MATIC Price Forecast: Polygon tumbles below $1 as bears refuse to give up

- MATIC price is set for fresh declines as the $1 mark gives way.

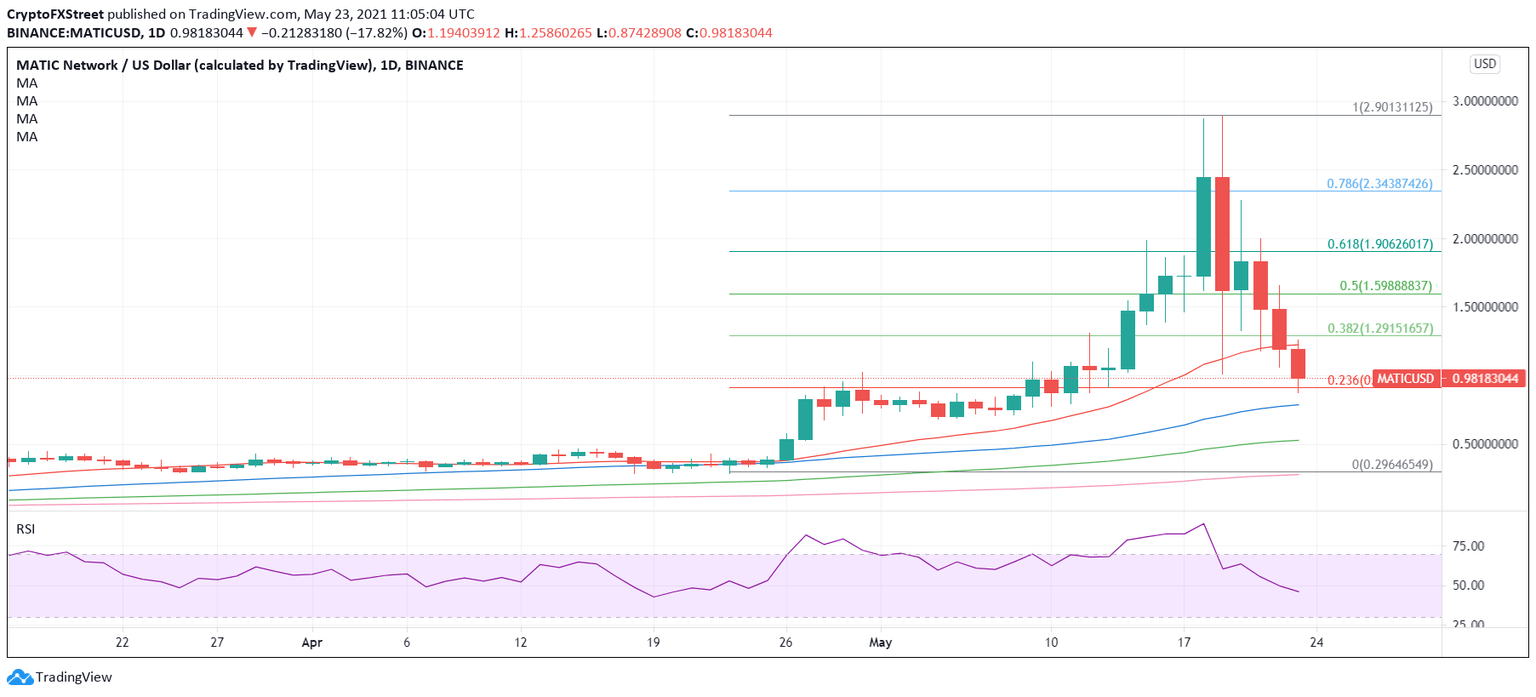

- Bears eye a decisive break below 23.6% Fibo level on the daily chart.

- Bearish RSI backs the downside bias, as the crypto market paints red.

MATIC/USD has taken out Wednesday’s flash crash low, falling below the psychological $1 threshold amid relentless selling seen across the crypto board this Sunday.

The MATIC price hit fresh weekly lows sub-$1, losing 16.50% on the day, as China’s crypto curbs continue to spook markets.

The ongoing three-day losing streak almost reverses the parabolic rise in Polygon from May 4 to May 19. The MATIC price recorded all-time highs of $2.8985 on Wednesday before crumbing 33% to finish the day at $1.6226.

MATIC/USD: Defends key support but for how long?

MATIC price accelerates declines this Sunday, having witnessed a daily closing below the critical short-term 21-simple moving average (SMA) at $1.2253.

The bears tested the key support at $0.9150, which is the 23.6% Fibonacci Retracement level of the meteoritic rise from April 23 to May 19.

If the sellers find a strong foothold below the latter, the upward-sloping 50-simple moving average (SMA) at $0.7832 could be put to test.

The next downside target awaits at the 100-SMA at $0.5194.

The relative strength index (RSI) pointing south, now at 46.22, strengthens the case for additional declines.

MATIC/USD: Daily chart

On the flip side, a bounce from the abovementioned Fibo support could bring the 21-SMA support now resistance back in play.

The 38.2% Fibonacci Retracement level of the same rally at $1.2915 will then get tested.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.