Maker loses 9% in past 24 hours as whales sell MKR for profits

- Maker’s large wallet investors sold $10.2 million worth of MKR for profits, early on Monday.

- A hedge fund recently announced its position in Maker, as the chain captures nearly 40% DeFi profits on Ethereum.

- MKR price wiped out over 9% of its value in the past 24 hours.

Maker (MKR) wiped out 9% of its value in the past 24 hours. Data from crypto intelligence tracker Santiment shows that large wallet investors are taking profit on their MKR holdings, likely driving down the asset’s price.

Maker whales sell over $10 million worth of MKR

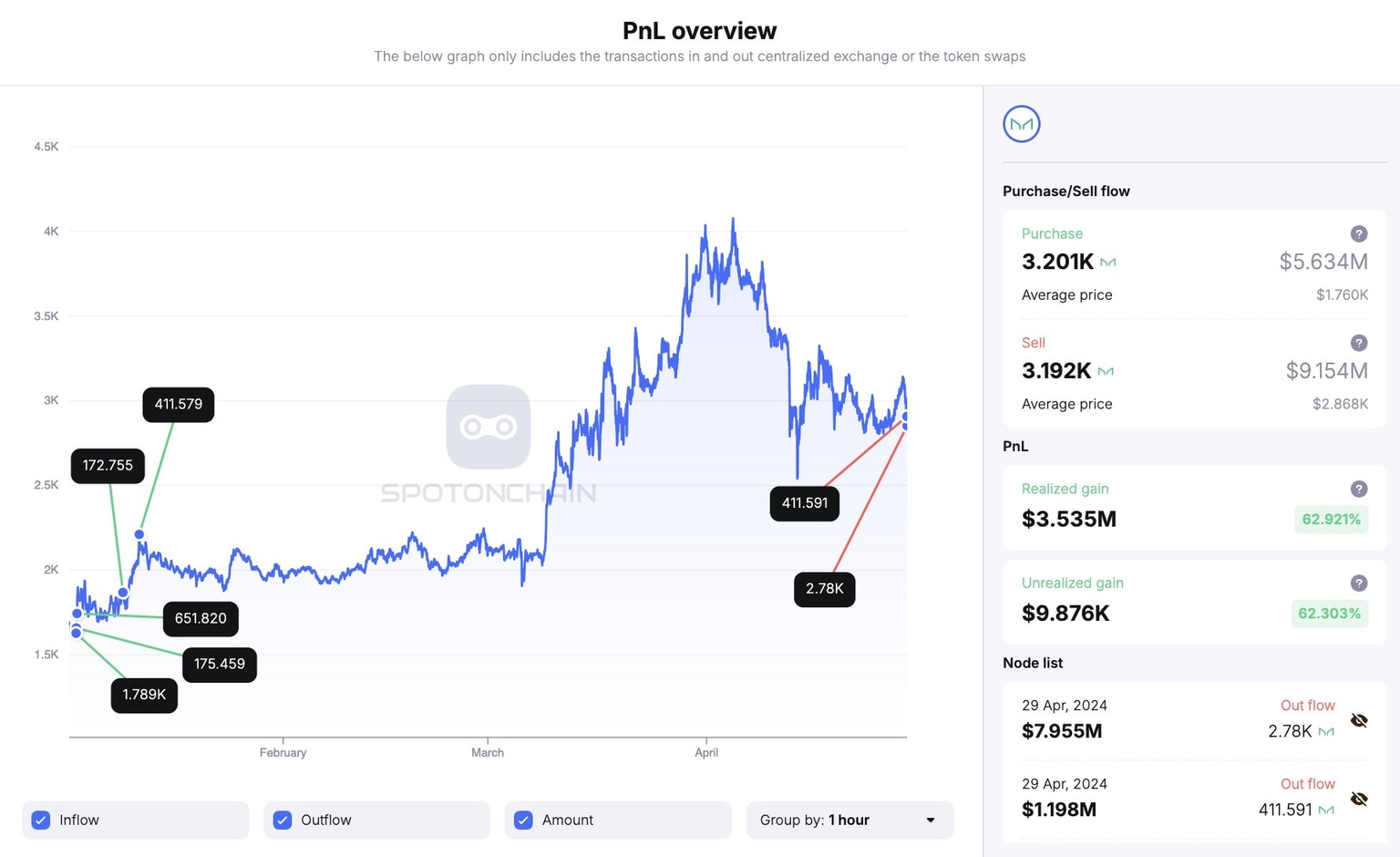

Spotonchain data shows whales identified with the wallet addresses 0x09e/0xdbb deposited 3,192 MKR worth $9.15 million to centralized exchange Binance, at an average price of $2,868, early on Monday. The large wallet investor realized an estimated profit of $3.54 million, or 63% within a four month time frame.

Whale takes $3.54 million profit

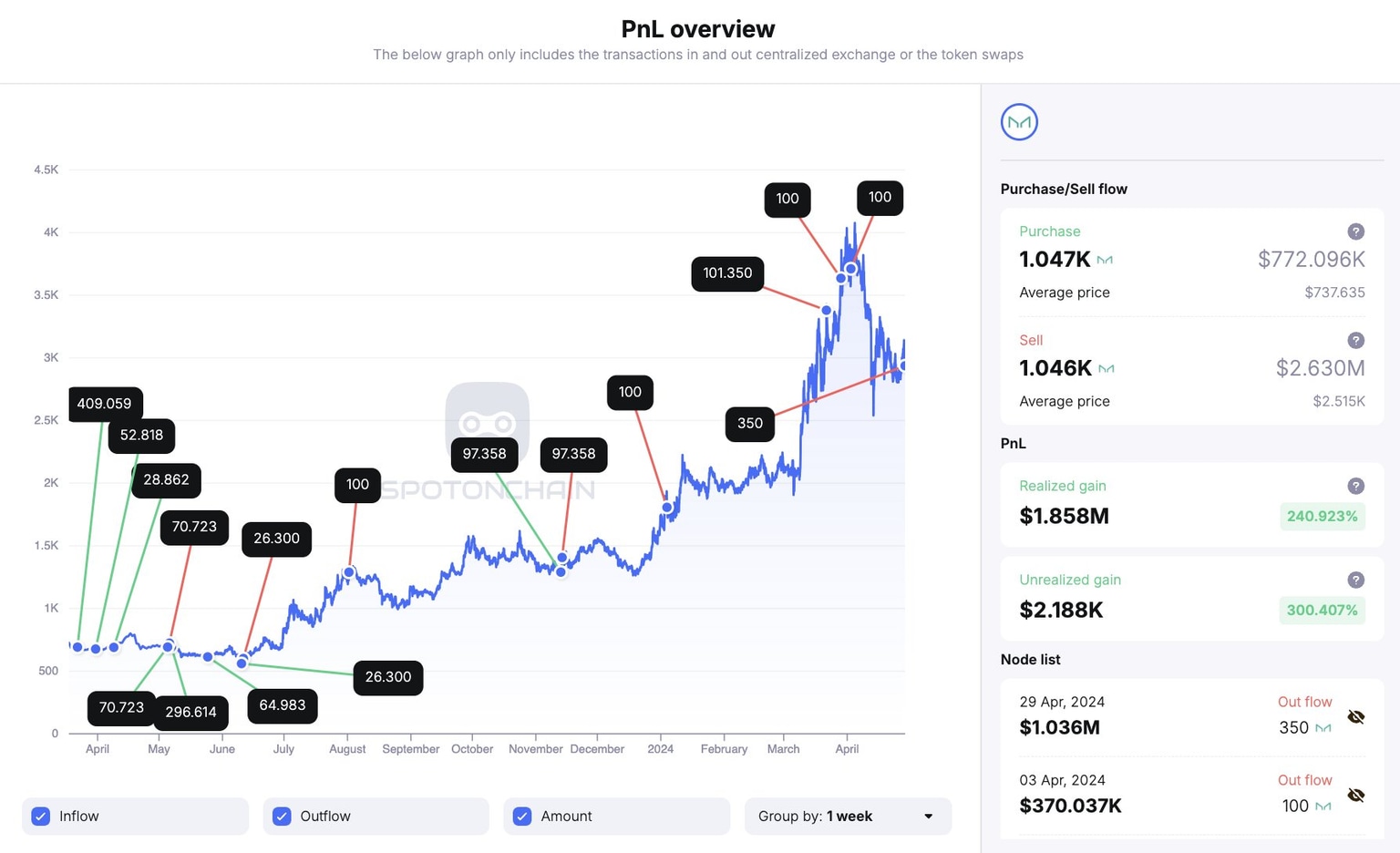

Another whale with the wallet address 0x637 sold the last 350 MKR for 325 Ether, or approximately $1.04 million. The large wallet investor’s average price was $2,961 and the whale closed the trade at an estimated profit of $1.86 million after a year of first purchasing MKR.

Whale takes $1.86 million profit

The actions of the above whales have contributed to the rising selling pressure on MKR. The token wiped out 8.79% of its value in the past 24 hours on Binance. MKR is exchanging hands at $2,799.

While whales took profits on their MKR holdings, Syncracy Capital, a thesis-driven hedge fund, showed high conviction on Maker last week. Ryan Watkins, co-founder of Sycracy, shared details in a tweet on X.

Over the past year Syncracy accumulated a large position in MKR.

— Ryan Watkins (@RyanWatkins_) April 25, 2024

We believe Maker could command a $40+ billion valuation this cycle given its vital role in financing Ethereum’s economy — a multi-billion dollar fee opportunity.

Our thesis on Maker in the Endgame Era.

1/ pic.twitter.com/y3F8pN07M7

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.