Luna Classic Price Prediction: One more out-of-nowhere LUNC spike

- Terra's Luna Classic has risen by 20% since the weekend.

- LUNC consolidates under low volume, signaling bulls are aiming for higher targets.

- Invalidation of the bullish thesis is a breach below $0.000173.

Terra's Luna Classic price (LUNC) could rise once more to solidify a 20% rally on the week. Following the weekend decline, the short-term technicals are pointing north. Key levels have been defined to gauge a potential move.

Luna Classic makes a move

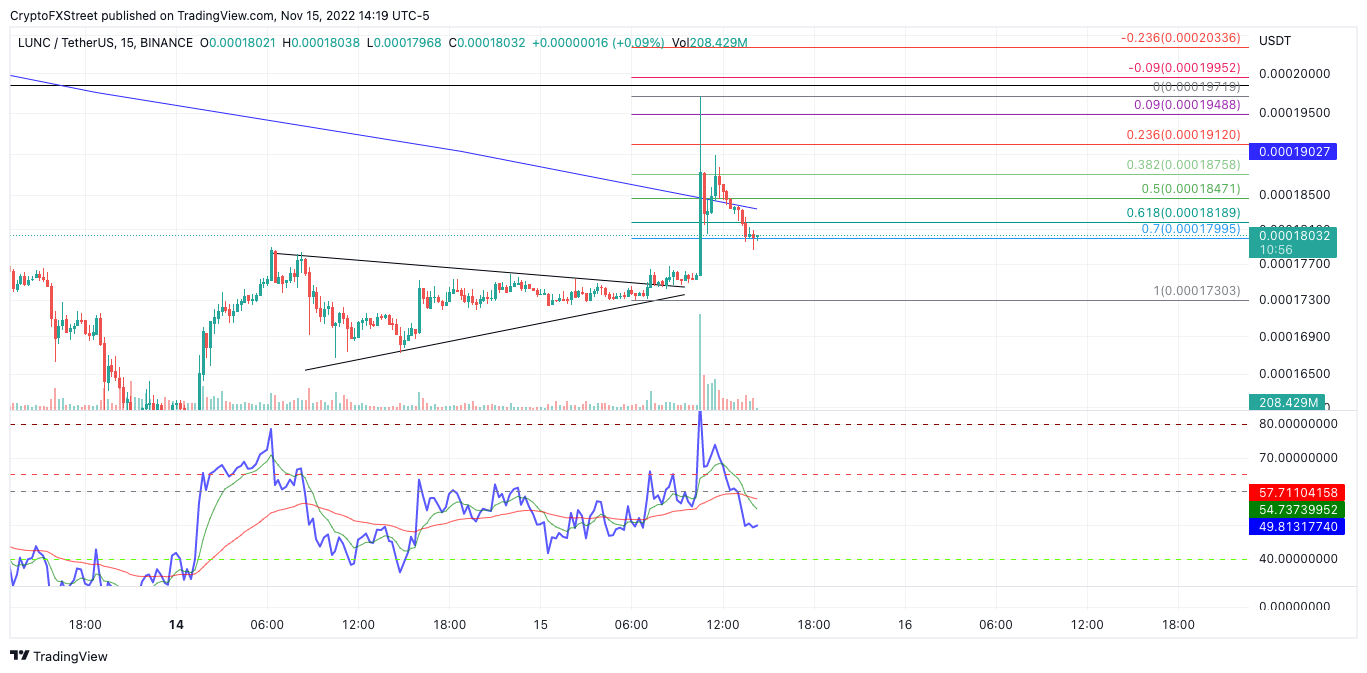

Terra's Luna Classic price has risen by 20% since the weekend crash. During the downswing, the bulls established a higher low which catalyzed the move higher. As the third trading week commenced, LUNC went into consolidation mode as a triangular pattern was displayed on smaller time frames. Now, the bulls have breached the triangle to the upside, causing a spike with a high of $0.000197.

Luna Classic price currently auctions at $0.000180 as a profit-taking consolidation has commenced post-rally. A Fibonacci retracement tool surrounding the strongest part of the rally shows the current price as a 70% retracement. The bears' ability to breach through the 50% and 61.8% levels suggests smart money may be loading up on bearish positions. Still. the Volume Profile Indicator remains sparse, which suggests the uptrend move is not yet over.

LUNCUSDT 30-Min Chart

Still, this thesis proposes that the triangle breakout could produce one more high that will challenge retail bears in the market. Bullish targets are capped just above the recent high at $0.000197 and possibly $0.000200.

Invalidation of the bullish idea is a breach below the origin point of the rally at $0.000173.

If the bears tag the invalidation point, the uptrend's potential would be void. Investors could expect a breach into the sub $0.000150 liquidity level, resulting in a 12% decline from the current Luna Classic price.

Here's how Bitcoin's moves could affect LUNA Classic price -FX Street Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.