MasterCard advances its Bitcoin and crypto card adoption with new partnerships, Polygon, Solana in the mix

- MasterCard disclosed a new partnership with Polygon, Solana, Ava, and others during the Consensus 2023.

- The product, MasterCard Crypto Credential, will be based on trust in the blockchain ecosystem.

- Tools will verify trusted interactions and help secure interactions between web2 and web3 apps.

- SOL has reacted positively to the news, outperforming MATIC, AVA, and APT.

MasterCard revealed a new partnership with Polygon (MATIC), Ava, and Aptos, among others, on a joint venture set to advance their innovative work in blockchain technology. The product, dubbed MasterCard Crypto Credential, will enhance “trust in the blockchain ecosystem,” according to an official announcement at Consensus 23 on April 28.

At #Consensus23, we announced how we are instilling trust in the blockchain ecosystem through Mastercard Crypto Credential. With crypto wallet providers @Bit2Me_Global, @LiriumAG , @MercadoBitcoin and @UpholdInc and public blockchain network organizations @AptosLabs,… pic.twitter.com/P33mtDVAas

— Mastercard News (@MastercardNews) April 28, 2023

The New York-based company is committed to expanding its Bitcoin and crypto card adoption. The crypto card program is designed to enable users’ digital asset use through MasterCard payment technology. Currently, the company boasts over three billion cards in circulation worldwide and is accepted at more than 90 million locations.

MasterCard to instill trust in the blockchain ecosystem

Based on the announcement, the service will also “improve verification in non-fungible tokens (NFTs), ticketing, enterprise, and other payment solutions.” A host of blockchain companies is also partisan to the collaboration, including Solana (SOL), with a press release on the MasterCard Crypto Credential system underscoring its focus on trust in the blockchain space.

The Solana Foundation is excited to work with @Mastercard on tools to verify trusted interactions and help secure interactions between web2 and web3 apps.

— Solana Foundation (@SolanaFndn) April 28, 2023

This is a positive step forward in enabling trust in trustless environments for consumers, businesses, and the greater… https://t.co/QhOsEmhIeD

MasterCard head of crypto and blockchain, Raj Dhamodharan, who pioneered the company’s innovative growth initiative, detailed what the innovative system will entail, saying:

MasterCard Crypto Credentials will establish a set of common standards and infrastructures that will help attest trusted interactions among consumers and businesses using blockchain networks.

According to Dhamodharan, MasterCard Crypto Credential will have several applications based on the understanding that “consumer and business verification needs vary widely based on market and compliance requirements.” Nonetheless, the executive noted that the system would be integrated into the MasterCard Music Pass NFT and MasterCard Artist Accelerator offers.

Securing interactions between web2 and web3 apps

From the announcement, it appears MasterCard Crypto Credentials wants to ascertain that anyone who wants to interact across Web3 environments enjoys the set standards for their needed activities. With this, the partnership with networks such as Polygon and Solana, among others, underscores the potential of the technology.

Notably, this is not the first time MasterCard is collaborating with crypto firms. Among its older associates include a host of cryptocurrency exchanges like Binance, Nexo, and Gemini, all within the crypto card service scope.

Also Read: Will Visa and Mastercard retreat from crypto drive adoption of Crypto.com, Coinbase cards?

Solana price rises 5% on the day amid news of newly found collaborator

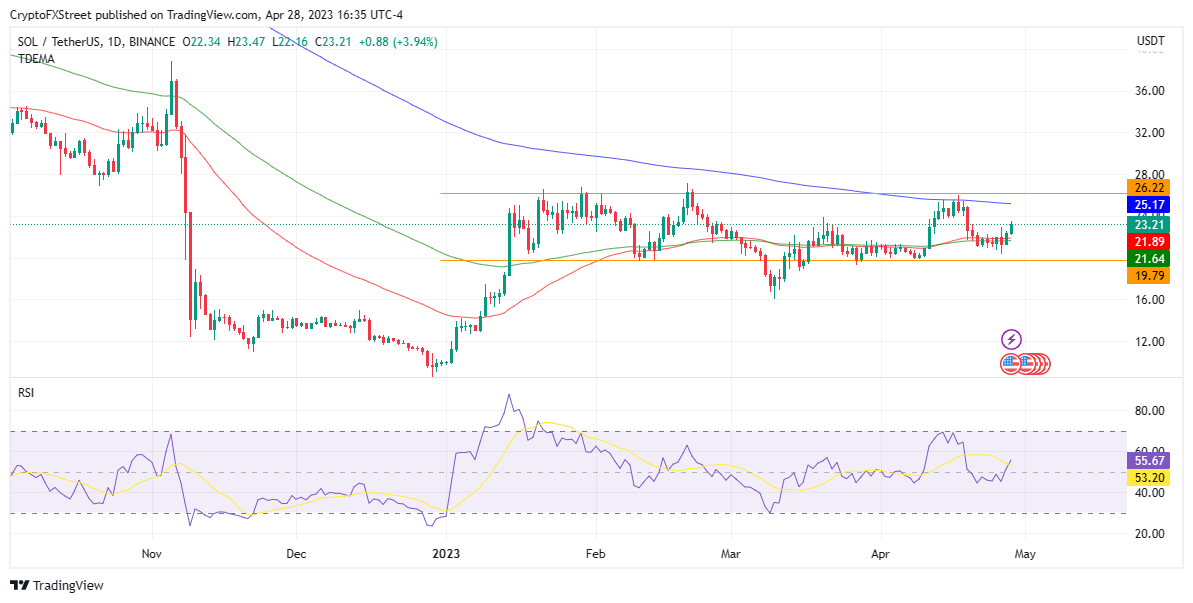

Solana (SOL) price is up almost 5% in the last 24 hours amid the MasterCard-related hype. The current market value is a 15% increase from its price 30 days ago, marking a notable improvement. A sustained increase in buyer momentum could send the Ethereum (ETH) killer up an additional 10% to the February 20 high of around $26.22.

SOL/USDT 1-day chart

MATIC, APT, and AVA have also reacted to the news in the lower timeframes, but still not as much as SOL.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.