- MATIC price drops back below the 2021 VPOC, signaling weakness.

- Bear flag signals continuation move south.

- A Target zone of $0.85 could create a very bullish setup.

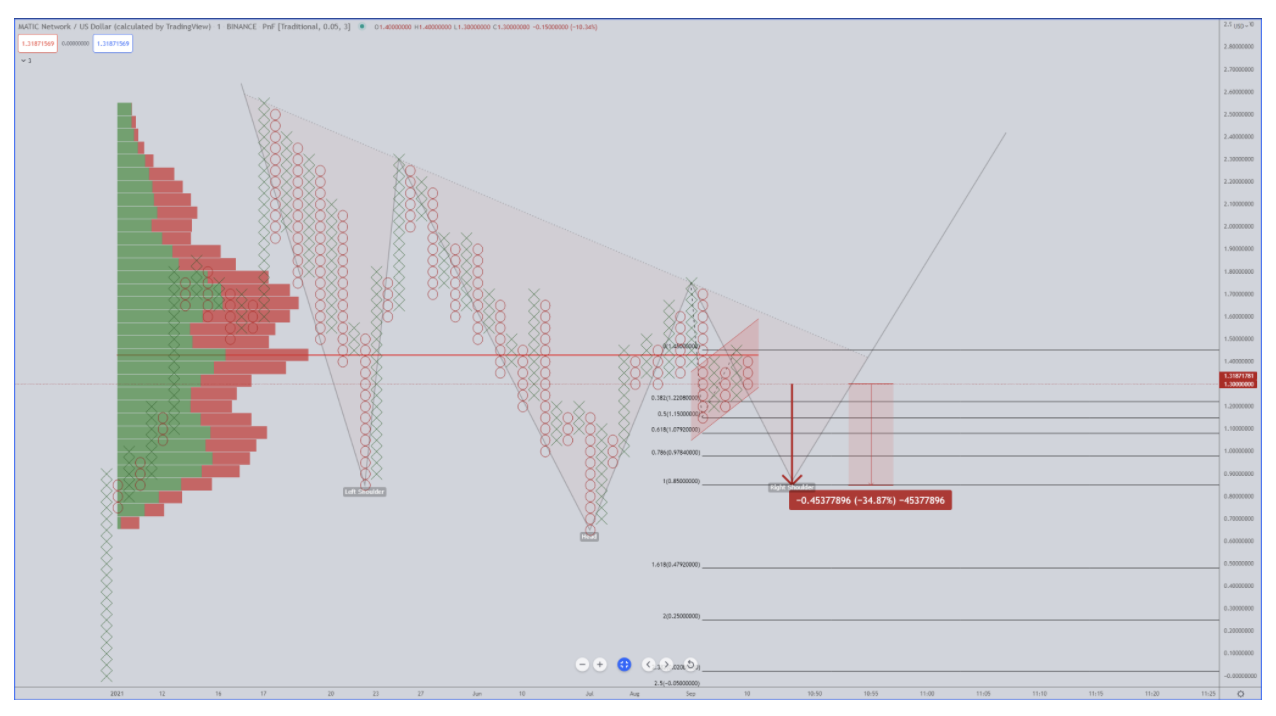

Polygon’s price has not been immune to the weakness across the entire cryptocurrency market. Before the flash crash on Tuesday, MATIC has struggled to maintain any trending price moves above the psychological price point of $1.50. The consistent rejection against $1.40 is now a warning signal that lower prices are incoming.

MATIC price action suggests a strong move south, could trade below the $1.00 range

The 2021 VPOC (Volume Point-Of-Control) sits at $1.42 and has acted as the primary resistance level for MATIC. The current pattern on the $0.05/3-box reversal Point and Figure chart is forming a Bull Trap. A double-bottom will start if the recent column of Os falls to $1.20. One more box below $1.18 would likely trigger a continued drop towards the 100% Fibonacci expansion at $0.85.

For long-term bulls and hodlers, a drop to $0.85 may be a fortuitous development. The right shoulder of an inverse head-and-shoulder pattern could likely find its bottom upon reaching $0.85. Coincidentally, an expected breakout aboe the neckline in the future would coincide with a breakout above the 2021 VPOC and will likely usher in a significant, new bull phase.

MATIC/USD chart

In the near term, bears will want to be cautious of a clear return to the $1.55 value area as this would invalidate the current Bull Trap Point and Figure pattern. Any near-term bearish outlook will be effectively terminated if MATIC price drives up to $1.80.

Bulls and bears will want to pay special attention to MATIC price behavior if it returns to $0.85. The 161.8% Fibonacci expansion at $0.48 is an easy target for bears to reach. The volume profile thins out considerably below $0.85. This means that the MATIC price has a more manageable (and faster) time moving lower than higher.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's (SEC) Crypto Task Force met with El Salvador's National Commission on Digital Assets (CNAD) representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

DeFi Dev Corp buys additional 65,305 SOL amid broader institutional interest: Solana price slides below $150

Solana (SOL) price faces growing overhead pressure and slides below $150 to trade at $148 at the time of writing on Thursday. The sudden pullback follows the crypto market's edging higher on improving investor sentiment, which saw SOL climb to $154 on Wednesday.

Uniswap Price Forecast: UNI whale moves 9 million tokens to Coinbase Prime

Uniswap (UNI) price hovers around $5.92 at the time of writing on Thursday, having rallied 12.8% so far this week. According to Wu Blockchain, data shows that the address potentially related to the Uniswap team, investor, or advisor transferred 9 million UNI to the Coinbase Prime Deposit on Thursday.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.