MATIC set to squeeze out some minor gains for week

- Polygon prices fade slightly in European trading but still hold onto +1% daily gain.

- MATIC flirts with the opening price from Monday morning.

- It will be important to see where MATIC can close at the US closing bell before going into the weekend.

Polygon (MATIC) price is on the cusp of catching up for at least some of the incurred losses for November as price action is bouncing off an interesting support level. With markets being reminded again of the tail risks still hanging over price action, MATIC could receive some underpinning from bulls. Expect to see MATIC trying to squeeze out a small gain for the week on Friday, with an important close setting up the weekend that could hold more gains.

MATIC is at a key level that could bring 7% gain over the weekend

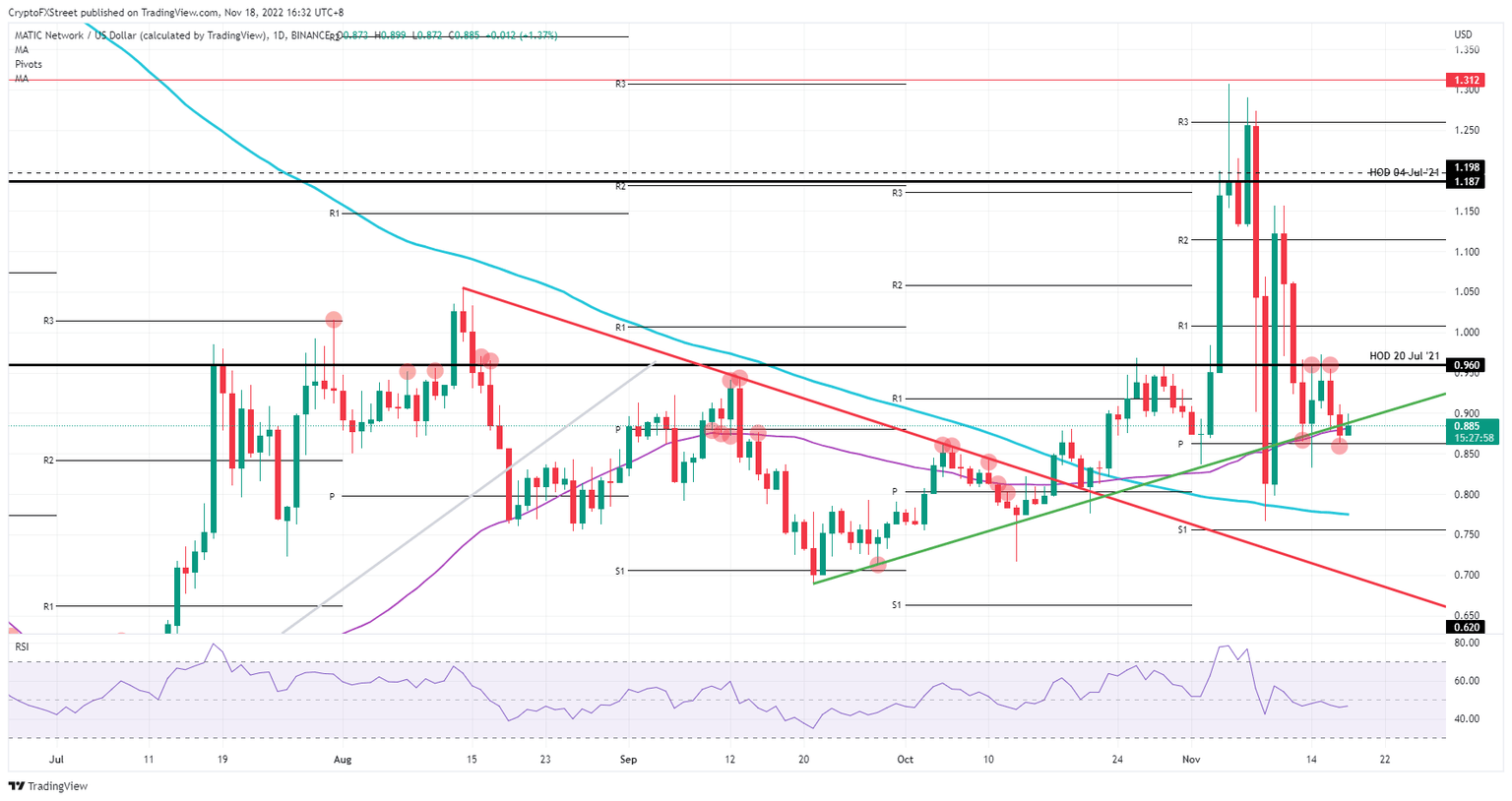

Polygon price is currently flirting with the opening price from Monday morning during the ASIA PAC session at $0.888. It would be good for morale and confidence if MATIC can close above that marker and possibly above the green ascending trend line and the 55-day Simple Moving Average (SMA) that all meet around that same level. This makes the $0.888 level a crossroads that could see some more follow-through into the weekend, should bulls be able to keep supporting the price action and accomplish the mission to get that Friday close above $0.888.

If this vision is carried to fruition, MATIC price would set forth a good weekend as traders would get a hall pass to rally higher toward $0.96. Although that means only a slim 7% profit, it would make sense as the Relative Strength Index (RSI) would not overheat too quickly and could be the first signal that more gains are at hand. With the holiday week in the US next week, a Thanksgiving rally could be underway with $1.18 on the horizon.

MATIC/USD daily chart

It is a good reminder yet again that the current tail risks are still alive and present and could flair up at any moment. Although markets were on edge on the back of that missile attack in Poland, the situation de-escalated in just 12 hours. However, it comes with an advisory that traders need to keep in mind that the war in Ukraine is far from over. The comments from both Ukraine and Russia on Thursday show that they are still miles apart from one another, and any next escalation could easily push MATIC back to $0.862 or $0.777 on the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.