MATIC Price Prediction: Polygon price set to jump as tailwinds broaden

- Polygon price sees bulls performing kneejerk reaction in the RSI.

- MATIC price gains 2% during ASIA PAC and European session, set to rally back above $1.60.

- Expect to see MATIC close the trading week with gains and price near $1.75.

Polygon (MATIC) price sees bulls performing a blow to bears with the Relative Strength Index (RSI) nudging upwards, triggering a bit of profit-taking amongst nervous short-sellers that possibly will not see their profit target met at $1.40 or $1.30. Up until Wednesday, MATIC price was dragging a lot of tail risk with it, but after the Fed Minutes, comments from US President Joe Biden and more sanctions on Russia coming from the EU, investors have all the pieces of the puzzle to move forward and place their investments.

A warm tailwind joins Polygon price and could set the tone for Friday, rallying back to new highs for April.

MATIC price is set to pop above $1.75 and the 200-day SMA

Polygon price is performing a kneejerk reaction that hurts bears in the process. The renewed interest and trust in cryptocurrencies comes from investors fearing the Fed would make a policy mistake, trapping investors with hefty losses. Cryptocurrencies are always first on the chopping block in case a safe-haven flow is triggered. With a decent amount of tail risks fading or being resolved, investors see a window of opportunity to enjoy some new gains in the cryptocurrency markets, with MATIC as one of the ideal candidates.

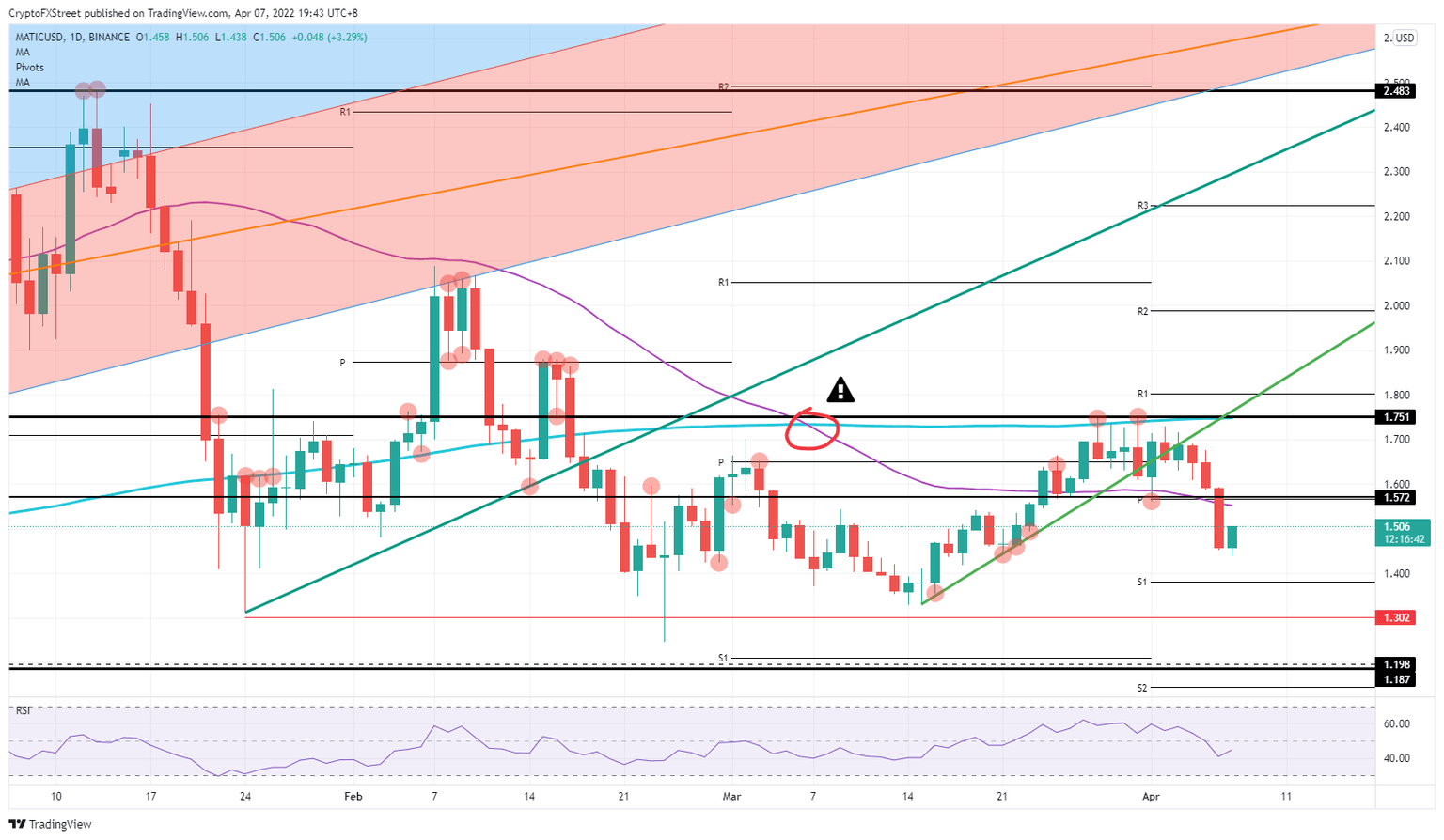

MATIC price is set to return up to $1.60, turning the 55-day Simple Moving Average (SMA) and the historic pivotal level at $1.57 back into support. From there, it is the ideal jumping point to stretch further and try to top $1.75, which falls in line with the 200-day SMA. If bulls can pull that off, and with the RSI not yet in overbought territory, new highs for the year could be just around the corner.

MATIC/USD daily chart

With more embargoes and sanctions being issued, the economic situation for Russia could start to bite even more. The US has already warned other countries not to make deals with Russia, or sanctions could be coming to them in an attempt to isolate Vladimir Putin completely. Should Russia retaliate with nuclear weapons, expect to see a sharp nosedive drop towards $1.20.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.