MATIC hits new all-time highs, a pullback to $2.50 is expected before another rise

- MATIC price regains a mantle of leadership as it prints new all-time highs.

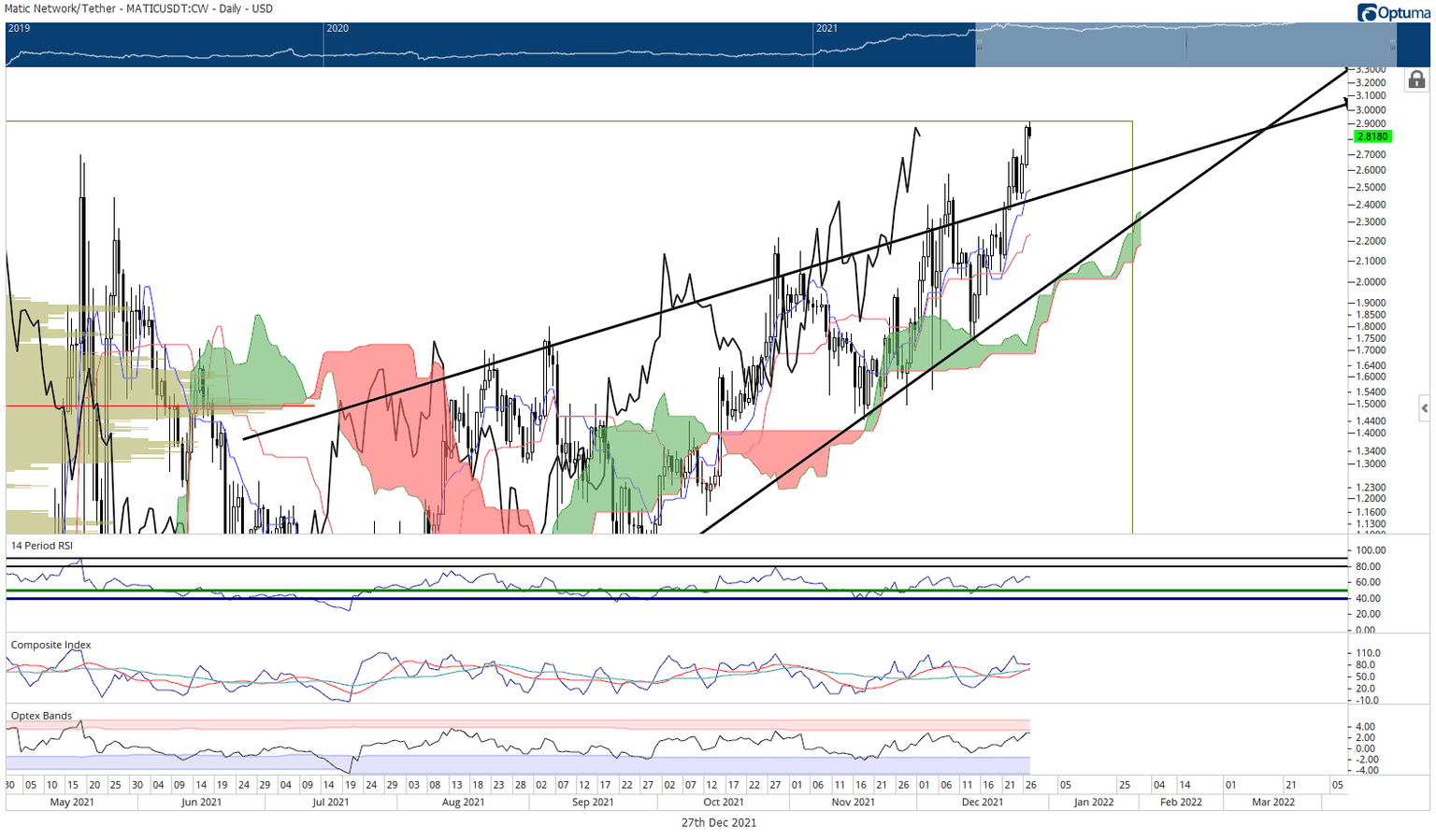

- Significant gaps within the Ichimoku Kinko Hyo system warn of an expected mean reversion setup.

- Upside potential is limited until a retest is complete.

MATIC price has resumed its extremely bullish momentum above a prior rising wedge, extending the gains to just shy of the critical $3.00 price level.

MATIC price to hit $3.00, then retrace to $2.50 before making another run towards new all-time highs

MATIC price action has been a leader of the entire cryptocurrency space thus far for December. MATIC has gained more than 60% in less than a month from the December open to the recent new all-time high. Because of that fast rise, some profit-taking should be expected.

MATIC recently tested the breakout above the rising wedge on December 24 with a retest of the shared support zone at the Tenkan-Sen and upper trendline of the rising wedge at $2.40. Confirmation of that support buoyed MATIC price higher to a new all-time high at $2.92. It is expected that $3.00 will get hit before any downside pressure were to take hold, but it is not a requirement.

Significant gaps between the bodies of the daily candlesticks and the Tenkan-Sen are developing, putting constraints on how much longer and how much higher MATIC price can move without a pullback. Additionally, the Optex Bands oscillator is approaching extreme overbought conditions while the Composite Index is printing regular bearish divergence.

A pullback to the Tenkan-Sen at $2.50 would be the second test of the Tenkan-Sen and upper trend line of the rising wedge, supporting any further upside momentum. However, MATIC price does not necessarily need to fall; a mean reversion over time instead of through price is also likely. In that scenario, MATIC would consolidate for up to three weeks between the $2.80 and $3.00 value area.

Downside risks for MATIC price should be limited to the daily Kijun-Sen at $2.25.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.