MATIC price eyes $0.70 despite Polygon network’s plans to launch blockchain aggregation layer

- Polygon price remains in a downtrend since January 12, bearing the brunt of a broader market crash.

- MATIC could extend the fall to the $0.70 psychological level amid bearish technicals and a volatile market.

- The bullish thesis will be invalidated upon a break and close above the $0.97 resistance level.

- The network is preparing to launch blockchain aggregation layer, AggLayer in February, towards liquidity unification.

Polygon (MATIC) price downtrend has culminated in a nearly 30% fall from the January 11 peak of $0.95 to the Tuesday low of $0.69. The slump was the aftermath of broader market crash, with Bitcoin (BTC) price liquidating up to $130 million when it first started. The dump inspired volatility in the market, with most altcoins suffering in the aftermath, including MATIC.

Also Read: MATIC price risks a 7% fall even as the network empowers the next wave of DeFi on Polygon zkEVM

Polygon network prepares for 'AggLayer' debut in February

The Polygon network is planning to introduce a blockchain aggregation layer in February. The solution christened “AggLayer,” will focus on the unification of liquidity, connecting blockchains with zero-knowledge proofs. Specifically, developers will be able to connect blockchains with zero knowledge proofs, leveraging Ethereum for settlement.

Until now, blockchain scaling had 2 paradigms: Monolithic & Modular

— Polygon (Labs) (@0xPolygonLabs) January 24, 2024

Introducing the next one: Aggregation

A novel solution combining the benefits of monolithic & modular designs by unifying liquidity via safe, near-instant atomic cross-chain txs using ZK proofs.

Feb Mainnet … pic.twitter.com/mE0qssoWyJ

The solution will ascertain fairness in security across modular and monolithic chains, including those within the Polygon ecosystem. This makes it an integral part of Polygon 2.0, the network’s next iteration. An excerpt from the announcement reads, “As a central component of Polygon 2.0, AggLayer will use ZK proofs to create a seamless, aggregated environment that feels like a single chain – even as each chain in the ecosystem remains sovereign.”

Polygon price outlook with $0.70 in sight

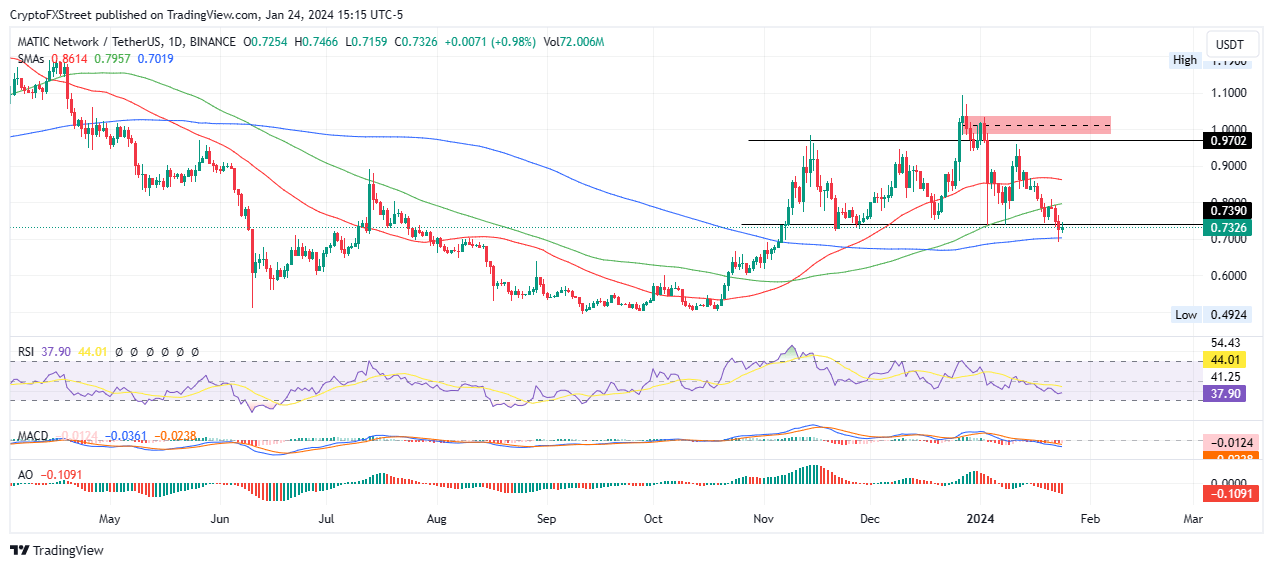

The Polygon price downtrend is likely to extend to the $0.70 psychological level, nearly 4% below current levels. It comes amid growing overhead pressure with both the 100- and 50-day Simple Moving Averages (SMAs) providing resistance at $0.79 and $0.86 levels respectively.

The Relative Strength Index (RSI) is also below the 50 level, pointing to a weak price strength, while its general southbound move suggests falling momentum. Making matters worse, both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) indicators are in negative territory, showing the bears have the upper hand.

With this, it is plausible that Polygon price could slip past the $0.70 psychological level to tag the $0.60 psychological level, last tested in October. This would be the dire case, constituting a 17% fall below current levels.

MATIC/USDT 1-day chart

On the other hand, if the bulls come back to the market, MATIC price could flip the $0.73 resistance into support before targeting the 100- and 50-day SMAs at $0.79 and $0.86 levels respectively. In a highly bullish case, the gains could see MATIC extend past the $0.90 psychological level before tagging the $0.97 blockade.

To confirm the continuation of the uptrend, the Polygon price must foray into the supply zone between $0.98 and $1.04, with a break and close above its midline at $1.01 being the first sign.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.