MASK Network continues downtrend despite successful hackathon event

- MASK Network’s token continued its decline despite the successful completion of the Network State Hackathon.

- The hackathon concluded with six winners across different categories, with protocols focused on decentralization of identity and privacy.

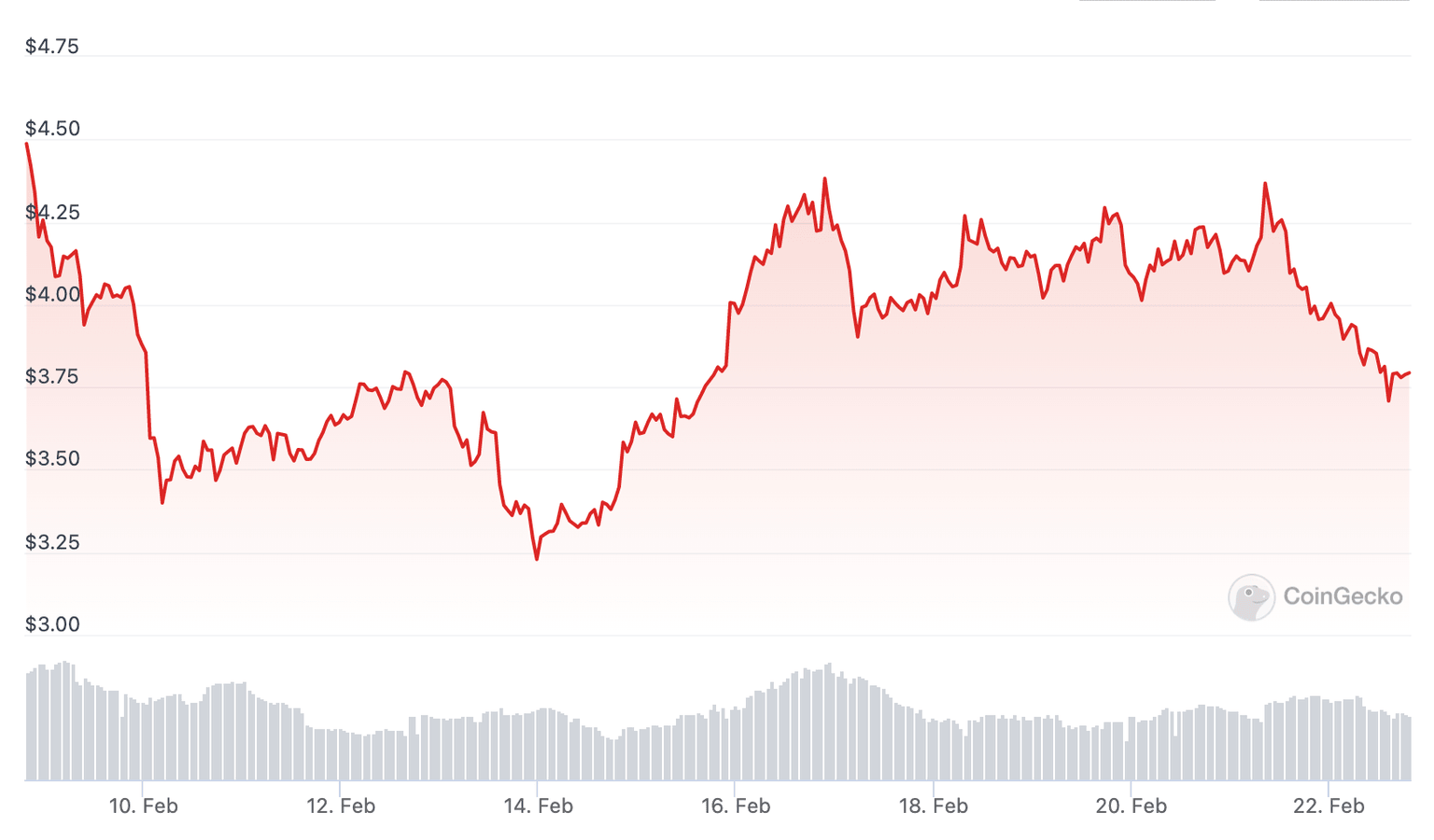

- MASK price nosedived 6.5% since February 21 and the token has yielded 15.3% losses over the past two weeks.

MASK Network is the protocol that enables users of popular social media platforms to interact with dApps and share encrypted content over Twitter. The protocol’s token has yielded 6.5% losses overnight, despite a successful completion of the Network State Hackathon event.

Also read: Here’s why MASK Network’s token yielded 11% gains overnight

MASK Network successfully completes hackathon event

MASK Network State Hackathon was successfully concluded on February 20. Protocols building and developing prototypes participated, and six projects emerged winners in their categories. Over 200 participants from many different countries, including China, India, the US, Nigeria, Japan, Singapore participated.

The Hackathon is backed by MASK Network’s social ecosystem and Starkware’s core eco projects. The social wallet Civia won the Gold, followed by Mind Network and W3Space. Across the social, infrastructure and game categories Noname.Monster, Matrix Multi chain unity ToolKit and Degen Reborn emerged as winners.

Most Web3 projects that participated were focused on decentralized identity and privacy.

MASK price nosedived 6.5% since February 21. The token is currently in a short-term downtrend, after 15.3% losses since February 8.

MASK price chart

MASK has witnessed a steep decline in the first week of February. The recent downtrend looks similar to the drop witnessed by MASK holders prior to February. MASK holders are awaiting the launch of Twitter’s crypto payments as they anticipate the token will find wider utility and adoption on the social media platform. MASK is competing with Shiba-Inu-themed cryptocurrency Dogecoin for being accepted as payment on the social messaging protocol.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.