- Matic price continues to shape the handle of a cup-with-handle base on the daily chart.

- Extreme overbought conditions on the daily and weekly Relative Strength Indexes (RSI) were removed during the May correction.

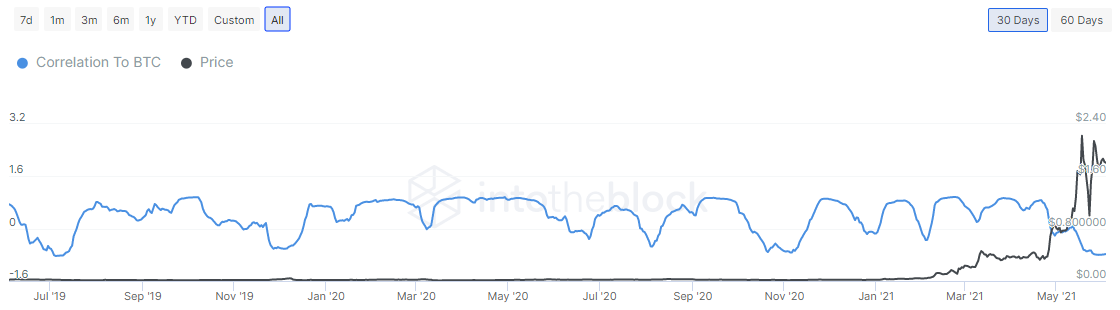

- Polygon correlation with Bitcoin falls to -.78, the lowest reading since July 2019.

MATIC price strength has been a positive highlight of the May correction, despite the plunge of 75%. The extraordinary rebound of 230% from the correction low on May 23 combined with the negative correlation with BTC and clarified price structure has positioned Polygon in an advantageous position to tackle new highs in the coming weeks.

MATIC price tightness and low volume point to a substantial move

Until the May 19 collective collapse in the crypto market, MATIC price had engineered a tremendous rally of 500% following the decisive breakout from a multi-week consolidation on April 26. The breakout was accompanied by a substantial surge in volume and generated the most overbought readings on the daily RSI since February.

Like other digital assets, the May 19-23 stretch shattered MATIC price strength, taking it down 75% before identifying support at the tactically important 50-day simple moving average (SMA) at $0.791 but remained above the 2021 rising trend line at $0.645.

As leading cryptocurrencies should do, MATIC price rebounded 230% from the May 23 low, quickly establishing the technical foundation for the currently developing cup-with-handle base. The base evolution has been consistent with success. The right side of the cup is flashing above-average volume, with the handle primarily forming in the upper half of the base on increasingly lighter volume. The lighter Polygon volume indicates that weak holders have been evacuated from the token, raising the probability of a sustainable breakout.

The base has a trigger price of $2.48, the high of the handle, so investors need to let the handle complete its formation. Due to the cup’s compressed side, the handle has been extended a bit longer to release the price compression, but MATIC price should be close to a breakout attempt.

The measured move target of the Polygon cup-with-handle base is $8.20, producing a 230% gain from the handle high for investors.

On the path to the measured move target is substantive resistance at the intersection of the 161.8% Fibonacci extension of the May correction at $4.21 with the topside trendline from the March high through the May high at $4.30, returning a gain of 65% from the handle high.

Additional Polygon resistance levels preceding the measured move target need to be calculated once the resistance listed above has been surmounted.

MATIC/USD daily chart

Keen Polygon investors must be informed of the critical support levels, particularly as the base continues to shape. Key to the bullish narrative is the low of the handle at $1.51. A close below the price would expose MATIC price to a decline to the 50-day SMA, currently at $1.12. It would be a loss that cripples projections for new highs in the next few months.

Placing relative strength at or near the top of any investment selection process is a valuable step in securing outsized returns following sizeable market corrections. One of the ways to gauge it in the cryptocurrency market is to examine the correlation with Bitcoin. A high correlation leaves it to BTC’s sphere of influence, good or bad, and a negative correlation can signify relative strength.

With the outlook for Bitcoin somewhat cloudy due to regulatory concerns and significant technical resistance levels on the charts, it is compelling to see that Polygon has a negative correlation with BTC. Currently, it has a reading of -.78, the lowest since July 2019.

It highlights the strength of Polygon over the last month and suggests that the short-term instabilities in Bitcoin will not jeopardize the ongoing base construction.

MATIC Correlation to BTC - IntoTheBlock

For the long-term investor, MATIC price is bolstered by the increasingly rapid adoption of Polygon as a blockchain network with built-in scaling solutions for various projects. Moreover, the integration of Polygon assets into Google Cloud’s BigQuery that enables scalable analysis over petabytes of data and the much-discussed investment by Mark Cuban solidify a promising outlook for the Indian blockchain.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.