- MAGA price breaks above the descending trendline, suggesting a bullish move.

- Sideline buyers can accumulate TRUMP around $6.576 daily support level.

- A daily candlestick close below $4.579 would invalidate the bullish thesis.

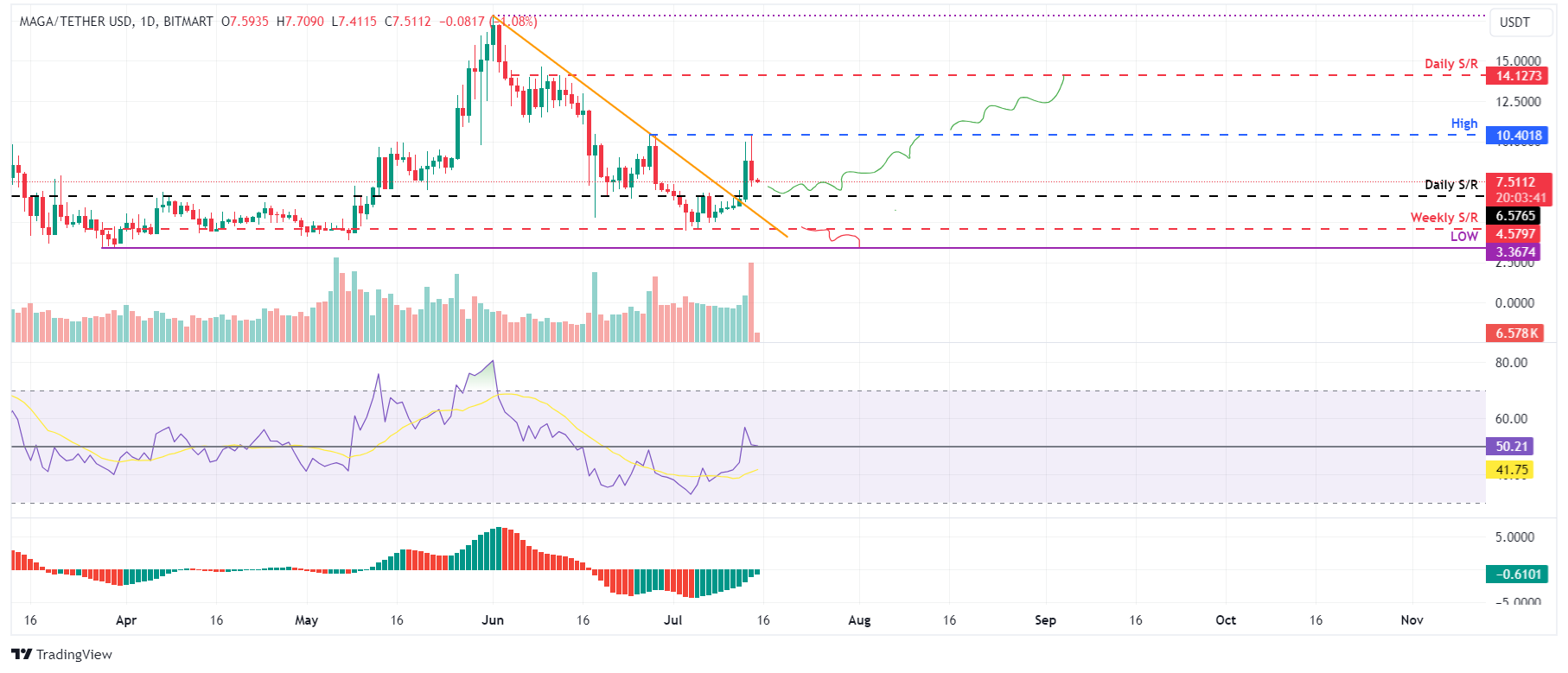

MAGA (TRUMP) has breached the descending trendline, indicating a potential bullish trend. Investors on the sidelines may consider accumulating TRUMP near the $6.576 daily support level ahead of a potential upside rally in the coming days.

MAGA price shows potential for an upside move

MAGA price broke above the descending trendline and the daily resistance level at $6.576 on Saturday and rallied 19% the next day to retest its daily high of $10.401 from June 27.

MAGA encounters resistance at the $10.401 level and, at the time of writing, trades 1% down at the $7.511 level on Monday.

If the trendline holds as throwback support roughly coincides with the daily support level around $6.576, TRUMP’s price could surge 58.5% and retest its daily high of $10.401 from June 27.

The Relative Strength Index (RSI) is currently above the neutral level of 50 on the daily chart, and the Awesome Oscillator (AO) is also approaching its neutral level of zero. If bullish momentum continues, both indicators must stay above their average levels to support the ongoing recovery rally. This would contribute positively to the upward movement.

If TRUMP's price closes above $10.401, it could initiate a 36% further rally, aiming to retest its next daily resistance of $14.127.

TRUMP/USDT daily chart

However, if TRUMP closes below $4.579, resulting in a lower low on the daily timeframe, it would nullify MAGA's bullish thesis. This scenario could trigger a 25% crash, revisiting its March 28 low of $3.367.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.