Mastercard exceeds earnings expectations in Q4, aims to increase Ethereum scalability

- Mastercard has exceeded earnings expectations in Q4 as online spending continues to surge.

- CEO of Mastercard stated that the firm aims to increase Ethereum scalability.

- The payment firm partnered with ConsenSys to roll out a new ETH scaling system in Q4.

Mastercard has seen its fourth-quarter net income rose to $2.38 billion from $1.79 billion and its reported revenue of $5.22 billion, exceeding analysts' expectations. The payment company is seeking to increase Ethereum scalability through its partnership with ConsenSys.

Mastercard seeks to delve further into crypto

Mastercard reported revenue of $5.22 billion in Q4 2021, up from $4.12 billion a year earlier. The payments firm highlighted that card-not-present transactions, mostly used for online spending continued to show strength.

Earlier in 2021, Mastercard revealed that the company is preparing for the future of cryptocurrencies and payments, and will start supporting certain digital assets directly on its network.

Mastercard believes that accepting cryptocurrencies will create a lot more possibilities for shoppers and merchants, enabling them to transact in an entirely new form of payment.

Mastercard has partnered with ConsenSys in Q4 to roll out a new Ethereum scaling system, enabling the expansion on both the Ethereum mainnet and private use. The two firms aim to address the challenge of scalable applications on the Quorum tech-stack through an offering that provides “enterprise-grade scalability” to financial organizations.

During the latest earnings call, Michael Mieback, the CEO of Mastercard said, “We want to help increase Ethereum scalability via our ConsenSys partnership.”

Ethereum price fails to escape downtrend

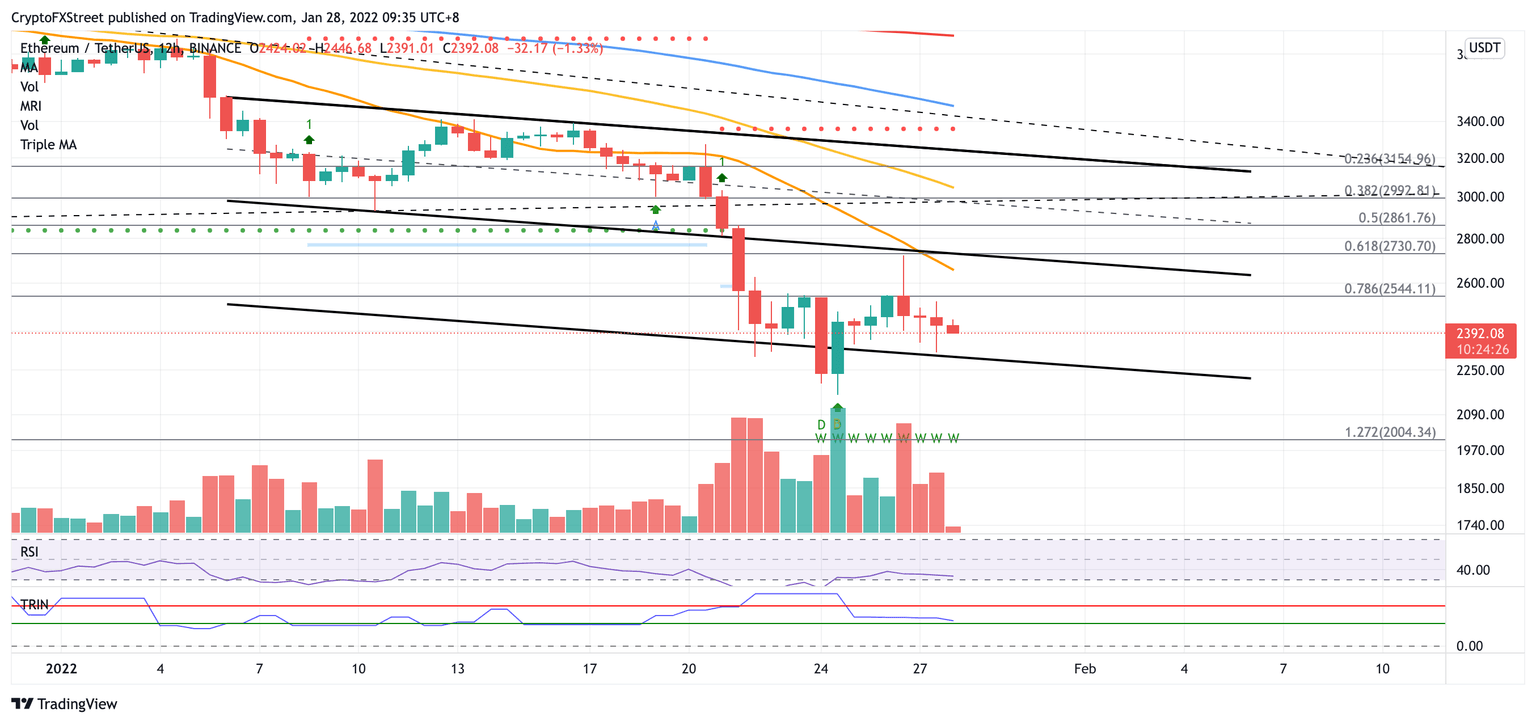

Ethereum price could continue to fall further following the break below the descending parallel channel on the 12-hour chart.

Although Ethereum price has already exceeded the bearish target given by the prevailing chart pattern at $2,337, ETH is sealed within a consolidation pattern.

ETH/USDT 12-hour chart

Until Ethereum price can escape above the lower boundary of the governing technical pattern at $2,730, ETH could continue to be locked in a downtrend.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.