MATIC price magic fades away as investors’ presence retreats to two-year lows after a 20% dip

- MATIC price is currently trading below the $1 mark as the altcoin dropped to a two-month low.

- Since the beginning of the decline on April 14, Polygon has lost about 52% of its active users.

- By the looks of it, large wallet holders are also feeling the waning optimism as they have shed nearly $9 million worth of MATIC in a couple of days.

MATIC price lost a key support level as it followed the lead of the biggest cryptocurrency in the world. The bigger issue than the price fall, however, is the fall in conviction, as close to half of the investors have pulled back since red candlesticks gained dominance on the charts.

Read more - Is Bitcoin price set to shine as stock market investors “Sell in May and Go Away”?

MATIC price fall leads to this

MATIC price since April 14 has declined by about 19% to trade at $0.9603. Unlike Bitcoin price, however, the layer-2 solution token failed to mark any recovery over the last week.

Consequently, following the 4% dip over the last 24 hours, the cryptocurrency fell to a two-month low, as the last time the altcoin was below $1 was back in January this year.

MATIC/USD 1-day chart

This was naturally expected to have a negative impact on the investors, but the amount of losses that the nearly 20% crash led to amplified the pessimism. Over the last two weeks, the presence of investors has declined by over 52% from 3,600 to under 1,700 active addresses in a single day.

This decline can be observed to be one of the biggest noted decrease in active addresses year to date, with the on-chain users count falling to a two-year low of February 2021.

MATIC active addresses

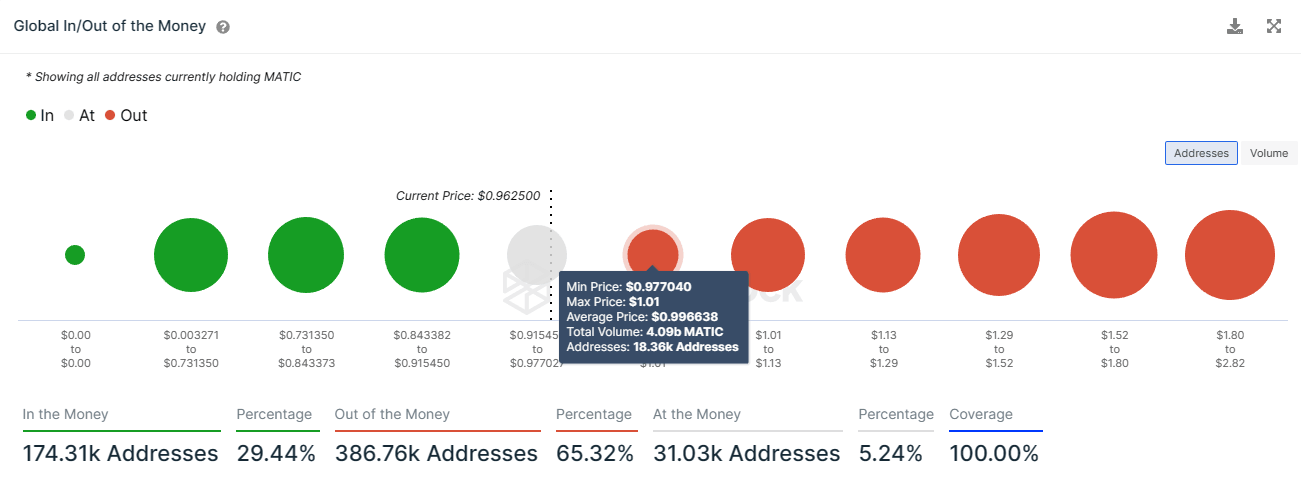

The reason behind this is the losses witnessed by the investors following the crash in MATIC price. Nearly 75,000 addresses are underwater at the moment who purchased their supply between the trading price of $0.96 and $1.13.

Collectively these addresses hold 5.15 billion MATIC worth $4.9 billion that is awaiting a rally to become profitable again.

MATIC GIOM

But beyond the spot market slump, Polygon’s performance in the Decentralized Finance (DeFi) market has taken a hit as well, albeit not as significant. The total value locked (TVL) on the chain has decreased by over $70 million in the last month.

This further contributed to the grim conditions of the DeFi market, wherein the Decentralized Applications (Dapps) have collectively lost $10 billion.

DeFi TVL

On the other hand, now that MATIC price has suffered a bearish run, the only way left is up. That is unless the upcoming interest rate hike triggers further bearishness, in which case $1 might become a stronger barrier for the altcoin.

Read more - Bitcoin traders watch US Fed’s interest rate decision to plot likely return to $30,000

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.