LUNA price hits new all-time high as Terra emerges as one of the most competitive Layer-1 solutions

- LUNA price hit $47.29 in a price rally triggered by the Columbus-5 upgrade on the Terra ecosystem.

- Analysts expect Ethereum alternatives LUNA, SOL, AVAX, FTM to continue posting steady gains in October.

- LUNA and competitor SOL noted a spike in whale activity on cross-bridges.

Terra's Columbus 5 upgrade increased the deflationary pressure on the platform's utility token LUNA by implementing a burn policy. The recent upgrade is the key driver of LUNA's price rally.

LUNA hit a new all-time of $47.29, correlation with Solana and Avalanche hit a high

LUNA, one of the two tokens of the Terra ecosystem, has noticed an uptick in the daily trade volume since the Columbus 5 upgrade. The upgrade introduced a "burn policy" to permanently burn LUNA in conversion to Terra's algorithmic stablecoin (UST).

The primary purpose of Terra's utility token was to supplement UST when its value would drop below $1. LUNA used in the process was sent to the community pool.

The Columbus 5 upgrade was a game-changer as it meant LUNA used to supplement UST would be permanently burned. Therefore reducing the token's circulating supply and increasing deflationary pressure.

13/ Columbus-5 is just the beginning.

— Terra (UST) Powered by LUNA (@terra_money) September 30, 2021

It lays the foundation for future waves of apps, protocols, builders, and users to onboard into the TeFi ecosystem -- wielding the power of decentralized money that is more attractive to spend and hold than fiat incumbents.

Historically, an increase in deflationary pressure and dropping supply triggers a rally in the token. A tighter correlation between UST and LUNA, alongside the utility token's plunging supply, is expected to increase its price.

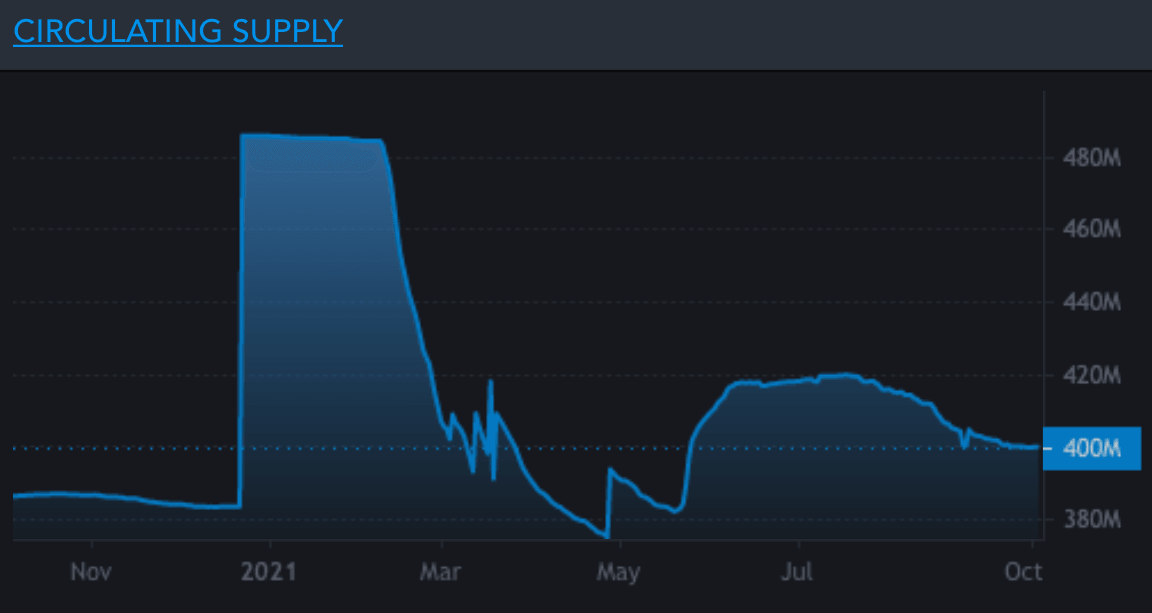

The following chart shows the consistent drop in LUNA supply since the implementation of the burn policy in Columbus 5.

LUNA circulating supply.

Earlier today, LUNA hit a new all-time high of $47.29. LUNA's correlation with its competitors, layer-1 scaling solutions Solana (SOL), Avalanche (AVAX) and Fantom (FTM), has increased consistently, hitting a high.

LUNA's correlation with SOL and AVAX is 0.89 and 0.93, respectively. The updates on the Terra blockchain that have a bullish impact on LUNA price are expected to trigger a rally in the tokens of other layer-1 solutions.

Pseudonymous cryptocurrency analyst and trader @AltcoinSherpa commented on LUNA's rally in a recent tweet,

$LUNA: Breaking all time highs has some interesting implications:

— Altcoin Sherpa (@AltcoinSherpa) October 4, 2021

-I expect other L1s to do well

-Alts will probably run just a bit longer before btc takes the throne

-Expect other L1s to do well such as AVAX, SOL, FTM#LUNA pic.twitter.com/QFY3liSRTg

Based on a recent Spencer Noon report, engagement on the Terra network has increased. As seen in the following charts, there is an increase in activity on the Terra bridge.

Traffic on Terra bridge (in USD).

The report also notes a spike in activity on the Solana blockchain.

@LomahCrypto, an analyst at a cryptocurrency trading group, The Haven Crypto, is looking to further accumulate LUNA when the price drops.

The analyst shares in a recent tweet that he is waiting for the token's supply to drop further,

Imagine doubting a bullish setup in a bullish market.

— Loma (@LomahCrypto) October 4, 2021

Took some off at these local highs. As usual, I'll be looking to compound on any $LUNA dips.

In Columbus-5, we trust. pic.twitter.com/6tZRKkuzWT

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.