- MATIC price defies broader market concerns and weaknesses by moving higher and higher.

- Bulls slap away any bears attempting to take control.

- Early evidence of a short-term market top beginning to appear.

MATIC price action has certainly been some of the most dramatic post flash crash. Multiple vigorous attempts by short-sellers to push MATIC lower have all failed and have led to MATIC pushing towards new all-time highs.

MATIC price may have one final push before correcting

MATIC price action, in case you missed it, has gained over 66% from its flash-crash lows. This is a fantastic gain by any standard and one that could continue higher or face a solid but temporary pullback. Options and trade setups exist for bulls and bears.

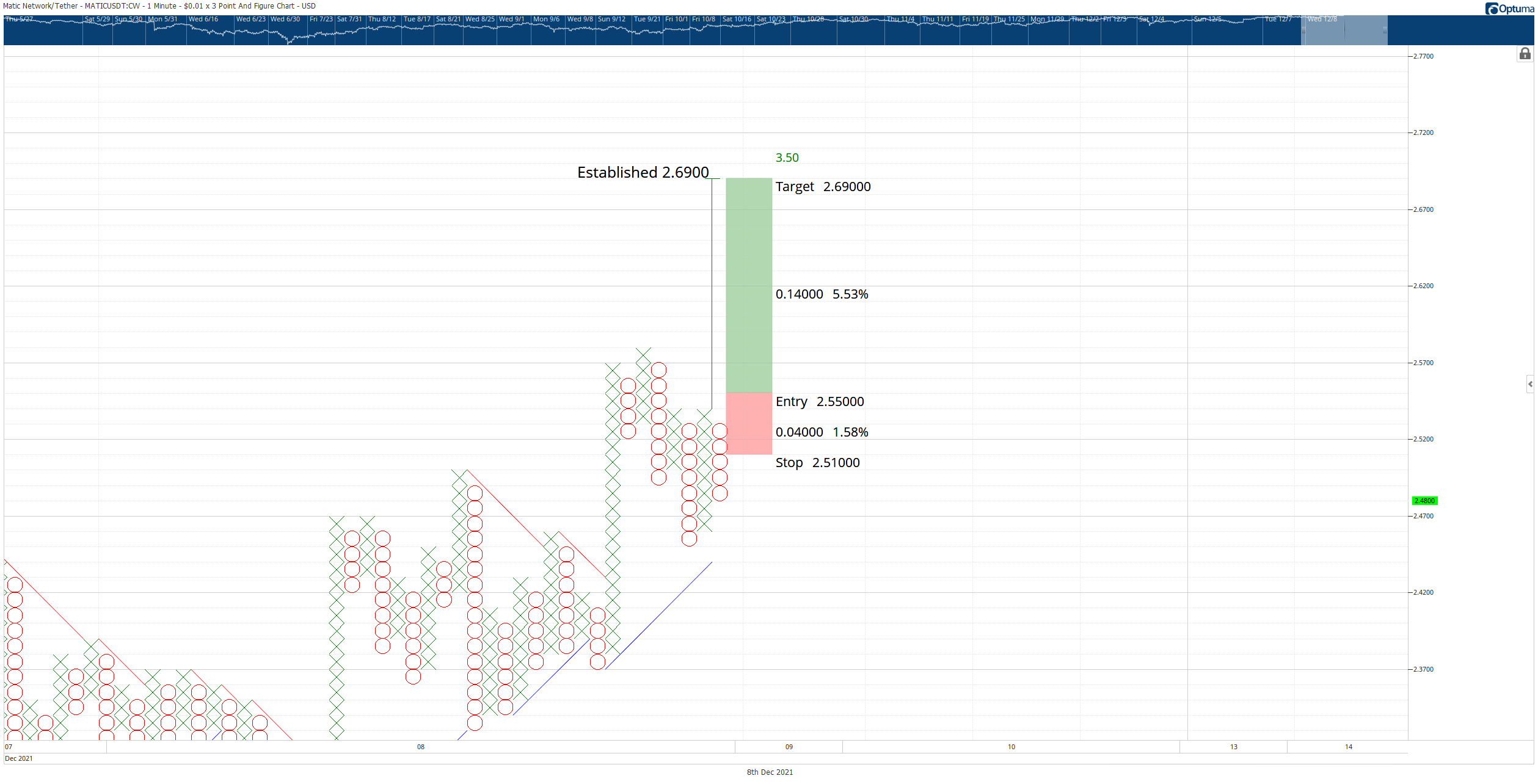

On the long side of the market, a hypothetical entry would be a buy stop at $2.55, a stop loss at $2.51, and a profit target at $2.69. The entry is based on the breakout above a triple top. A trailing two-box stop would help protect any implied profits.

MATIC/USDT $0.01/3-box Reversal Point and Figure chart

The hypothetical long trade is invalidated if MATIC moves below $2.44.

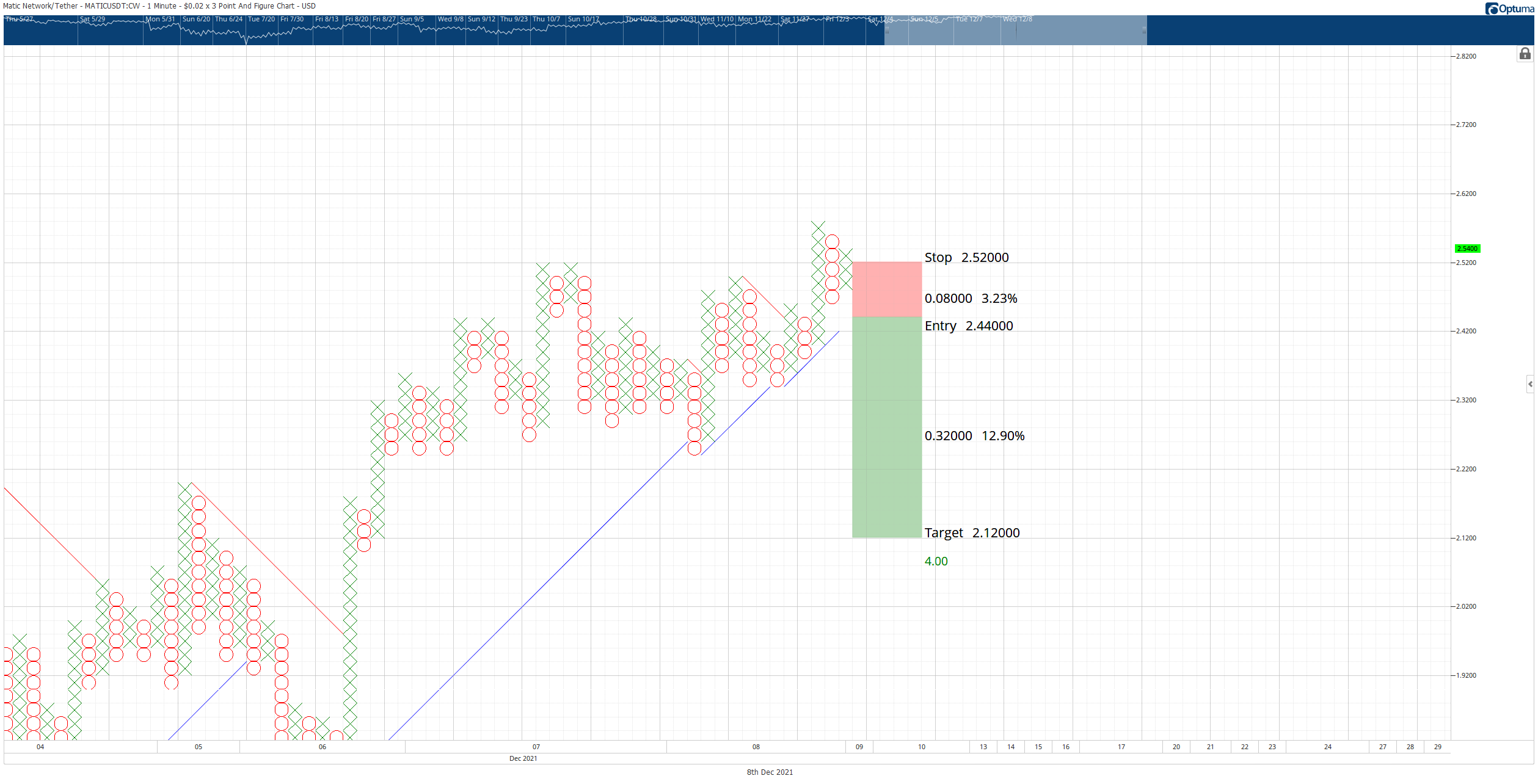

The short trade idea is a theoretical sell stop order at $2.44, a stop loss at $2.52, and a profit target at $2.12. The entry is based on a sell entry from a Pole Pattern retracement. Additionally, the entry would convert the $0.02/3-box reversal Point and Figure chart into a bear market.

MATIC/USDT $0.02/3-box Reversal Point and Figure chart

This trade is invalidated if the long entry identified above is triggered.

Traders on the short side are more at risk here than the longs. This is due to the proximity of MATIC price to new all-time highs and the persistent, sustained momentum higher in the short-term.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: ADA, AVAX, TON in profit as BTC stalls at $100K

Altcoin market updates: ADA, AVAX, TON emerge as top gainers While BTC has stagnated on Monday, traders are redirecting capital toward mid-cap assets, driving the likes of Cardano (ADA), Avalanche (AVAX) and Toncoin (TON) above key resistance levels.

Ripple's XRP aims for $1.96 as WisdomTree registers for an XRP ETF in the US

Toncoin Price Forecast: Crypto whales spotted buying $30M TON in 4 days, amid Gensler’s exit

Toncoin price opened trading at $6.2 on Monday, up 27% since Gary Gensler's exit confirmation on November 21. On-chain data trends suggest a $7 breakout could follow as whale investors have scaled up demand for TON considerably over the last 5 days.

MicroStrategy set to push Bitcoin to new highs after 55,500 BTC acquisition, should investors be concerned?

MicroStrategy revealed on Monday that it made another heavy Bitcoin purchase, acquiring 55,500 BTC for $5.4 billion at an average rate of $97,862 per coin.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.