (ONDO), with YTD gains of 451%. Among the top three tokens in the sector, ONDO, Pendle (PENDLE), and Mantra (OM) wiped out between 3% and 6% of their value in the past 24 hours. This offers traders a buy-the-dip opportunity on Thursday.

RWA narrative assets

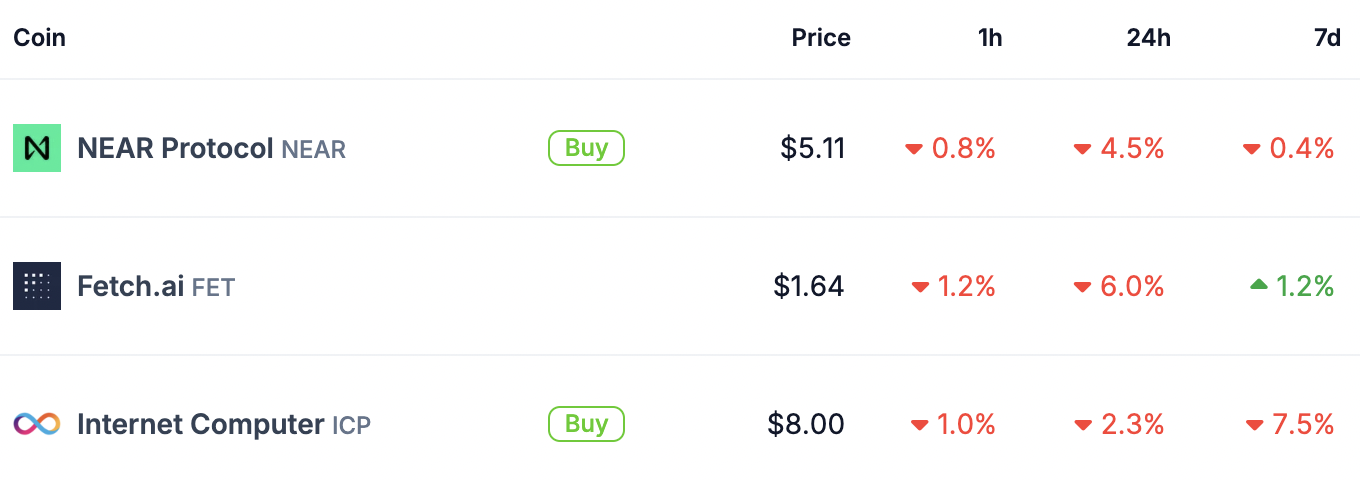

The AI sector offered traders over 71% gains. Among the top tokens of the sector, Arkham (ARKM) rallied 215%, and AIOZ Network added 192% to its value. NEAR Protocol (NEAR), Fetch.ai (FET), Internet Computer (ICP) prices are down between 2% and 5% in the past 24 hours. The three AI tokens pose an opportunity for traders to “buy the dip.”

AI tokens

The market capitalization of the three sectors is down nearly 3% in the past 24 hours, per CoinGecko data.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.