- Maker price has performed exceptionally over the past five days, rising by more than 45%.

- As a result of the rally, 21,660 MKR stand on the verge of turning green if Maker price crosses beyond $1,002.

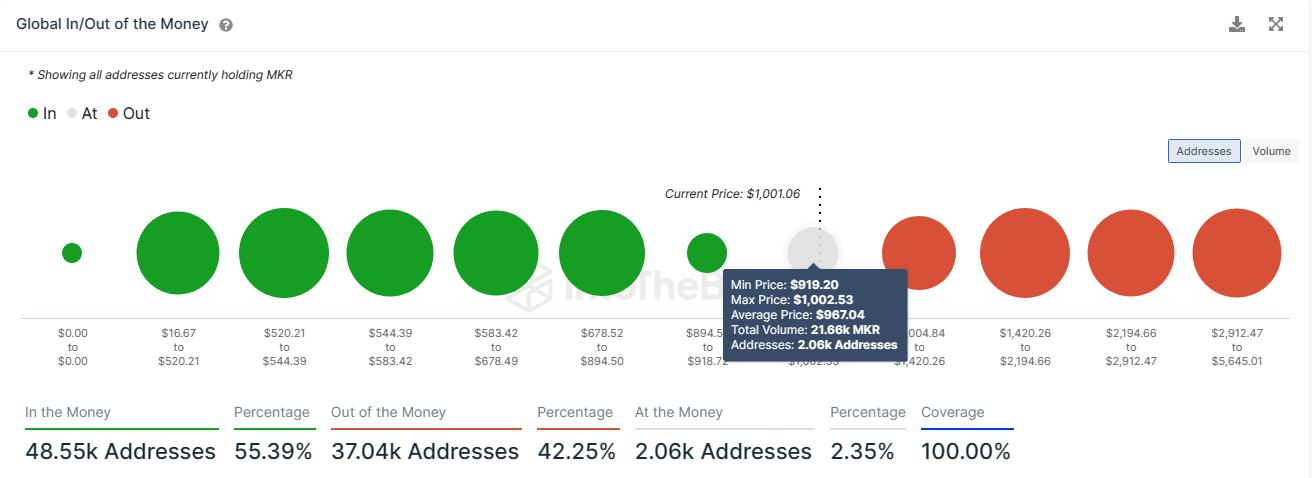

- Consistent selling and a market cool-down might result in corrections, potentially keeping over 2k investors from witnessing profits.

Maker price achieved significant gains this week after posting green candlesticks day after day. This revived hope in the hearts of investors that they could be seeing profits soon. However, the changing market conditions and peculiar investor behavior might keep some of these investors from seeing profits for a while.

Maker price rise comes to a halt

Maker price shot up by over 45% in the past week to trade at $989 at the time of writing, even breaching the $1,000 mark during the intra-day rise. This rise, however, slowed down on Tuesday after the altcoin climbed back down from the highs of $1,039 as broader market cues and price indicators switched their bearing from bullish to neutral.

The Relative Strength Index (RSI) is currently hovering in the overbought zone above the 70.0 mark. This area is synonymous with corrections as it suggests that the market is overheated and would need to cool down.

MKR/USD 1-day chart

Furthermore, selling has been a consistent activity observed since last month, where MKR holders have been slowly but significantly offloading their assets. Between June 10 and the time of writing, more than 11,000 MKR worth almost $11 million has been deposited back into exchange wallets.

Maker supply on exchanges

These developments have raised concern among investors, especially the 2k addresses that are presently hanging in uncertainty. These investors bought their supply at an average price of $967, with the upper limit on this supply being $1,002.

Thus if Maker price were to tag and flip the $1,000 mark into a support floor, the chances of these 2k investors gaining profits would increase.

Maker GIOM

Consequently, the total volume of 21,660 MKR bought between $919 and $1,002 would become profitable, bearing profits worth more than $21.6 million at the present price. But should the concerns turn true and the altcoin note corrections, these investors would be left in losses, awaiting another eight-month high from MKR.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[04.51.59,%2005%20Jul,%202023]-638241129137431478.png)