LUNC community calls for Binance CEO’s leadership as Terra Luna Classic price falls 25%

- The LUNC community wants Binance CEO Changpeng Zhao to lead revival efforts for the network.

- The move comes after they rejected a proposal put forward by a non-custodial validator.

- Binance and KuCoin exchanges have already approved similar proposals to that of the validator, with CZ offering insights.

Terra Luna Classic (LUNC) price remains in a downtrend, falling below a crucial support level after a so-called ‘Final Vision Plan’ proposed by a non-custodial validator was rejected by the community. Now members are turning to a leading crypto executive to lead the effort to salvage the network.

Also Read: BNB price declines as Binance suffers regulatory crackdown in Australia

LUNC price falls 25%, Terra Luna Classic community thinks Binance CEO is the answer

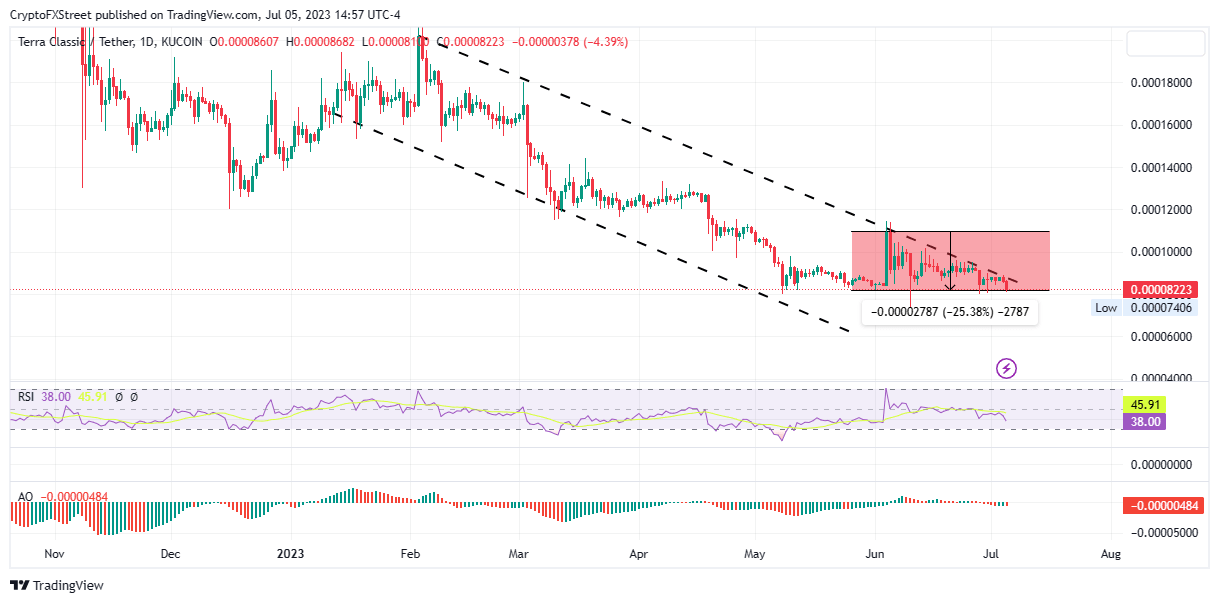

Terra Luna Classic (LUNC) price is down 5% over the last day and 25% over the last month after a proposal, christened ‘Final Vision Plan for LUNC $1+,” the brainchild of non-custodial validator Christopher Harris – who goes by the name of JESUSisLord on Twitter – was rejected in June.

LUNC/USDT 1-Day Chart

Harris had proposed an off-chain ‘burn tax’ on centralized exchanges (CEXs) at a rate of 1.2% per transaction as part of a strategic plan to reduce the 6.84 trillion total supply of Terra Luna Classic tokens and ultimately restore the token’s value above $1.0. According to the validator, tactfully burning these tokens would enable the LUNC chain’s recovery. Against the 1.2% burn tax, the CEXs would enjoy a 15X funding increase to balance off-chain/on-chain disparity, while decentralized applications (dApps) would be exempted from any taxes.

Despite the proposal, the plan fell through as community members voted against it, saying the network had just increased the burn tax by 0.5% already.

Thank you to everyone who has supported my Final Vision Plan for #LUNC to $1+!

— JESUSisLORD (@ForTheCross_CH) June 3, 2023

I see how the vote is going. It would be difficult to pull a win from here, but it's not impossible.

Let's see how the final results play out, and who decides to support!

Even if we don't… https://t.co/NIhWYJPSk0

Notably, Both Binance and KuCoin exchanges signed off on a 0.5% burn tax proposal, with the former’s CEO, Changpeng Zhao opining that Terra whales would disapprove of the 1.2% upping, and potentially following through with their threats to exit the network.

#binance will upgrade #TerraClassic tax to 0.5% at block height 12,902,400. Read more info in this link.#LUNC ✨ #HaileyLUNC ✨ $LUNC ✨#LUNCcommunity #LuncBurn #CZBinancehttps://t.co/8qTJWtLZ2J

— Hailey LUNC ✳️ (@TheMoonHailey) May 23, 2023

LUNC community call for Binance CEO’s leadership

Not completely disregarding the suggestion, CZ has advised that the 1.2% burn tax is better suited for the Terra blockchain where it can first be pedaled among CEXs. Considering the LUNC community members voted against Harris’ $1+ burn tax after CZ labeled it as a ‘too soon’ for CEXs, the Binance executive’s voice bears authority within the industry, specifically in the Terra ecosystem.

Evidence of this authority is seen in the July 5 post on Twitter, where LUNC community members invite Changpeng Zhao to extend his industry wit, management acumen, and leadership skills to pull the LUNC chain from its current pits sub-zero.

Terra Classic Community Proposes Binance CEO to Lead Revival Efforts for LUNC#LUNC #LuncArmy#LUNCcommunity#Luncburn https://t.co/xsCsfLFkt8

— Terra Luna army ™ (@terra_army) July 5, 2023

With comments calling for a vote that would see 100% approval and others acknowledging this as “the best decision” to bring a clear and well-known leader to the fore, it remains to be seen whether CZ will accept the invitation.

Changpeng Zhao is cited as the ideal nominee in proposal number 11614, submitted on June 29, for taking the role of a central authority expected to revitalize the Terra ecosystem, through effective management, resources, development coordination, and astute decision-making toward a reinvigorated LUNC.

Considering Binance and its CEO have already shown support for LUNC burns in the past, as detailed above, it would be unsurprising, though highly ambitious, to see CZ steer the Terra infrastructure. A more practical possibility would be to see him making governance decisions for LUNC as part of a collaborative mission to steer its value to the desirable levels above $1.0.

While FXStreet aims to keep you abreast of any developments, LUNC community members would be happy to know that the LUNC developer group is actively working to reduce LUNC and USTC token supplies. This is evidenced in the fact that the network signed off for a core developer Joint L1 Task Force (L1TF), for Q3 chain developments and maintenance, as reported by Coingape.

Terra still not on terra firma

The Terra ecosystem remains vulnerable amid continued uncertainty after the epic collapse of the Terra Luna blockchain in May 2022. The network collapsed following the sudden fall in the value of Terra USD (UST) stablecoin, causing huge loads of Terra Luna (LUNA) minting targeted at stabilizing UST’s value. Terra Luna price slumped as LUNA tokens saturated the market. Investors lost much money in this demise.

Terra Luna Classic (LUNC) is the do-over of the LUNA ecosystem, although the latter was created to be the original ticker for the Terra blockchain. In what the blockchain’s founder, Do Kwon, calls ‘Revival Plan 2” in the network’s developer forum, LUNC operates as a twin token for LUNA, trying to absorb the price deviation of the UST.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.