MATIC price recovery catalysts to watch out for in Polygon ecosystem

- Polygon launched its latest zero-knowledge EVM product, potentially creating go-to Layer 2 protocols for users.

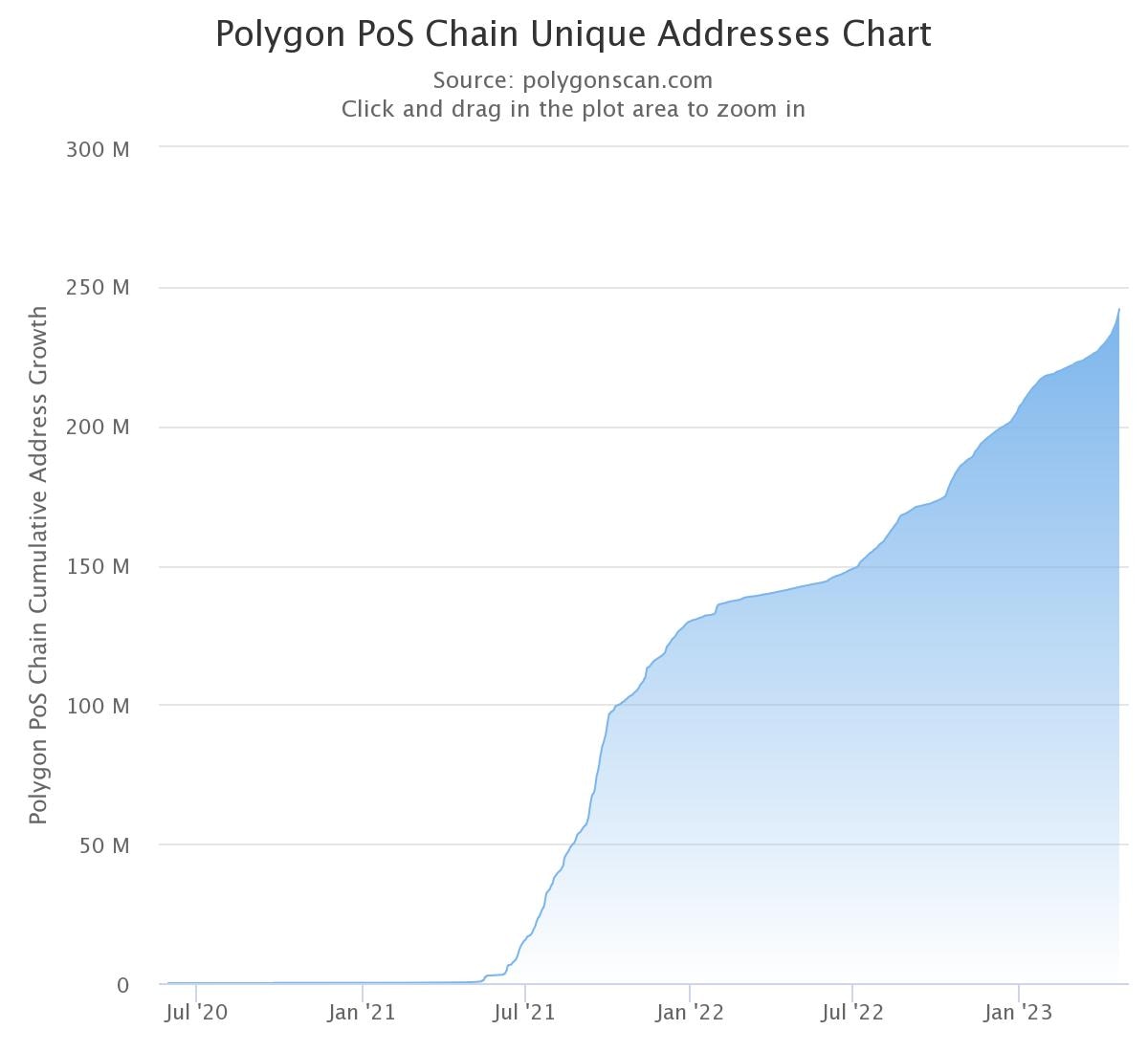

- MATIC’s blockchain crossed 240 million unique addresses, rising accumulation and social dominance could fuel a recovery in the token’s price.

- Polygon network projects building on zkEVM could shift priority to scaling, catalyzing MATIC price recovery.

MATIC network launched its latest product offering in the zero-knowledge domain on March 27. Since the launch of zero-knowledge Ethereum Virtual Machine’s (zkEVM) beta, projects like Mantis are actively building in the Polygon ecosystem.

MATIC accumulation by whales could drive the token’s price higher

Whale accumulation is an on-chain metric that signals the unified outlook of long-term investors. Accumulation by large wallet investors denotes a bullish outlook and analysts refer to this metric to ascertain the direction of MATIC price trend.

There is clear accumulation by MATIC holders in three distinct segments, 100,000 to 1,000,000; 1,000,000 to 10,000,000 and 10,000,000 to 100,000,000 are scooping up more tokens consistently.

%2520%5B11.49.34%2C%252024%2520Apr%2C%25202023%5D-638179154116626887.png&w=1536&q=95)

MATIC accumulation

This accumulation trend signals a shift in sentiment among long-term holders. It could act as a catalyst for MATIC price recovery. Polygon ecosystem’s rising social dominance is another factor likely to drive the token’s recovery.

Polygon’s social dominance is on the rise

%2520%5B11.53.56%2C%252024%2520Apr%2C%25202023%5D-638179154424307322.png&w=1536&q=95)

MATIC social dominance v. price

In the case of metric, there is a consistent increase in social dominance since March 14. Further increase in social dominance is likely to act as a catalyst for MATIC price.

Another key indicator of increasing adoption of MATIC is the rise in unique addresses on Polygon’s blockchain. Based on data from Polygonscan, the total number of wallet addresses has crossed 240 million, signaling a rise.

Polygon’s unique wallet addresses

The number of wallet addresses has climbed consistently since July 2021, as seen in the chart above.

Polygon’s rollout of its zkEVM mainnet beta ushered in a number of projects building actively in its ecosystem. Mantis is one such projects, gearing up for launch on Polygon’s zkEVM. CryptoShiro_ has shared further details on the decentralized automated market maker in the tweet thread below:

Polygon zkEVM is the new innovation in the @0xPolygon Ecosystem.

— Shiro (@CryptoShiro_) April 21, 2023

zk Scaling will be the next big Narrative after Optimistic Rollups (Arbitrum, Optimism, ...)

However, there are still few protocols building on zkEVM.

Don't miss one of the first movers!

A THREAD

(+ Alpha) pic.twitter.com/rJbRCzdcTF

MATIC price recovery targets

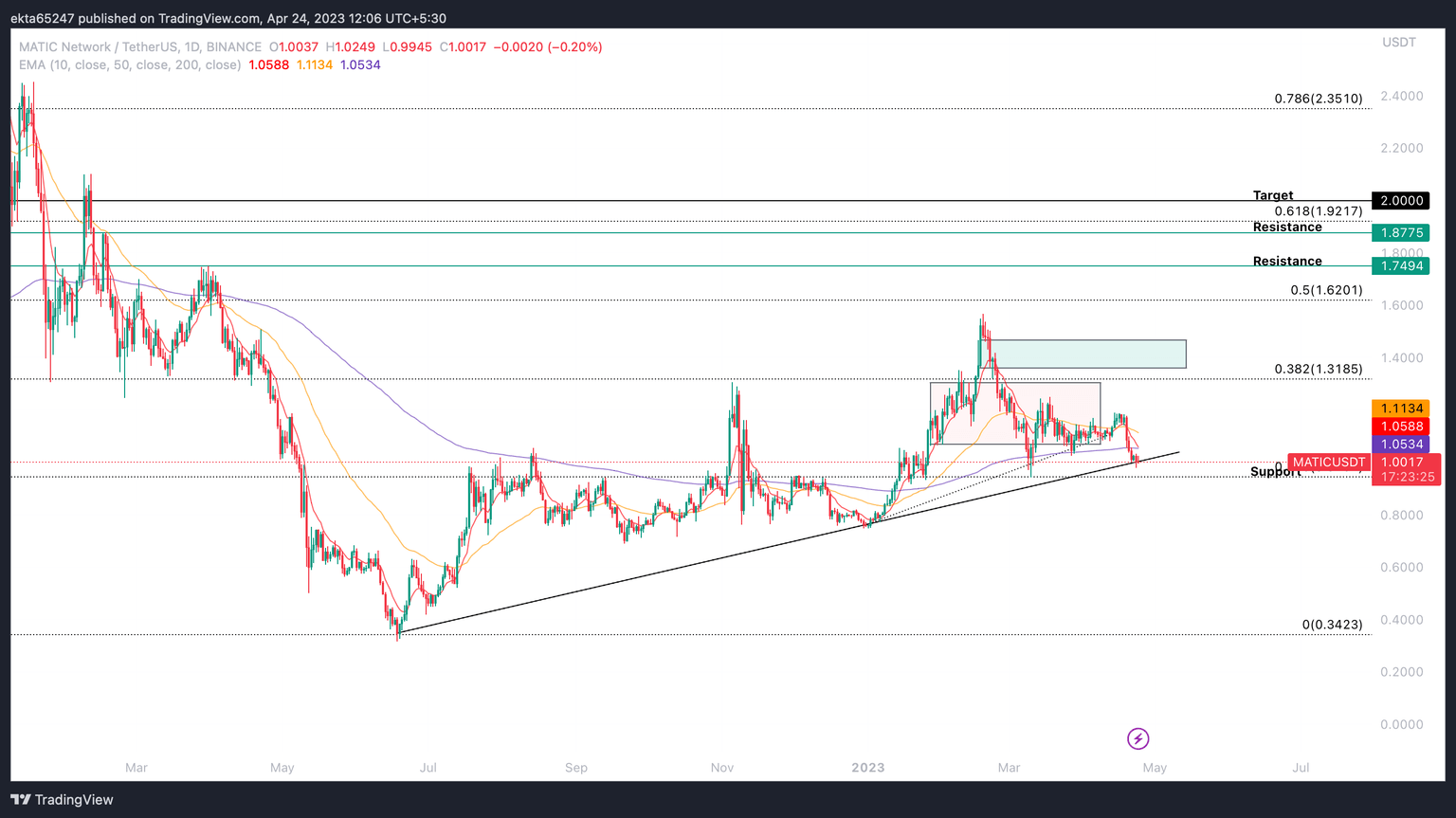

MATIC price is currently in a multi-month uptrend that started in July 2022. The asset’s price climbed consistently staying above the trendline as seen in the MATIC/USDT one-day price chart below.

MATIC price has a key resistance zone between $1.06 and $1.30, this is a zone that needs to be breached in Polygon’s uptrend. Once MATIC price crosses this hurdle, next resistance zone is between $1.35 and $1.46.

These levels have been identified by locating support and resistance levels where the asset has spent a majority of its time in 2021 and 2022, during its downtrend.

MATIC/USDT 1D price chart

The targets for MATIC price are 38.2%, 0.50% and 61.8% Fibonacci retracement levels at $1.31, $1.62 and $1.92 respectively. In the event that MATIC price breaches below the trendline, a decline to support at $1 is likely.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.