LUNA gears up for revival as Terra community passes Terraform Labs proposal

- LUNA price rally is likely sustainable as the community passes Terraform Labs’ proposal for Terra recovery.

- TFL has begun evaluating opportunities to deploy its non-LUNA treasury to support Terra ecosystem growth.

- LUNA price climbed 12.65% over the past week.

The Terra ecosystem is likely to begin its recovery with the community’s approval of proposal 4790. Terraform Labs’ (TFL) proposal was passed with the support of 86.9% of the community. LUNA’s weekly gains are likely to sustain with these developments in the ecosystem.

Also read: Terra Luna Price Forecast: Key levels to watch, as LUNA remains borderline overbought

Terra community passes Terraform Labs’ proposal 4790

Terraform Labs’ proposed a revival of the Terra economy by leveraging their non-LUNA treasury. The proposal was passed with an overwhelming majority where 86.9% of voters supported TFL’s plan.

On-chain Proposal vote ended!

— Terra Governance Alerts (@terra_agora) October 25, 2023

Prop #4790: TFL Community Grant

Status: Passed (86.9% of YES votes, turnout: 56.1%)

Link: https://t.co/tTPTLGOJHG

TFL has requested 150 million tokens from the community pool, of which 100 million LUNA will go to the blockchain firm’s treasury, 25 million tokens to strategic partnerships and another 25 million LUNA tokens to the liquidity fund. TFL plans to match its non-LUNA treasury with the liquidity fund and deploy it to support Terra’s growth.

The firm proposes using a multisig wallet to manage funds earmarked for treasury and ecosystem partnerships. The token vesting program proposed by TFL will ensure that there is no immediate selling pressure on LUNA as the firm proposes vesting tokens linearly over five years, with a one-year cliff, starting January 2024.

TFL announced the first project that will receive the firm’s support, Celatone, an open-source Cosmos explorer. The project will deliver tooling and analytics for developers.

2/ TFL has already begun evaluating opportunities to deploy non-LUNA capital in collaboration with our community partners to support Terra ecosystem growth. One of the first projects to receive support is @celatone_, which delivers powerful new developer and analytics tooling ️ https://t.co/sw3YIhTMol

— Terra Powered by LUNA (@terra_money) October 25, 2023

TFL will share further details of its plan on November 3. Find TFL’s action plan and background on the proposal here.

LUNA price posted 12.65% weekly gains for holders and the token is likely to sustain its uptrend with bullish developments. LUNA is trading at $0.4557 on Binance at the time of writing.

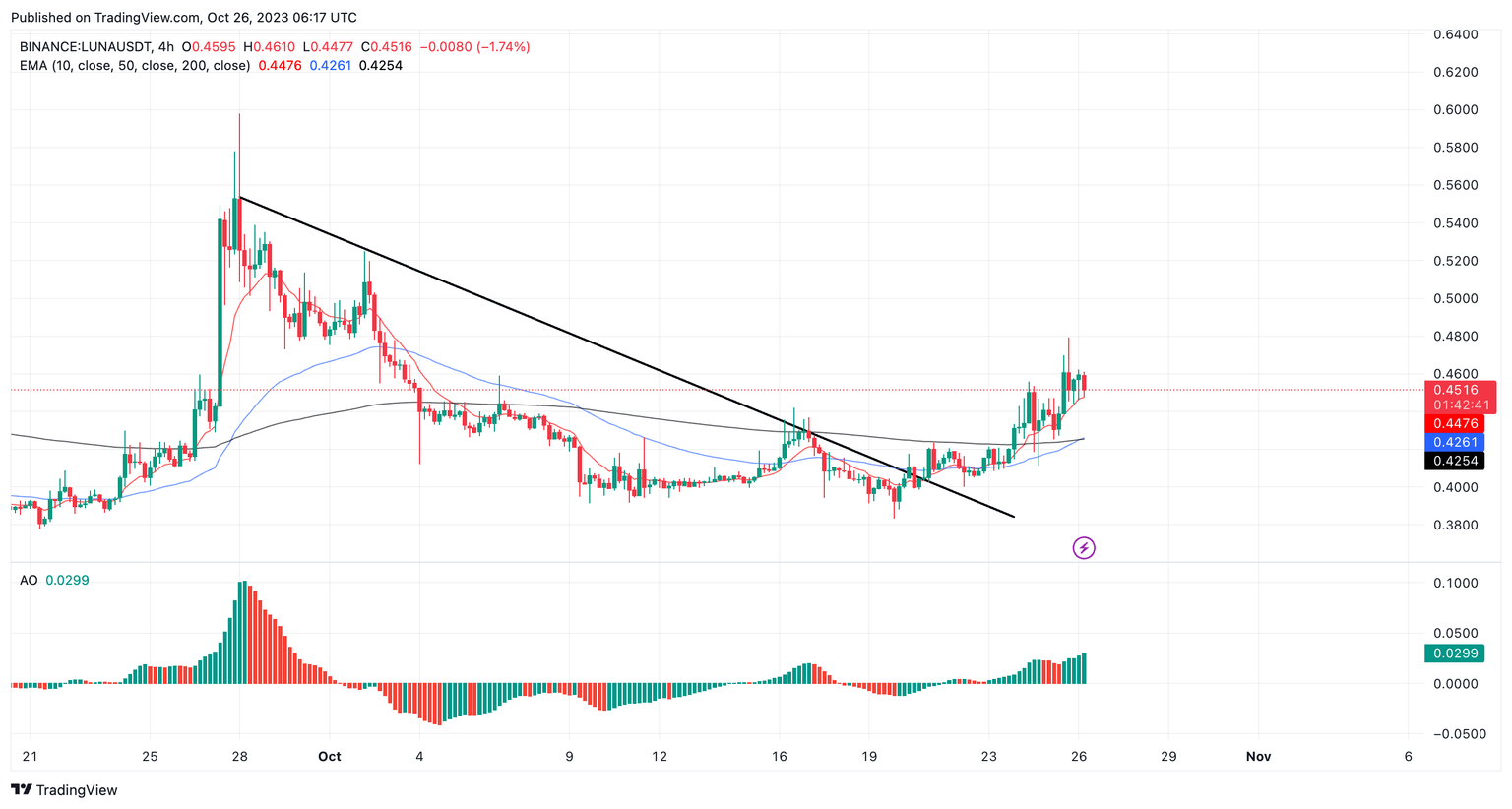

LUNA price reversed its trend on October 22, breaking out of a nearly month long downtrend. LUNA is currently trading above its three exponential long-term moving averages, 10, 50 and 200-day EMAs at $0.4476, $0.4261 and $0.4254 respectively.

LUNA’s uptrend is supported by the histogram bars of the Awesome Oscillator (AO). The bars are flashing green in the positive zone while LUNA price climbs higher on the four hour price chart. This shows that the bullish momentum is likely to drive LUNA price higher.

LUNA/USDT four hour price chart

In the event of a price drop, the 200-day EMA is likely to act as support at $0.4254. This marks a 5.8% decline from the current price level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.