Luna Classic Price Prediction: Assessing LUNC's retaliation potential

- Terra's Luna Classic price has risen by 10% since the weekend.

- LUNC shows several bullish divergences, while the Volume Profile Indicator remains sparse in transactions.

- Invalidation of the bullish thesis is a breach below $0.000146.

Terra's Luna Classic price (LUNC) could produce a countertrend rally to challenge newfound bears in the market. Following the weekend decline, the short-term technicals are pointing north. Key levels have been identified to gauge LUNC's next potential move.

Luna Classic price has retaliation potential

Terra's Luna Classic price has risen by 10% following a weekend mudslide. During the downswing, the bulls reproduced a higher low that promoted countertrend ascension. Now, as the market consolidated, traders are forced to ask which side of the market they want to join for the remainder of November.

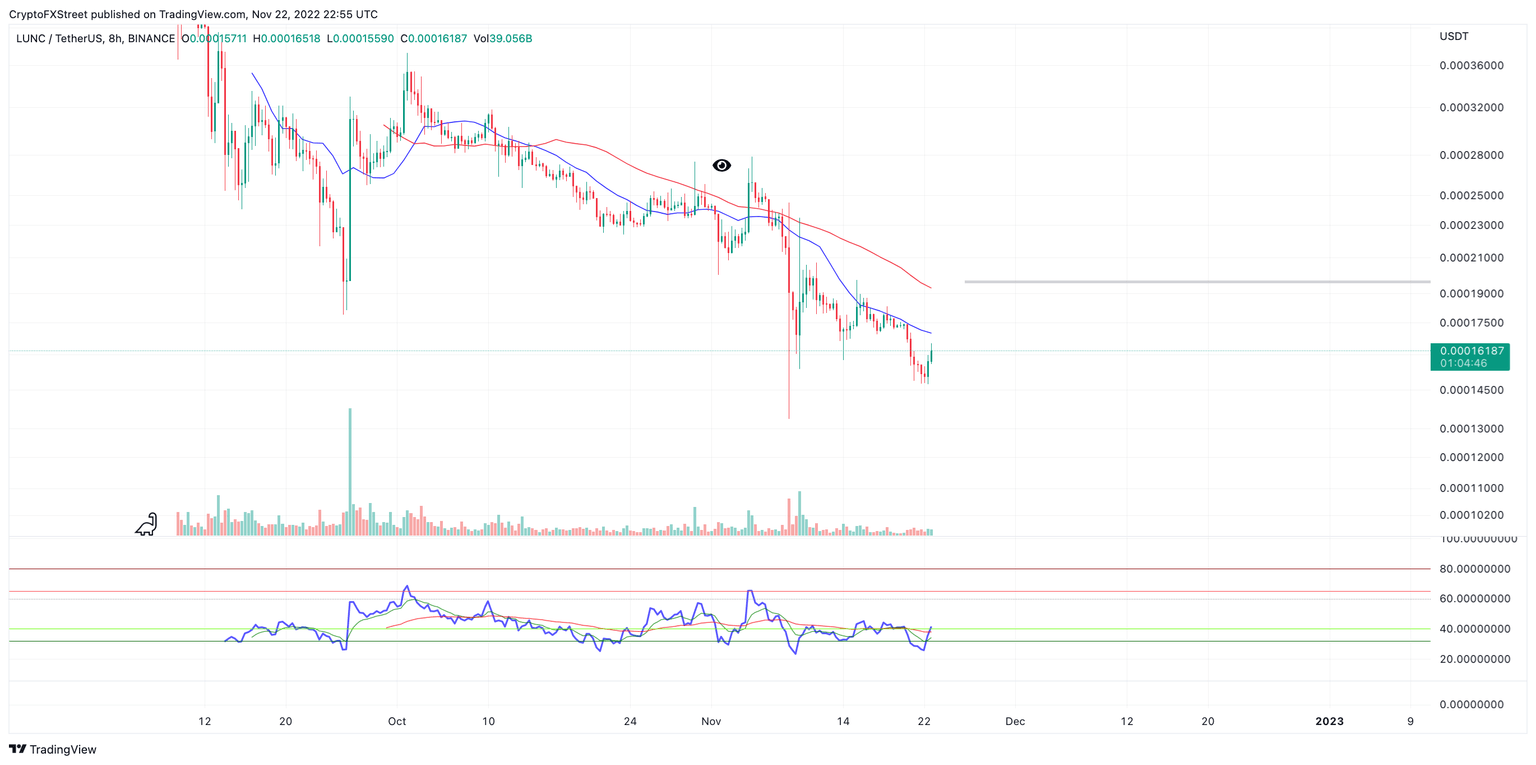

Luna Classic price currently auctions at $0.000161 as consolidation takes place after the 10% rally. The Relative Strength Index shows the bulls hurdling back into support after producing a double bottom extremely oversold territory. The Volume Profile Indicator shows the weekend's decline as having far fewer transactions than the previous sell-off, which compounds the notion that the bears may face a challenge in the coming days.

LUNCUSDT 4-Hour Chart

If the bulls genuinely have the strength to rise, the targets would be at the November 15 swing high at $0.000197 and possibly $0.000200 to challenge newfound bears in the market. Early confirmation of the move could be a breach of the 8-day exponential moving average currently positioned at $0.000171.

Invalidation of the bullish idea is a breach below the recent swing lows at$0.000146. If the bears tag the invalidation point, the uptrend's potential would be void. Investors could expect a breach into November lows at $0.000133, resulting in a 16% decline from the current Luna Classic price.

In the following video, our analysts deep dive into the price action of Bitcoin , which will likely have an effect on the price fluctuations of LUNC in the coming days. FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.