LUNA teases arrival of Cosmos-based protocol Alliance’s assets on Terra

- Terra introduced the community to open-source module Alliance in its recent tweet.

- The project teased Alliance Liquidity Provider assets’ arrival on Terra.

- LUNA price increased slightly to $0.6419 after weekly gains of nearly 4%.

Terra dropped details of an open-source Cosmos-chain-based module Alliance in its recent tweet on X (formerly Twitter). Alliance powers mutually beneficial relationships between blockchains and traders can stake Alliance assets to earn rewards using their Terra station wallets.

Also read: XRP price could deteriorate with Ripple’s request for deadline extension in SEC lawsuit

Terra users could see arrival of Alliance assets on the blockchain

Terra ecosystem will introduce users to the Alliance’s Liquidity Provider (LP) assets soon. The project made an official announcement on X and shared a step-by-step guide with users to stake Alliance assets and earn rewards.

Terra ecosystem’s web application, Station, offers users a wallet that supports cryptocurrencies and interaction with Terra Core and other chains. Users can use their Station Wallets to stake assets and earn staking rewards through Cosmos-based module Alliance.

2/ Follow this step-by-step guide to stake Alliance assets and earn Alliance rewards using @StationWallet ️https://t.co/02Vn5LxgrM

— Terra Powered by LUNA (@terra_money) February 6, 2024

Almost any token can be transformed into an Alliance asset and its rewards can be adjusted through governance votes. Alliance is therefore a tool that can help scale Terra’s ecosystem needs.

LUNA price increased 1.12% to $0.6478 on Wednesday. The token yielded nearly 4% gains to holders in the past week.

LUNA price recovery likely

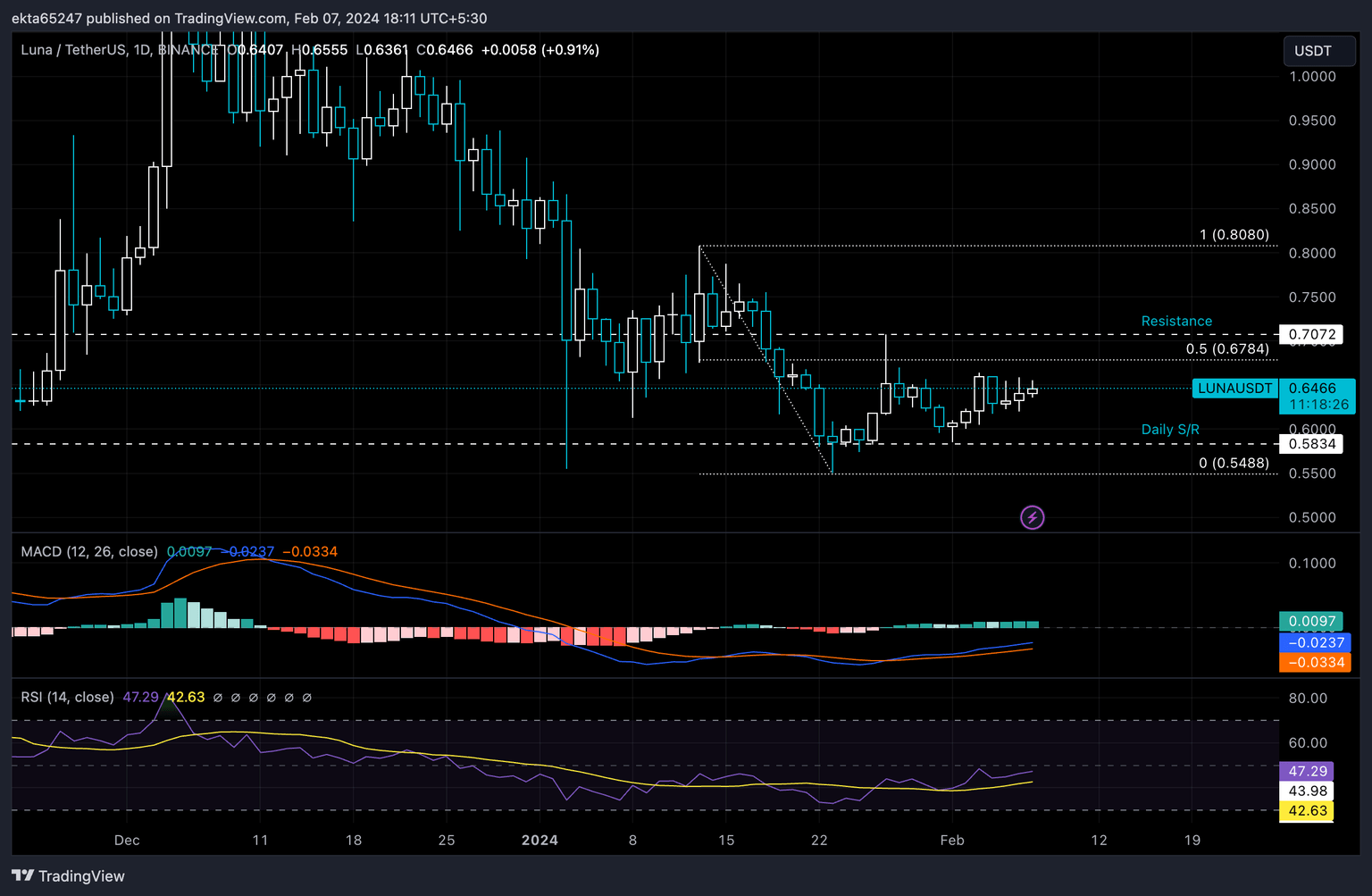

LUNA price is in a downward trend that started in December 2023. The asset is currently close to its 50% Fibonacci Retracement of the decline between January 13 and 23, at $0.6784. The closest support is at $0.5834, a level that has acted as support for several months now.

In its upward trend LUNA price could face resistance at $0.7072. The green bars on the Moving Average Convergence Divergence (MACD) signal a likelihood of LUNA price rally. Relative Strength Index (RSI) complements the outlook as it inches closer to the neutral level, at 47.29 at the time of writing.

LUNA/USDT 1-day chart

A daily candlestick close below $0.5834 could invalidate the bullish thesis for LUNA price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.