Meet Polkadot's next generation of decentralized governance as DOT price struggles to clear $7.70

- Polkadot price must close the day above $7.70 to affirm the bulls' presence in the market for gains eyeing $9.50.

- Polkadot flaunts upcoming parachains that could revolutionize Web3 and improve decentralized governance.

- Fellowship, a parachain dedicated to collectives, will eliminate the need for third-party input in Web3.

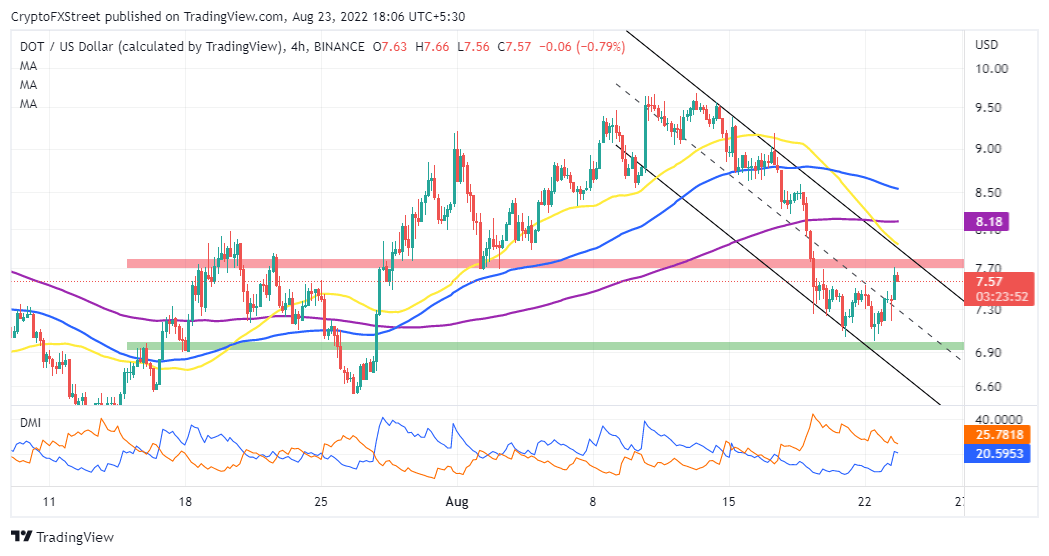

Polkadot price is struggling to find a solid footing in the wave of declines endured from around mid-August. The parachain token bounced off support at $7.00, but seller congestion at $7.70 stands in the way of gains its major hurdle at $9.50. It goes without saying that a break above this resistance might trigger new buy entries and ultimately propel DOT highs beyond $9.50.

Polkadot announces a parachain dedicated to collectives

On Tuesday, Polkadot's development team announced via Twitter that ParityTech is developing several new blockchains to function as "common good parachains." It is worth mentioning that Polkadot governance can "allocate parachain slots," but only to chains, which it deems vital to the larger network. All the chosen chains sidestep the auction process.

According to the Twitter thread, Fellowship is a parachain that will be dedicated to collectives. This chain would offer the capability to organize and operate as a group without the need to trust outside parties (like attorneys and judges), which is a crucial component of Web3.

What Polkadot price needs to the uptrend to $9.50?

Two key levels currently hold Polkadot price hostage – the immediate resistance at $7.70 and support at $7.00. A break on either side of these limits would determine DOT's next direction.

Polkadot bulls must firmly defend the descending parallel channel's throughline to resume the move to $9.50. Such a move would sabotage the bears' desire to see DOT retest support at $7.00 while keeping an eye on upper levels at $7.70 and $9.50, respectively.

DOT/USD four-hour chart

The Direction Movement Index (DMI) has a positive signal suggesting that Polkadot price is more poised for the move north as opposed to exploring downstream levels at $7.00 and $6.00. Traders should closely watch as the -DI crosses above the +DI to validate the $9.50 bound gains.

The gravity of the Polkadot price seller congestion at $7.70 cannot be ignored, especially after the 50-day Simple Moving Average (SMA) crossed below the 200-day SMA on the same four-hour chart. Therefore, a firm break above $7.70 is required to avoid a bull trap.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren