MATIC price inches closer to hitting 12-month lows, discouraging even whales from participating

- MATIC price has declined by more than 6.5% in the span of 24 hours, closing in on losing $0.600.

- Whales or large wallet holders have domination over 67% of the entire supply, making their move crucial to recovery.

- Although their activity has been diminishing since February, the lack of it at present impact the price much more significantly.

MATIC price took a hit akin to the rest of the market on account of Bitcoin price dwindling earlier in the day. But beyond the recent events is the lack of interest and participation from the most important cohort in the case of the altcoin.

MATIC price continues to fall

MATIC price is currently trading at $0.617, down by almost 7% in the past day, adding to the already declining value of the cryptocurrency. The altcoin is actually closer to retesting the support of the $0.590 line, and in doing so, the Polygon token would end up losing the psychological support level of $0.600.

MATIC/USD 1-day chart

If this was to happen, MATIC price would once again be at an almost 12-month low, as the last time the altcoin was at this level was back in July 2022. A bounce back from this price point is crucial for the ERC-20 token as it would enable recovery of the recent losses. But this demands the support of MATIC investors, particularly of its most influential group of addresses.

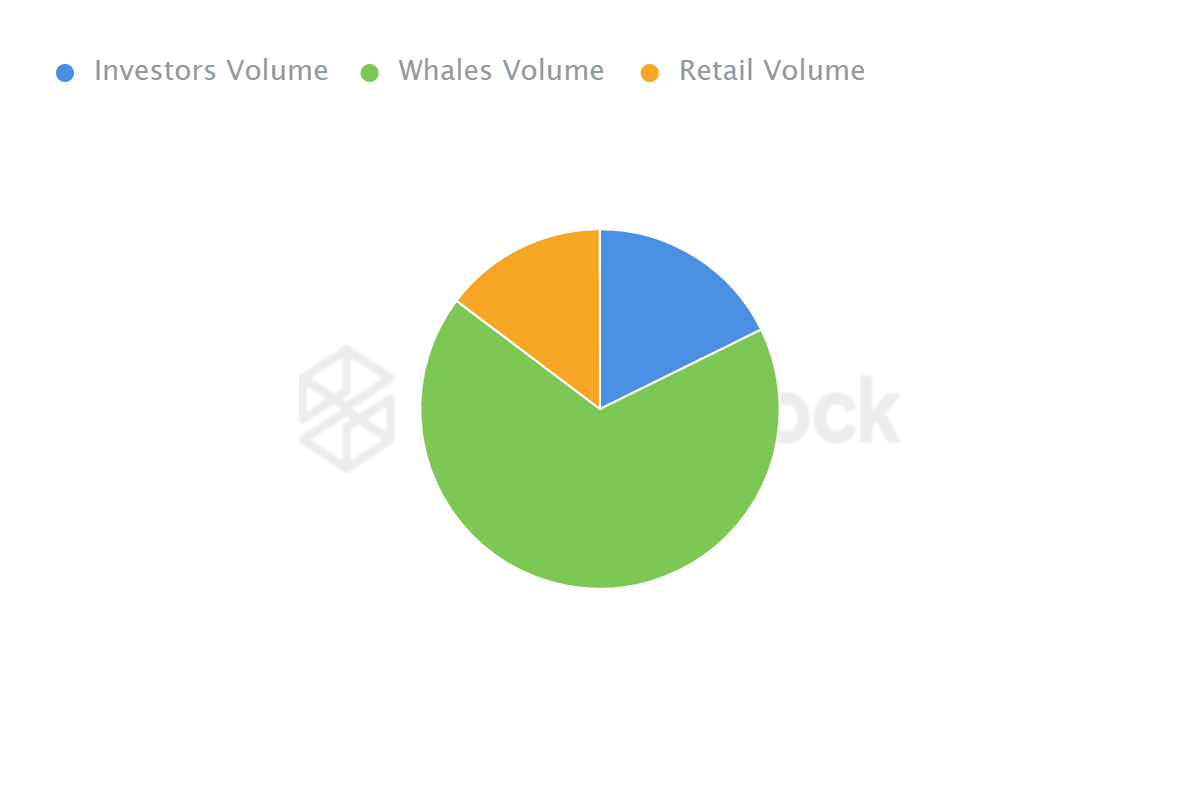

The whales, in the case of MATIC, command more than 67% of the entire circulating supply holding 6.76 billion MATIC at the moment. Their actions thus hold a significant impact on the price action.

MATIC Whale concentration

In times of market bottoms, these whales tend to actively accumulate, which generally acts as a trigger for the price to recover. But MATIC whales have not been following this pattern. These addresses have been pulling back from participating on-chain and conducting transactions, let alone accumulating.

Whale transactions, i.e., transactions worth more than $100,000 and $1 million, have been on a straight decline since February this year, with some spikes noted around the beginning of the month.

MATIC whale transactions

The overall net flows have also not observed any significant bout of inflows or outflows, verifying their lack of activity. Put simply, even if retail investors manage to act bullish and attempt to revive the price action, their efforts would be in vain if they do not find support from whales too.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.37.13%2C%252029%2520Jun%2C%25202023%5D-638235902469016146.png&w=1536&q=95)