MATIC Price Forecast: Polygon needs acceptance above $0.80 to resume uptrend towards $1

- MATIC price is primed for another run towards the $1 mark.

- Bulls need to crack this key hurdle to take on the upside once again.

- Polygon wavers in a descending triangle with bullish RSI.

MATIC/USD has stalled its two-day losing streak on Saturday, although the bulls seem to lack follow-through upside momentum, leaving the price confined in a narrow range of around $0.75.

The MATIC price has witnessed some volatility over the past five trading sessions, having failed to find acceptance above the $0.80 psychological barrier.

MATIC/USD: Primed for a big bullish breakout?

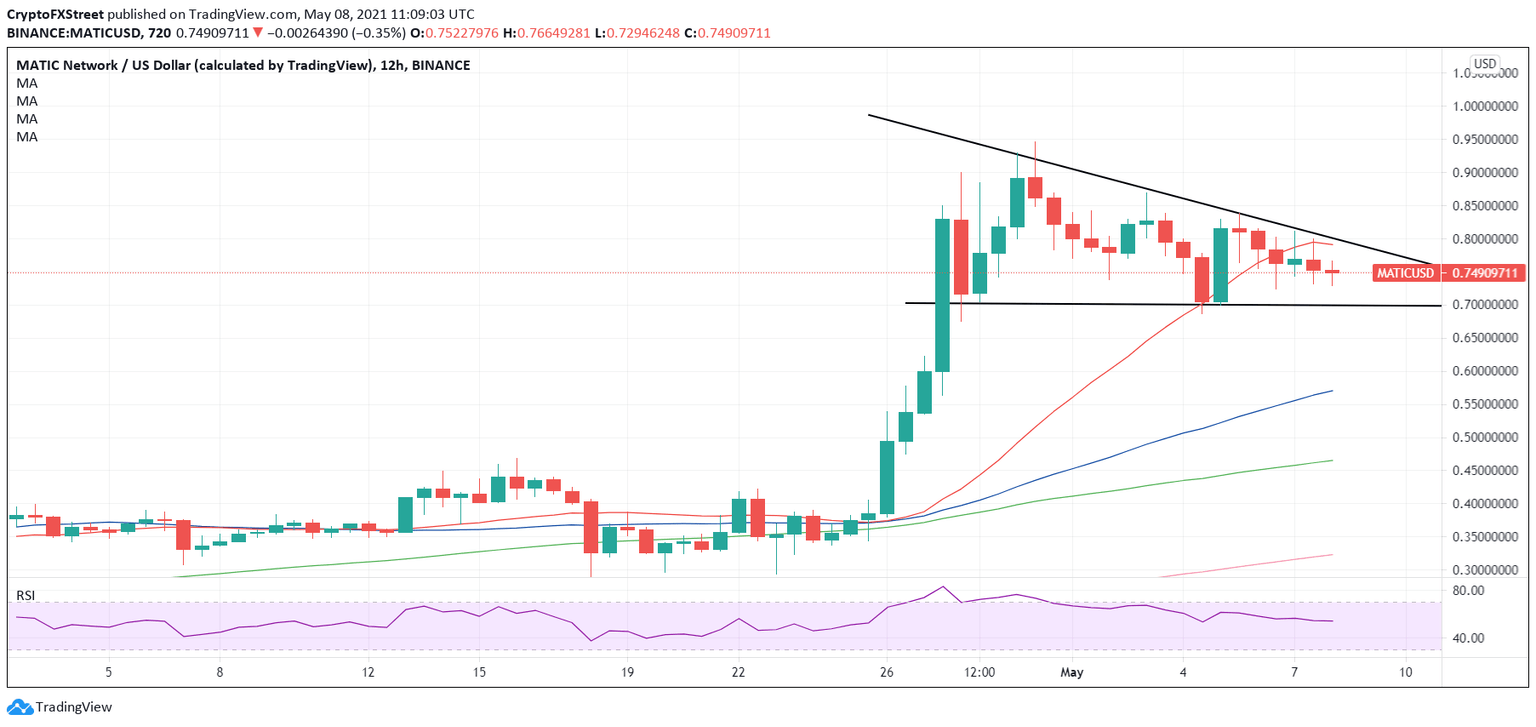

After reaching record highs of $1.0278 last month, the MATIC price has reversed a part of the rally, forming lower higher while buyers continue to lurk around the $0.69 region.

This price action has taken a shape of a descending triangle, with a 12-hourly candlestick closing above $0.80 required to confirm an upside break.

That level is the confluence of the falling trendline resistance and mildly bearish 21-simple moving average (SMA).

Doors would then open up for a test of the weekly tops at $0.8382. Only a sustained break about the latter is likely to recall the buyers, as they yearn to recapture the $1 mark.

The relative strength index (RSI) is on a steady decline but holds above the central line, keeping the MATIC bulls hopeful.

MATIC/USD: 12-hour chart

However, if the price fails to find a footing above the $0.80 powerful resistance, a drop back towards the triangle support at $0.69 cannot be ruled.

A breach of the last would validate a triangle breakdown, which could call for a test of the upward-sloping 50-SMA at $0.5707.

The last line of defense for the MATIC bulls is seen at $0.50, the psychological level.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.