- MANTRA announced its partnership with UAE real estate giant MAG on Wednesday via social media platform X.

- This collaboration introduces new investment opportunities for tokenized real estate worth $500 million in the flourishing Middle Eastern market.

- On-chain data shows that new Whales have accumulated 12.92 million OM tokens, and the exchange supply has decreased.

MANTRA announced its partnership with UAE real estate giant MAG on Wednesday via social media platform X, aiming to tokenize $500 million in real estate assets. Together, they plan to democratize luxury UAE real estate access through secure, yield-bearing vault products powered by MANTRA's L1 technology.

This collaboration introduces new investment opportunities for tokenized real estate in the flourishing Middle Eastern market, solidifying MANTRA and MAG's pivotal regional roles.

MAG Lifestyle Development CEO Talal Moafaq Al Gaddah emphasized that the alliance with MANTRA will enhance business operations and introduce forward-thinking products.

"MANTRA enables us to utilize cutting-edge blockchain technology to enhance the value and accessibility of our real estate offerings. This strategic partnership is crucial as we continue to innovate and lead in the luxury real estate sector," he said.

UAE Real Estate Giant #MAG Partners with #MANTRA to Tokenize $500 Million in Real Estate Assets

— MANTRA - Tokenizing RWAs (@MANTRA_Chain) July 3, 2024

✅ MANTRA and MAG will collaborate to democratize access to luxury UAE real estate using secure, yield-bearing vault products backed by MANTRA’s L1 technology.

This collaboration… pic.twitter.com/eVrwOUUa9H

Data from Arkham Intelligence shows that two fresh wallets withdrew 12.922 million OM tokens worth $10.79 million on Wednesday.

Within last 8 hours, 2 fresh wallets withdrew totally 12.922M $OM ($10.79M) from #Binance

— The Data Nerd (@OnchainDataNerd) July 4, 2024

0xD2A withdrew 4.758M $OM (~$4.16M)

0x95F withdrew 8.164M $OM (~$6.63M)

Addresses:https://t.co/kiK58IgzpLhttps://t.co/rln65d9TnJ pic.twitter.com/TjD2o0Ont8

In addition, on the same day, Santiment's supply on exchanges declined from 135.57 million to 125.46 million. This decrease indicates that investors move OM tokens to wallets and reduce selling activity.

%20[08.57.22,%2004%20Jul,%202024]-638556669758606217.png)

OM Supply on Exchanges chart

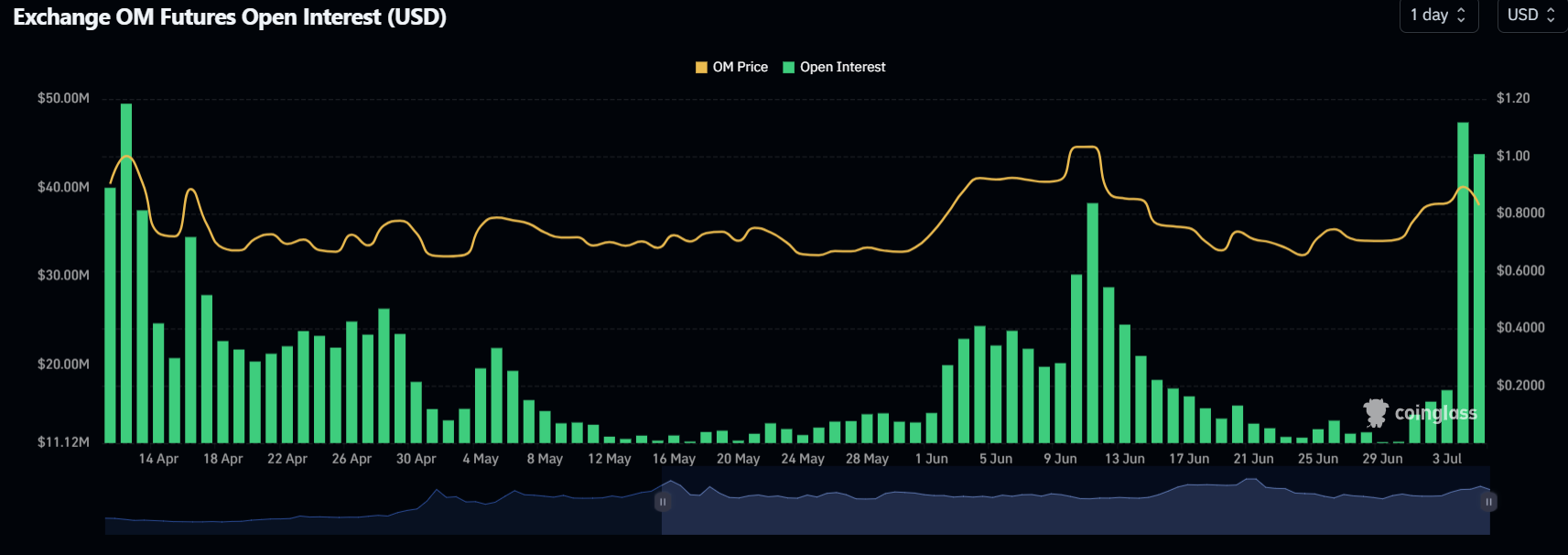

OM's Open Interest data indicates a significant surge, climbing from $15.80 million on July 2 to $47.35 million on July 4, marking its highest level since mid-April. This uptick suggests an influx of new capital and heightened buying activity in the market.

OM Open Interest chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

White House Crypto Summit could boost adoption across financial markets: Binance exec Rachel Conlan

Trump’s White House Crypto Summit is hours away, and executives maintain optimism and a positive outlook on crypto adoption. Rachel Conlan of Binance expects increased institutional and retail participation.

Bitcoin Weekly Forecast: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

Solana’s co-founder says ‘No Reserve’ to SOL as a part of Trump’s Crypto Strategic Reserve

Solana price stabilizes and trades around $142.8 at the time of writing on Friday after falling nearly 20% this week. Solana co-founder Anatoly Yakovenko raised concern about SOL as part of the US Crypto Strategic Reserve on his social media X.

BTC, ETH and XRP struggle despite Trump’s Bitcoin Reserve order

Bitcoin price is extending its decline on Friday after falling more than 7% so far this week. Ethereum price is retesting its key support level at around $2,125; a close below would extend the correction.

Bitcoin: BTC bloodbath continues, near 30% down from its ATH

Bitcoin (BTC) price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.