MATIC Price Prediction: Polygon marches steadily toward $1.30

- MATIC price respected the short-term ascending trend line from June 26.

- After the risk-off sentiment in the markets yesterday, traders will buy the dip today.

- With a technical indicator becoming support, the road for Polygon is clear for further upside.

Global indices on Monday fell sharply, with the Dow Jones trading below 1% at one point. But sentiment changed overnight, and investors are back playing the buy-the-dip tune, especially with regard to Polygon (MATIC).

MATIC price is very slowly but surely in a squeeze to the upside

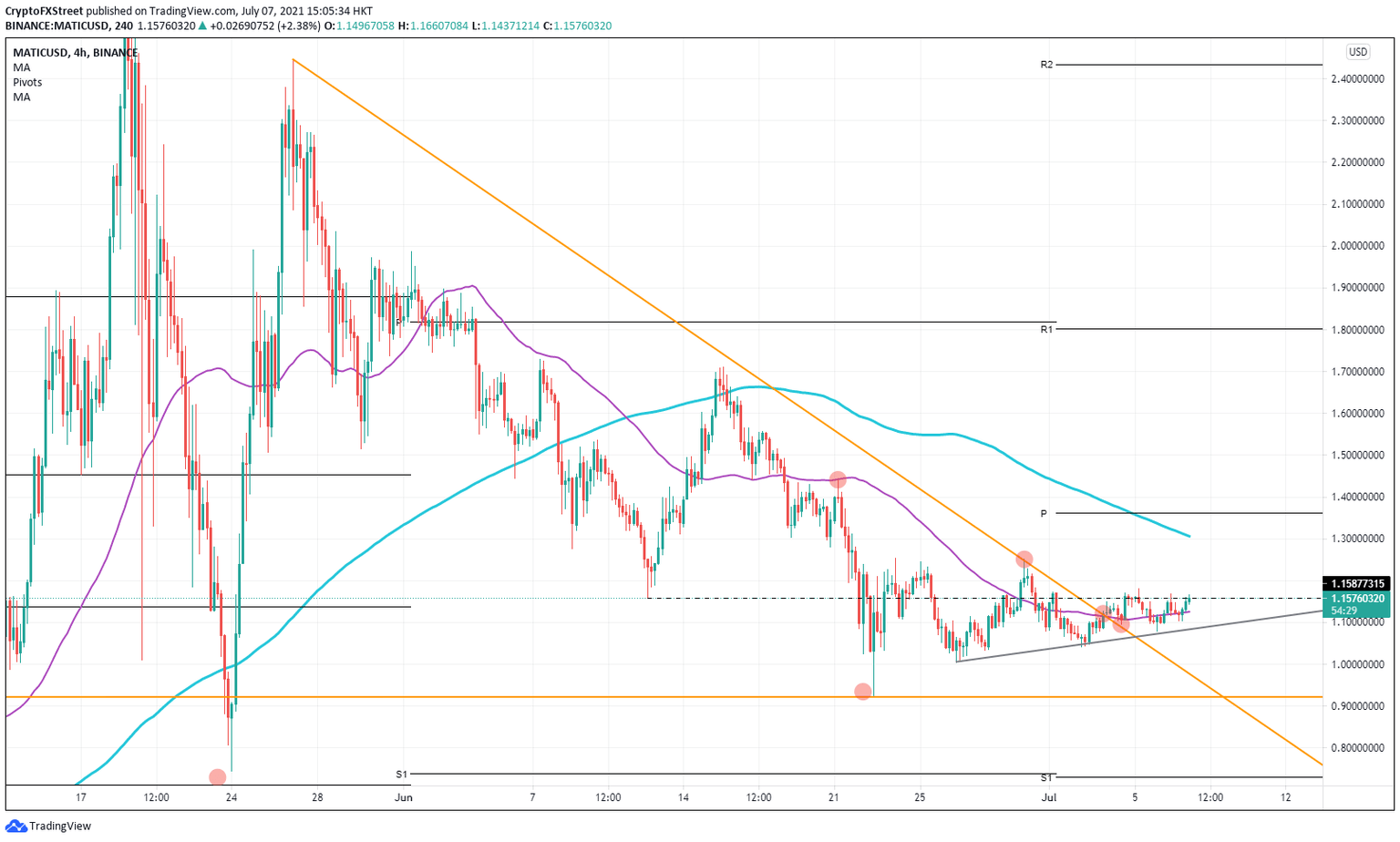

MATIC price had difficulties looking for any upside the past few weeks. Every attempt for a break higher either got rejected by the 55-day Simple Moving Average (SMA) on the 4-hour chart or Polygon price had to face the orange descending trend line from May 27.

But the dip toward $0.92 still has buyers very much in control. An intermediate level at $1.16 has proven to be tricky. After the rejection to the upside on June 29 and the bounce off the descending trend line, we cannot push firmly above that $1.16-marker.

The death cross in the 55-SMA and the 200-SMA on the 4-hour chart placed a cap on the potential upside for MATIC price. But that has changed now, with the 55-day SMA becoming support after a clear break to the upside. Add to that the respected short-term black ascending trend line from June 26, and we have two excellent short-term positions where buyers bought Polygon.

Buyers will wait for a clear break above the 1.16level before looking at taking a profit. The first port of call will be around $1.30, where we have a psychological level and the 200-SMA coming in.

Should market sentiment turn sour again as yesterday, expect a choppy retest around the 50-SMA and a possible third test of the black ascending trendline. If that one fails to hold, look for MATIC to dip toward $1 with its psychological effect and the ascending orange trend line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.