MATIC price battles crushing selling pressure despite Franklin Templeton's recent Polygon announcement

- MATIC price has failed to recover despite US registered mutual fund Franklin Templeton picking Polygon for blockchain support.

- Franklin Templeton’s $270 million fund connect could be a bullish catalyst for MATIC price, however the token failed to begin recovery.

- The Ethereum Layer 2 token continues its downward trend, under massive selling pressure across exchange platforms.

Ethereum network’s largest scaling solution, Polygon’s native token recently recorded the largest inflow of MATIC to exchanges. The resulting selling pressure has negatively influenced the asset’s price and bullish catalysts such as a US registered mutual fund’s connect to Polygon’s blockchain failed to fuel a recovery in MATIC.

Also read: Here is how DeFi users are gearing up for Optimism summer

US registered mutual fund connects to Polygon for blockchain support

Franklin Templeton announced on April 26 that the fund has connected to Polygon for blockchain support. The fund is considered one of the world’s largest asset managers with US$1.4 trillion under management.

The Money fund is now supported on the Polygon blockchain and investors can access the $270 million fund through Ethereum’s Layer 2 blockchain. This development was considered bullish by Ethereum and Polygon’s community on crypto Twitter, however instead of acting as a bullish catalyst, it failed to move native token MATIC’s price.

MATIC price continued its downward trend, yielding 9% losses to holders over the past week. The Ethereum Layer 2 token is struggling with the rising selling pressure from a large volume inflow to exchange wallets.

Large self-custody Polygon address moves 60 million MATIC to exchanges

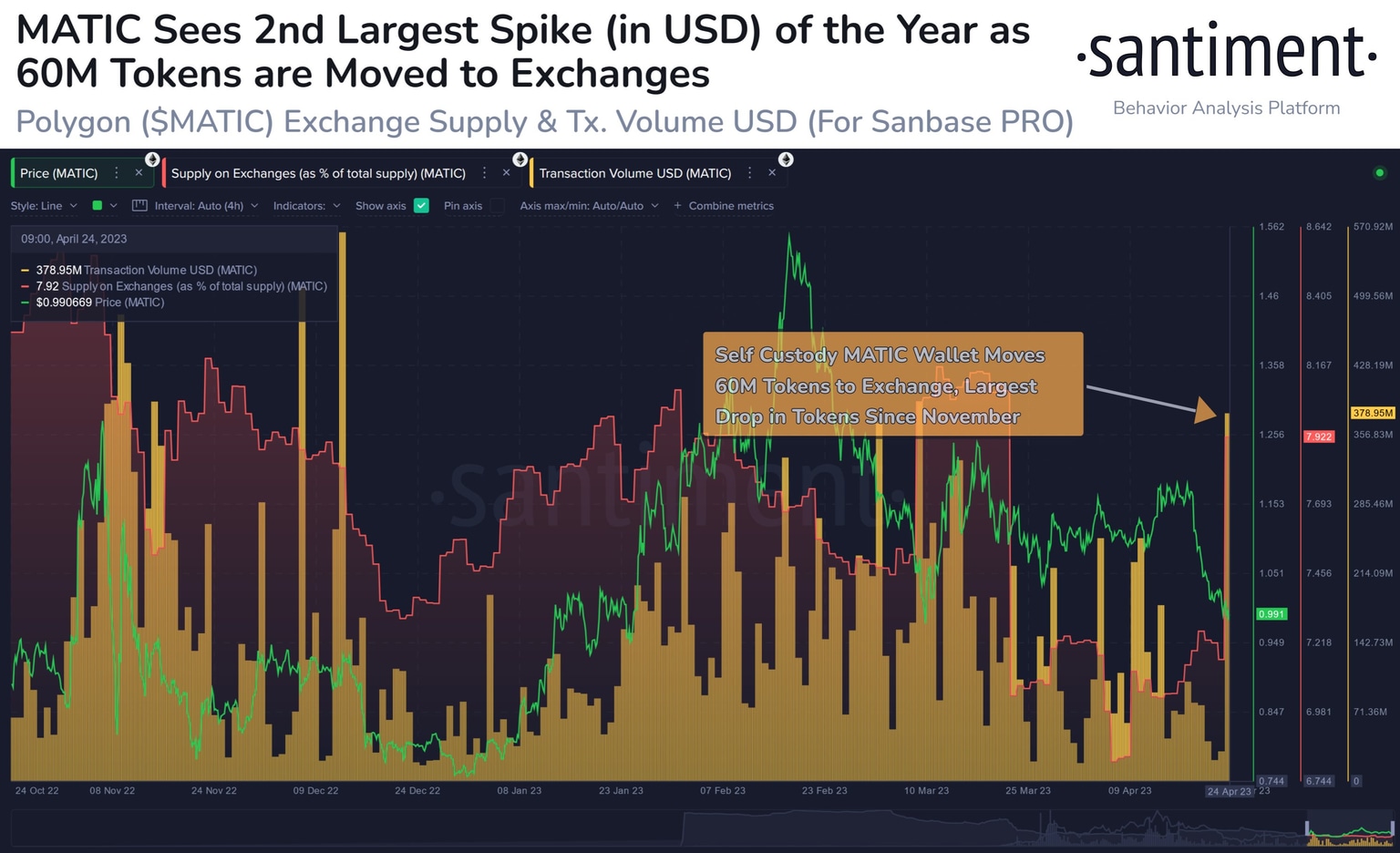

Crypto intelligence platform Santiment reported the move of 60 million MATIC tokens to exchange wallets. This move increased the volume of Polygon’s native token in circulation, and resulted in a spike in the selling pressure on MATIC across exchanges.

MATIC inflow to exchanges

MATIC’s exchange supply climbed to 7.92%, a five-week high and the self-custody wallet continues to hold another 3.78 billion tokens in its portfolio. The Ethereum Layer 2 token is reeling from the consequences of a massive spike in selling pressure and struggling to begin its recovery.

What to expect from MATIC?

Crypto experts believe MATIC price is likely to witness further correction in its downtrend. On the daily price chart, MATIC is in an uptrend that started in August 2022. Polygon’s token started trading sideways in mid-March 2023, with the rise in selling pressure on MATIC.

As seen in the MATIC/USDT price chart below, MATIC is in an ascending parallel channel. It's important to note that MATIC price is set to decline below the lower trendline forming the parallel channel.

MATIC/USDT 1D price chart

If MATIC price sees a definitive close below the lower trendline of the ascending parallel channel, it will be considered a confirmation of a bearish trend and the asset could nosedive lower.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.