MATIC price has more legs up as Polygon buyers step in

- Polygon price action has been on the ascent since the correction on September 7.

- Bulls are struggling to overcome a trend line that should be helping them.

- Pop to the upside should favor the bulls and contain 12% gains if the monthly pivot can hold.

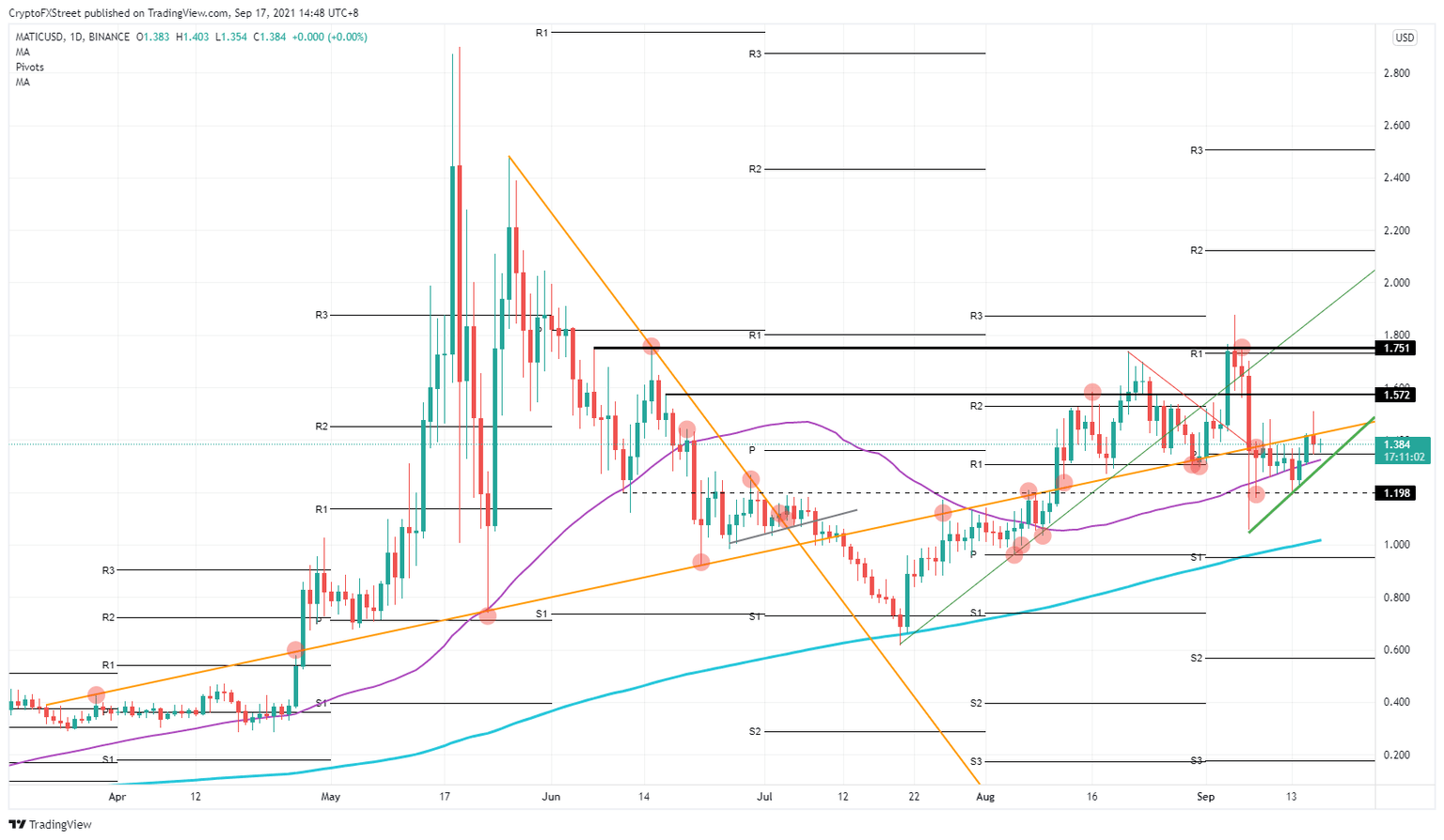

Polygon (MATIC) is recovering after losing 37% of its value on September 7. Since then, Matic was able to recover about two-thirds of that. But there is an obstacle in the way that in the past helped buyers as a supportive element. Buyers look bleak in their attempts to push MATIC above the yellow ascending trend line. A break higher should open up another 12% gain in price action for Polygon.

Polygon price need to pick up the pace

Polygon is a bit stuck for its next move as the ascending triangle is in their favor. Buyers have had a difficult time in making recovery work for Polygon. It was only since Thursday that MATIC had a daily close above the monthly pivot at $1.34. This pivot now should act as support and attract buyers to defend this level from a dip below. In the meantime, adding a new volume to the trade could do the trick of pushing MATIC above the orange ascending trend line originating from March 22. Granted that the trend line has been chopped up a bit in the past sessions, but the bodies of the candles are struggling to get above that trend line.

MATIC/USD daily chart

Once price action in Polygon can go and stay above the orange ascending trend line, expect a further run higher toward $1.57. If buyers can refrain from booking too much profit, there might even be another leg higher to $1.75. Then MATIC will have had a complete recovery, and the correction from September 7 erased and made good.

On the other hand, sellers will jump on the occasion to push price action downwards with the struggle buyers have to break the ascending orange trend line. Sellers will try to defend and will go for the rejection in price action. A break of the green ascending trend line can make price action drop again toward low levels near $1, which would bring MATIC back to the lows of September 7.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.