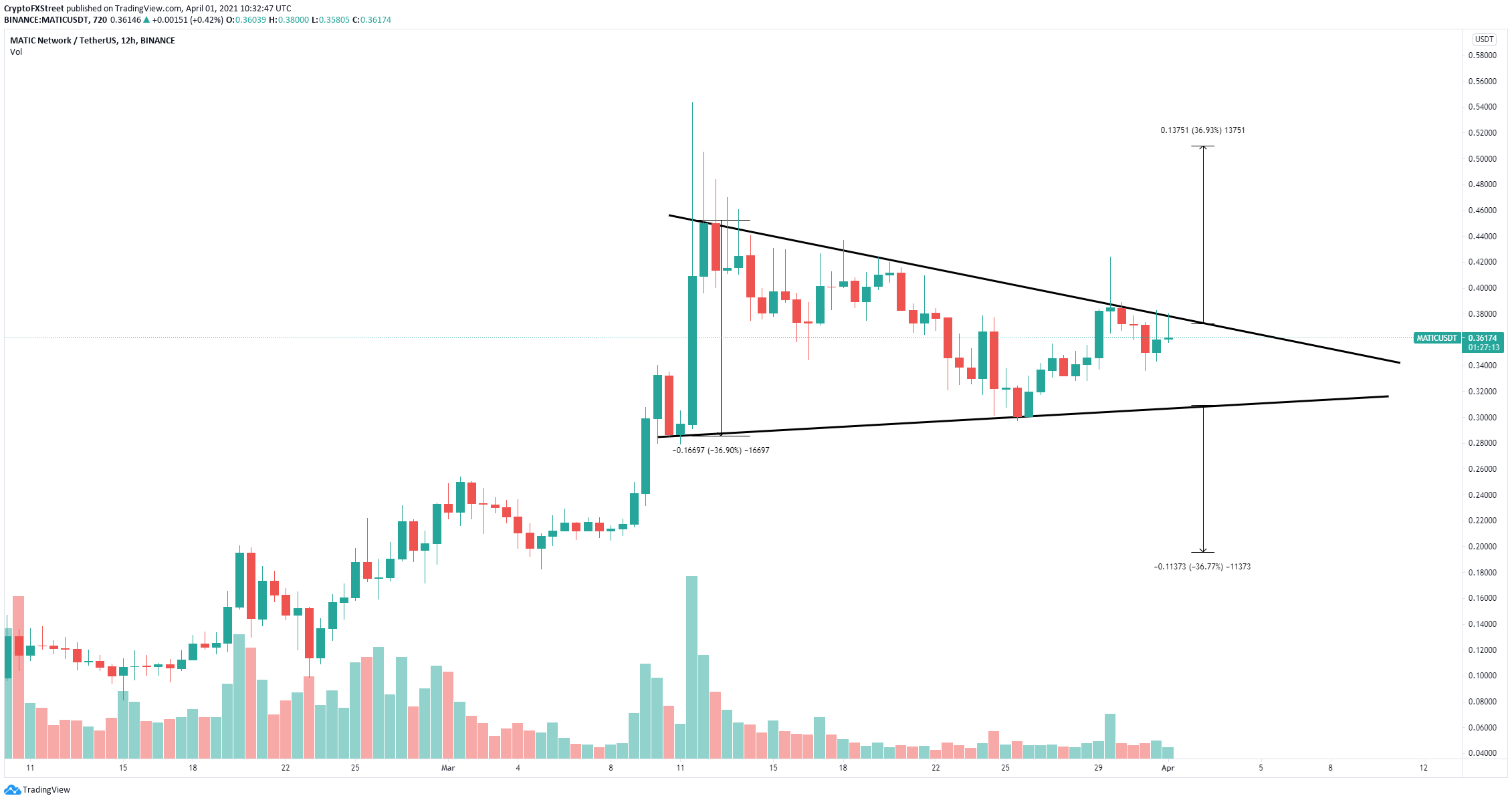

- MATIC price is bounded inside a symmetrical triangle pattern on the 12-hour chart.

- The digital asset needs to crack a key resistance level before a massive 37% breakout.

- The number of whales has continued to increase for MATIC, increasing buying pressure.

Polygon has been trading inside a tightening pattern for the past month and seems ready for a significant breakout as whales have gone into a buying frenzy for the past three weeks.

MATIC price is one barrier away from $0.51

On the 12-hour chart, MATIC has established a symmetrical triangle pattern with its resistance trendline formed at $0.374. A breakout above this critical point will drive MATIC price towards $0.51. A 37% move calculated using the maximum height of the pattern as a reference point.

MATIC/USD 12-hour chart

This breakout seems likely thanks to a significant spike in the number of whales. Since March 10, the amount of whales holding 10,000,000 or more MATIC coins increased from 31 to 62 and remains in an uptrend.

MATIC Holders Distribution chart

Nonetheless, a rejection from the upper boundary of the pattern at $0.374 would be bearish and has the potential to drive Polygon down to the lower trendline of the symmetrical triangle currently established at $0.30. It's important to note that a breakdown below this point will push MATIC towards $0.20.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Tether expands reach with Juventus acquisition and new Bitcoin-native public company launch

Tether announced on Thursday that it had acquired additional shares in Juventus Football Club, bringing its total stake to over 10.12% and representing 6.18% of voting rights. Tether, Bitfinex, SoftBank & Jack Mallers also launch Twenty-One, the first Bitcoin-native public company.

Ethereum Price Forecast: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum (ETH) saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Stacks price eyes $1 amid growing interest in Bitcoin layer-2 protocols' DeFi ecosystems

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem.

Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[12.36.38,%2001%20Apr,%202021]-637528711972527393.png)