MATIC Price Prediction: Polygon falls prey to market crash despite adoption spree

- Polygon integrates Gelato Network, bringing smart contract automation for its users.

- Umbrella Network’s decentralized oracles are live on Polygon, allowing access to a wide range of data feeds.

- MATIC price has entered a crucial zone, a bounce from which seems likely.

MATIC price seems to be holding up quite well considering the selling frenzy gripping the cryptocurrency market, while Polygon continues to make headway with its adoption.

Polygon builds ties with Gelato and Umbrella Network

Polygon is an example of an L2 scaling solution that has been on a tear when it comes to adoption. With a plethora of partnerships under its belt, Polygon recently announced an integration of Gelato Network’s automation abilities, which will further help the users and developers of both the communities, increasing efficiency in transactions, costs and speed.

Combining Gelato’s automated smart contract execution and Polygon’s scaling solutions, many centralized tools can now be implemented on Polygon-native products at a fraction of the cost.

Sandeep Nailwal, Co-Founder of Polygon, stated,

We are excited to have Gelato onboard, they are really pushing the boundaries of what once was thought possible for automation on Ethereum. It only makes sense to bring that capability to Polygon for the benefit of our projects and users.

Additionally, MATIC announced ties with Umbrella Network, a scalable, cost-efficient and community-owned oracle.

With DeFi booming right now, projects, developers and users require quick, reliable and tamper-proof data, which has given rise to plenty of oracle blockchains.

With this partnership, Polygon users will leverage decentralized oracles on its network via Umbrella Network’s Layer 2 oracle solutions, allowing them to access critical real-world data, including crypto asset prices, contract information, third-party data and so on.

MATIC price at critical level

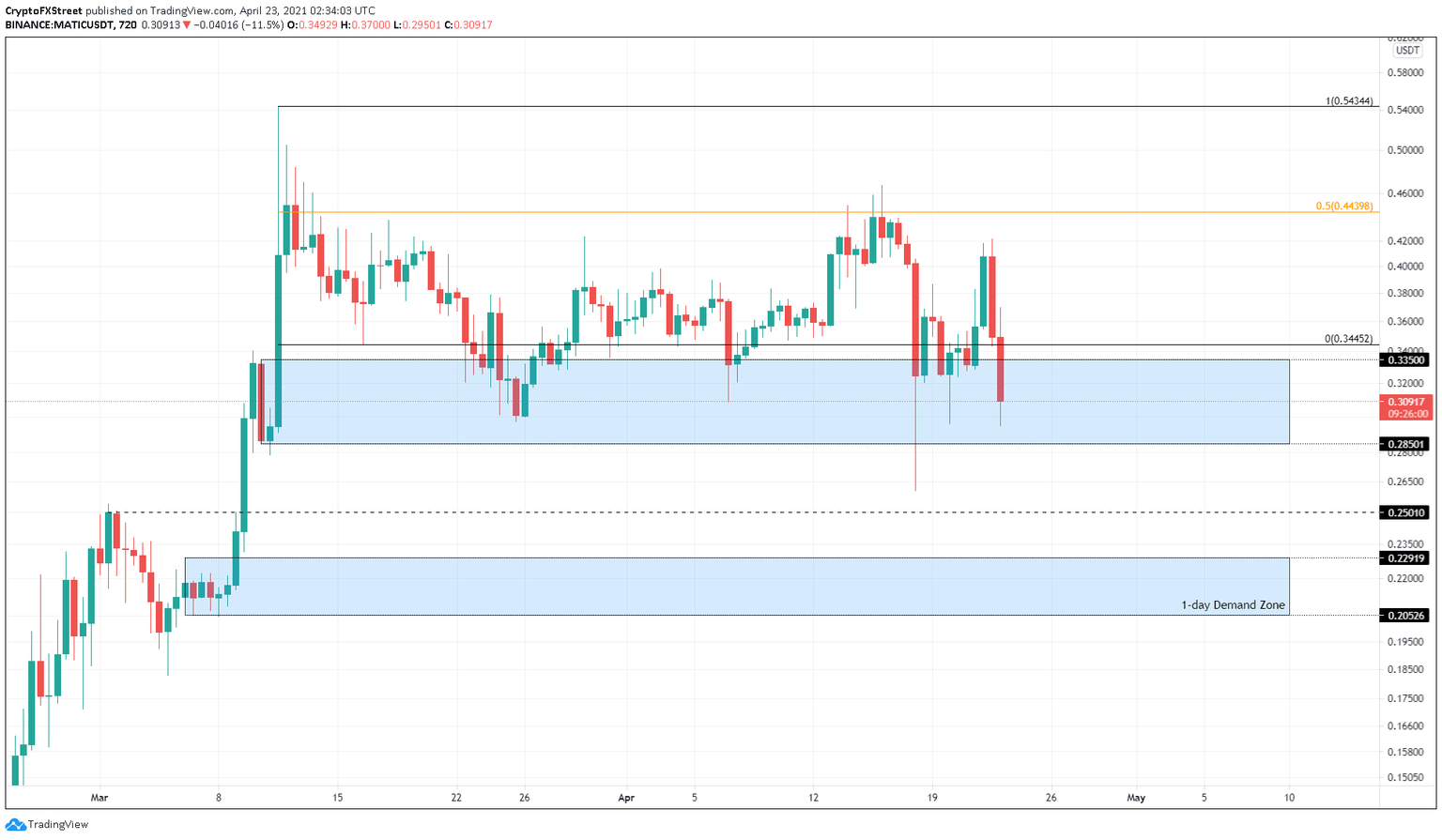

MATIC price shows a breach of the 50 Simple Moving Average (SMA) on the daily chart, which has resulted in a 15% decline tapping $0.295. Interestingly, this level coincides with the SuperTrend indicator’s buy signal that flashed on January 4.

In doing so, MATIC price has pierced the 12-hour demand zone that extends from $0.28 to $0.33. While the sell-off seems to be waning, a decisive close above $0.34 would be bullish for Polygon and promote a 22% upswing to the recent swing high at $0.42.

MATIC/USDT 1-day chart

If the crash continues, leading to a breakdown of the SuperTrend indicator’s buy signal followed by the demand zone’s lower trend line, a steep correction awaits MATIC price.

In such a scenario, the SuperTrend indicator would trigger a sell-signal last seen nearly four months ago. This move might extend the correction to the subsequent demand zone’s upper layer at $0.229.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.