MATIC price defends 200-DMA as Polygon bears keep $0.95 in sight

- MATIC price is testing bullish commitments at the critical 200-DMA.

- Polygon needs a sustained move above the 100-DMA to negate the bearish bias.

- Bearish crossover and RSI suggest that the downside remains favored for MATIC.

MATIC price is consolidating the swift recovery seen on Friday following the crash to the pivot support just above the $1 mark.

Despite the volatile trading, MATIC price remains in a familiar between $1.30-$1 seen so far this week.

At the moment, MATIC bulls are looking to extend the previous recovery momentum, snapping the two-day downswing from three-week highs of $1.273.

It’s worth adding that Polygon is in a downside consolidative mode, awaiting a strong bearish catalyst to yield a sustained move below the $1 mark.

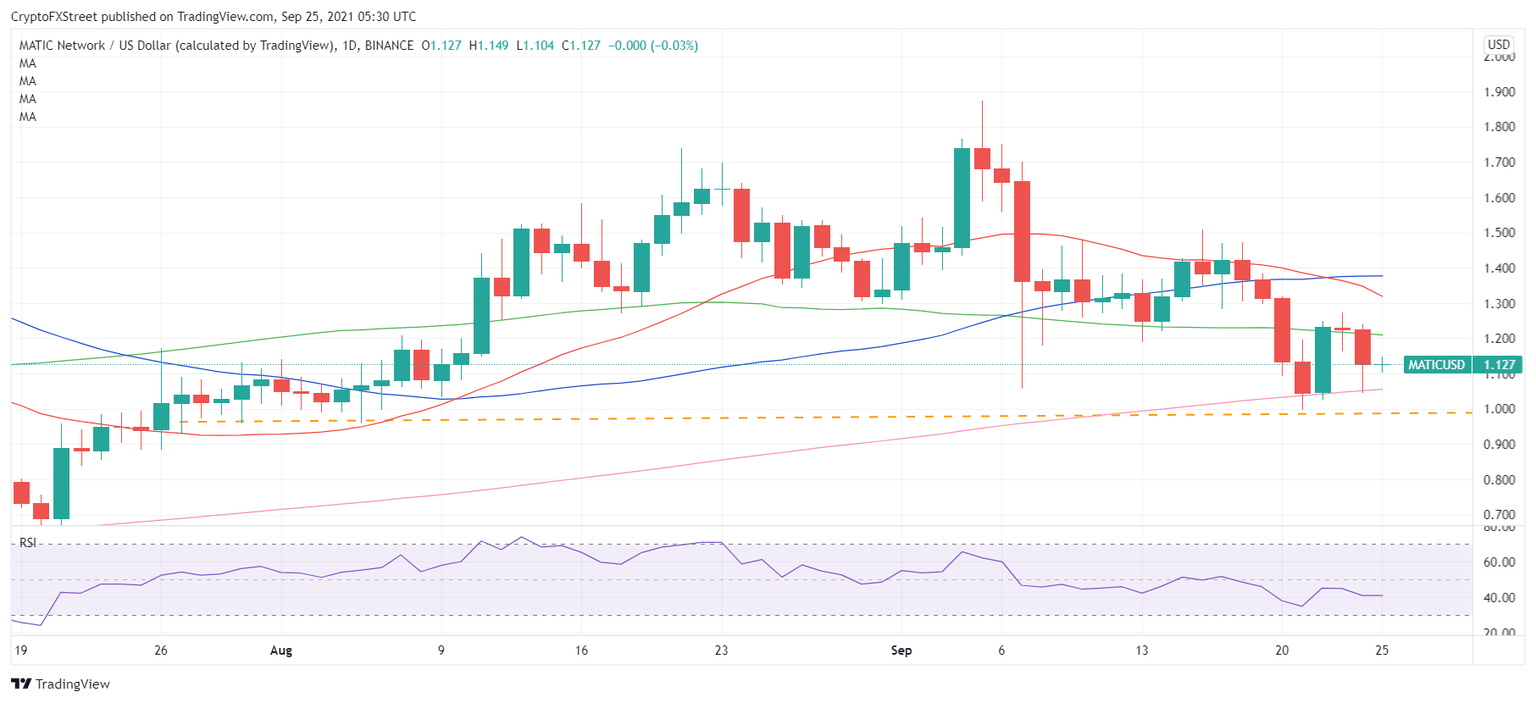

MATIC/USD: Rejection above 100-DMA recalls sellers

From a short-term technical perspective, the downside appears more compelling for MATIC price, especially after the bulls failed to resist above the 100-Daily Moving Average (DMA) at $1.21 over the last two trading sessions.

The bear cross, represented by the downward-pointing 21-DMA having pierced the slightly bullish 50-DMA from above on Thursday, adds credence to the additional weakness in Polygon while the 14-day Relative Strength Index (RSI) trades flat-lined below the 50.00 threshold.

That said, MATIC bears need a daily candlestick closing below the critical upward-sloping 200-DMA at $1.05 to resume the correction from three-month tops of $1.875.

Sellers will then target the horizontal (dashed) trendline support at $0.95 on intensifying downward pressure.

Further south, the $0.85-$0.80 demand area could come to the rescue of MATIC bulls.

MATIC/USD: Daily chart

On the flip side, a firm break above the 100-DMA is needed to negate the near-term bearish momentum.

The bearish 21-DMA at $1.32 could keep the further upside elusive in MATIC price. The next relevant upside barrier is envisioned at the ascending 50-DMA at $1.38.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.