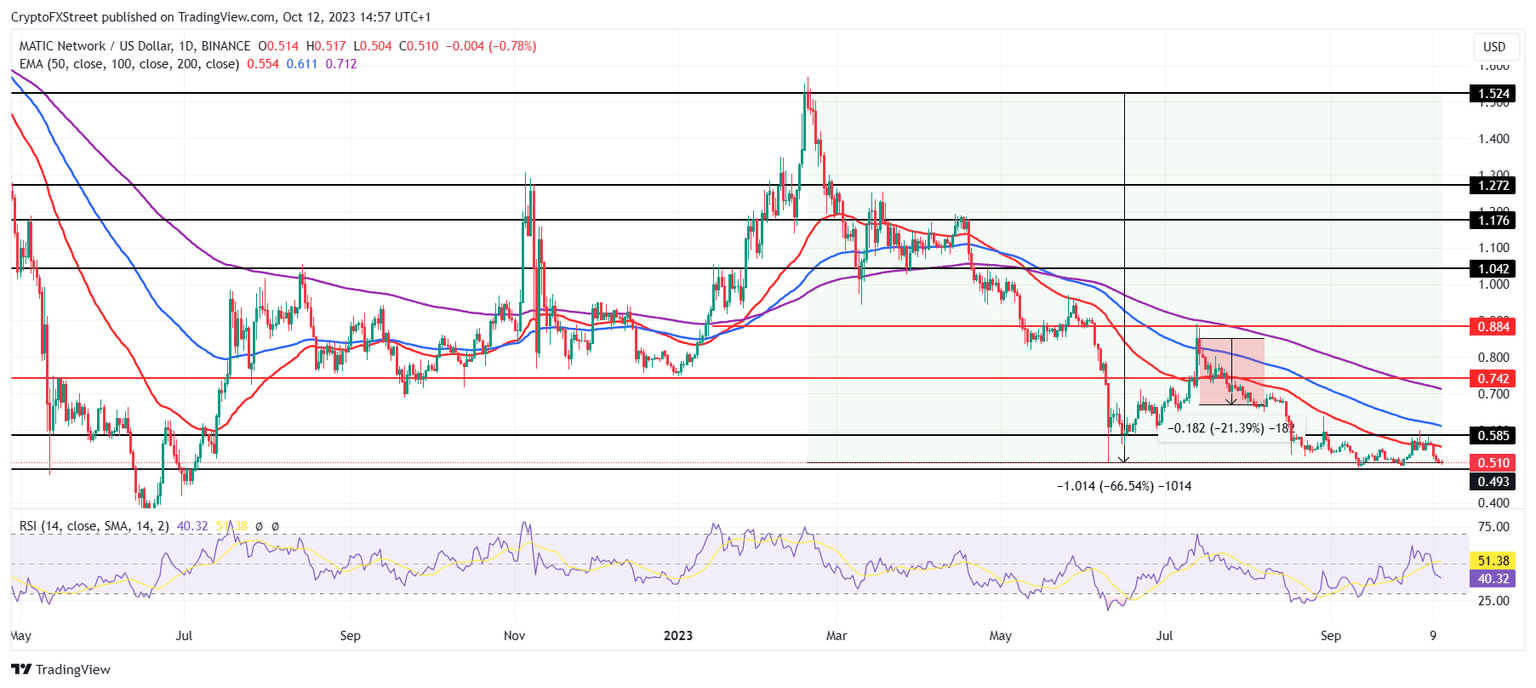

MATIC price crashes 66% from 2023 peak as Polygon hardfork looms

- MATIC price is close to falling below $0.50 after failing to breach the 50-day EMA.

- Polygon's hardfork, or network upgrade, is expected to take place on Friday.

- The hardfork will activate the "Milestones" feature, which offers faster deterministic finality.

Polygon (MATIC) price appears to be stuck in a downtrend since it reached a 2023 top in February, noting only one instance of recovery attempted. The drawdown has left the altcoin grasping at straws to note a rebound, with another attempt likely to be made in the next couple of hours.

Polygon hardfork around the corner

Polygon recently announced that the blockchain will be going through a hardfork that will act as an upgrade to the network. As noted by the firm,

"With this hardfork, the "Milestones" feature will be activated which offers faster deterministic finality.

Deterministic finality is basically drawn from consensus algorithms providing immediate finality for transactions. This means that the transactions are considered irreversible once consensus is reached. The consequence of this is enabling faster settlement times and enhancing transaction certainty.

The hardforks part of the Heimdall block is set to be executed on Friday at the 15,950,759 block. This will include the Bor and Heimdall upgrades, as well as the Erigon upgrade. At the time of writing, a little over 10,000 blocks remained, signaling around 19 hours before the hardfork occurred.

Polygon hardfork ETA

MATIC price to see further downfall

MATIC price has another shot at recovery in the next 24 hours following the hardfork. If the market finds bullishness and manages to bounce back from the support line of $0.49, it would save itself from falling below $0.500.

From a technical perspective, the chances of this happening are unlikely since the Relative Strength Index (RSI) is suggesting that bearish momentum is intensifying. This could lead to a fall below the $0.49 support line, resulting in MATIC not only extending the 66% crash that has been ongoing since 2023 peak of $1.52 in February but also marking fresh 15-month lows.

MATIC/USD 1-day chart

On the upside, a bounce back could also initiate a recovery provided MATIC manages to breach the 50-day Exponential Moving Average (EMA) at $0.58 and flip it into a support floor. This would invalidate the bearish thesis and set the altcoin up for a potential rise beyond $0.60.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.