Luna Classic Price Prediction: Bears aiming to wipe out retail traders

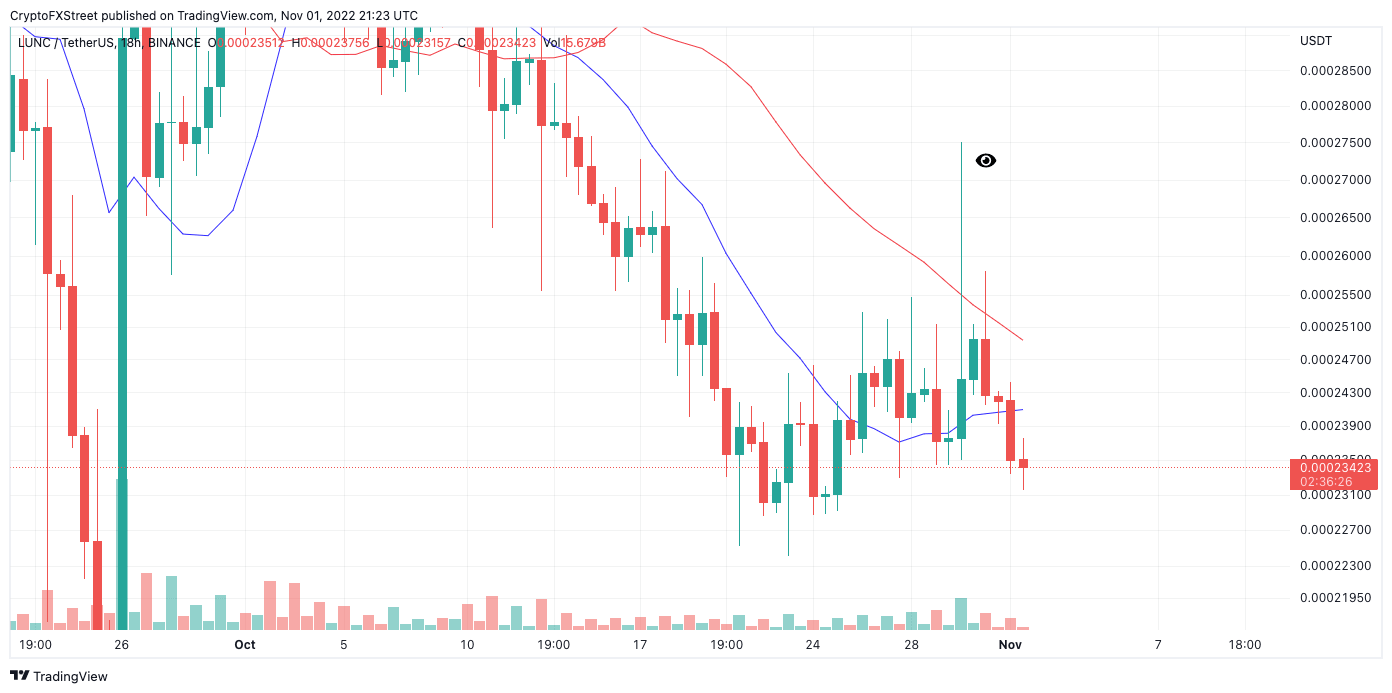

- Terra's Luna Classic price is down 10% since a 15% rally that occurred on Sunday.

- The bulls have lost support from two vital moving averages.

- Invalidation of the bearish thesis is a breach above $0.000250.

Terra's Luna Classic price is declining in free-fall fashion. A sweep-the-lows event is likely underway.

Luna Classic price heads south

Terra's Luna Classic price is showing concerning signals during the first trading day of November. After a 15% Sunday rally, LUNC abruptly fell under the 21-day simple moving average. The bulls then failed to produce a closing candle above the indicator as the week began.

Luna Classic price currently auctions at $0.000233. Following several attempts to move higher, the bulls ultimately caved and have since lost the support of the 8-day exponential moving average. Losing support from two vital moving averages in such a short time can be a testimony of the underlying bearish strength. If market conditions persist, a penny-from-Eiffel-style decline is likely underway and will breach the recent swing lows near $0.000223.

LUNC USDT 8 -Hour Chart

Invalidation of the bearish could occur if the bulls can hurdle the 21-day simple moving average currently positioned at $0.000250. If the bulls are successful, an additional uptrend move targeting the recent swing high at $0.000274 could occur. Such a move would result in an 18% increase from the current Luna Classic price.

Here's how Bitcoin's moves could affect LUNA Classic price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.