MATIC Price Prediction: Polygon looks for support to bounce to $1.75

- MATIC price gets firm rejection off the monthly pivot to the downside.

- Polygon price will dip further in look for support and put more cash behind the rally.

- Expect a bounce off lower levels with an upswing to top $1.75.

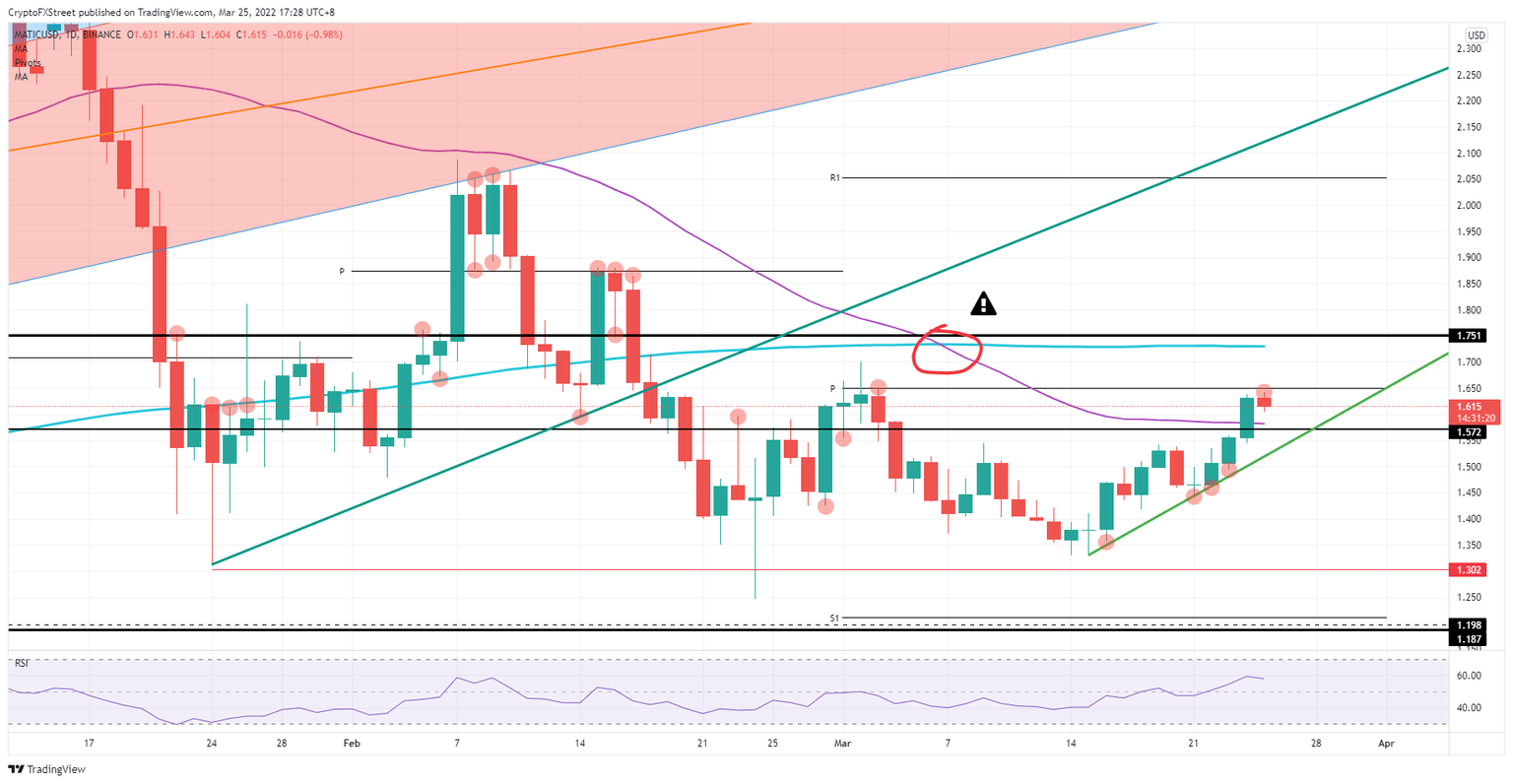

Polygon (MATIC) price undergoes a firm rejection near the monthly pivot at $1.643 this morning. MATIC price is tanking over 1% in the process as the fade sees bears getting involved for a short while and the earlier rejection seems to limit any further upside today. Expect the price to tank further towards $1.572 where it may bounce off either the historic pivotal level or the 55-day Simple Moving Average (SMA), creating an upswing towards $1.751, with the 200-day SMA as a cap.

MATIC price ready for rebound

MATIC price was on the cusp of going out with five consecutive gains this trading week. But instead, the price got cut short this morning after getting rejected near the monthly pivot at $1.643. With the rejection, MATIC price got pushed on the back foot, with bears coming in for a short and bulls taking profit.

Polygon price will probably tank back towards more supportive levels near $1.572 with the historic pivotal level and the 55-day SMA as a double belt of support that could provide plenty of room for bulls to bounce off and see MATIC price action rocket back up towards $1.751. That $1.751 in its turn is holding a double cap on the upside with the 200-day SMA and another historic pivotal level. With this, a solid trade would hold 10% gains.

MATIC/USD daily chart

With the fade on the monthly pivot, the risk to the downside is of MATIC price tanking if it breaks below the $1.572 level. That would open more room for bears to push bulls against the green ascending trend line and effectively turn the rally into a bull trap. If the green ascending trend line breaks, expect a complete paring back of the rally towards $1.35.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.