MATIC Price Prediction: Polygon holders need to be cautious of $0.888

- MATIC price bounced off the range low at $0.721, triggering an 18% upswing.

- If this trend continues, the altcoin will face a resistance confluence at $0.888, which is tough to overcome.

- A daily candlestick close that flips the $0.888 blockade into a support floor will invalidate the bearish thesis.

MATIC price has seen an incredible surge in buying pressure, pushing it higher over the last few days. However, things could turn around quickly as the Bitcoin price shows exhaustion after the recent rally.

MATIC price at an inflection point

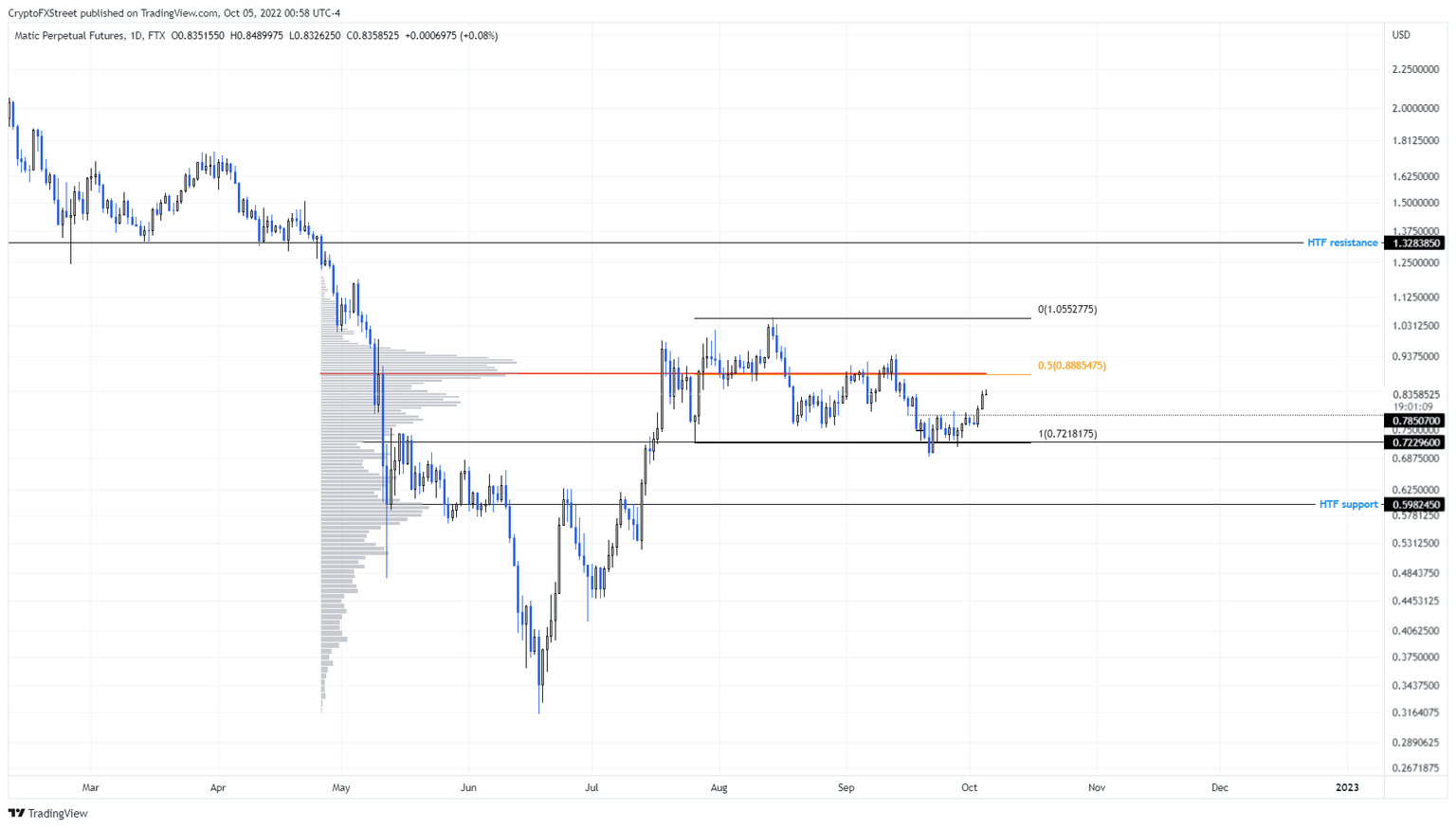

MATIC price rallied 18% after recovering above the range low at $0.721 on September 22. This recovery was a signal that the buyers are back. Adding more credibility to this narrative is the shift in directional bias for Bitcoin price, which caused altcoins, including Polygon, to rally higher.

As a result, MATIC price inflated by 18% and is currently hovering around $0.836, waiting to establish the next trend. However, the volume profile shows that the highest volume between April 26 and October 5 was traded at $0.888, coinciding with the range’s midpoint.

Therefore, an attempt to push higher would be foiled by this blockade. Adding more salt to this wound is the declining bearish momentum in the big crypto. Hence, investors should expect a pullback in the near term.

The apt level for a retest is the immediate support level at $0.785. However, if the sellers do not pause, MATIC price could slide to retest the range low at $0.721. If the support is defended successfully, buyers can once again step up and give the uptrend another attempt.

MATIC/USDT 1-day chart

Regardless of the bearish possibility, investors should note that Bitcoin price could consolidate and continue its ascent. Such a development could cause MATIC price flip the $0.888 blockade.

This development would indicate a resurgence of buyers and invalidate the bearish thesis for Polygon. In such a case, MATIC price could head higher and retest the range high at $1.055.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence MATIC price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.