LUNA Classic Price Prediction: A second opportunity to short LUNC’s 50% crash

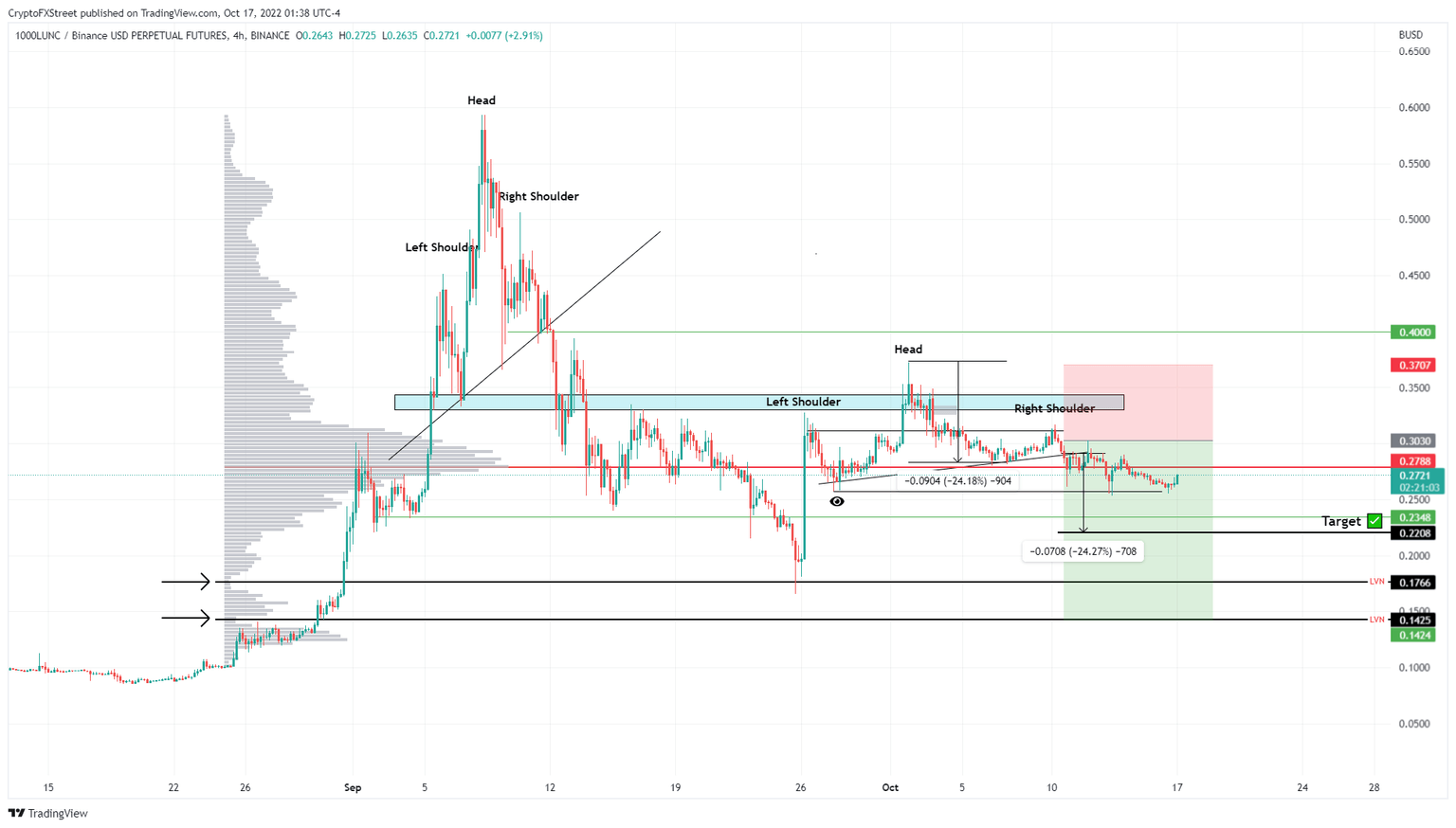

- LUNA Classic price shows a continuation of the downtrend after a breakdown from the head-and-shoulders pattern.

- Investors can re-enter their short position at the retest of $0.000278.

- A daily candlestick close above $0.000343 will invalidate the bearish outlook for LUNC.

LUNA Classic price continued to slide lower over the weekend but things seem to be turning around this week. As the new week’s Asian session kick-starts, investors can expect a minor rally that will provide a better entry for the ongoing bearish move.

LUNA Classic price provides another opportunity

LUNA Classic price created a head-and-shoulders setup between September 26 and October 10. However, the selling pressure on October 10 resulted in a break down, kick-starting a 50% move to the downside.

The head-and-shoulders setup forecasts a 50% downswing, determined by measuring the distance between the head’s peak and the valley that follows. Adding this measure to the breakout point at $0.000290 shows that the target is $0.000220.

So far, LUNA Classic price has dropped 11% but is on a rebound. It is likely going to retest the highest volume traded level since August 24 at $0.000278, which will serve as a resistance level. Therefore, investors interested in shorting LUNC can do so here.

If the sellers kick-start a downtrend before retesting $0.000278, there can be a premature crash that can knock LUNA Classic price to the $0.000234 support level. A breakdown of this level could further catalyze a nosedive to gaps in the volume profile aka low volume nodes at $0.000176 and $0.000142.

In total, LUNA Classic price can shed 50% from $0.000278.

LUNC/USDT 4-hour chart

On the other hand, if LUNA Classic price flips the $0.000278 hurdle, it is the first signs of weakness among sellers. However, a daily candlestick close above the $0.000329 to $0.000343 resistance barrier will invalidate the bearish outlook for LUNC.

In such a case, investors can expect LUNA Classic price to attempt a retest of $0.000400

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.