Luna Classic could yield massive gains for holders, if Terra community does this

- Luna Classic ecosystem has witnessed a peak in development activity based on on-chain metrics.

- The Terra community is recovering from the FTX exchange collapse; the development group raised funds for building DeFi projects.

- LUNC bulls could push the token from the 38.2% Fibonacci retracement level to the $0.000194 target.

An independent Terra development community, TerraCVita has raised $2 million to fund new DeFi projects on its ecosystem. Terra, which has suffered contagion after the collapse of crypto broker FTX, could see a recovery in its native token Luna Classic’s price as a result of the new cash injection in DeFi projects in the ecosystem.

Also read: Here’s how SHIB, BONE and LEASH holders can benefit from Shiba Inu layer-2 Shibarium’s launch

Luna Classic holders await massive gains as Terra community recovers from FTX crash

Luna Classic (LUNC) yielded double-digit gains for holders in the two week period between January 3 and January 17 and LUNC holders could witness further gains with the Terra community’s latest moves. The new funding is seen as a sign the development community is on track to recover from the collapse of the FTX exchange and sister trading company Alameda Research.

The $2 million was raised by Independent Terra Development Group TerraCVita from a recent sale of Terraport. The group has plans to launch a decentralized exchange (DEX), a governance token via an initial coin offering, and a Terra Classic fiat on/off-ramp. The independent group revealed a roadmap to burn 5 trillion Luna Classic tokens through various dApps, which should reduce supply and encourage a bullish narrative for LUNC.

We are delighted that over $2m investment has been raised from recent Terraport sales that were mainly reserved for delegators in;@TerracVita @LUNC_Italia

— TerraCVita (@TerracVita) January 16, 2023

We look forward to 2 public sales over the coming 5 weeks.

Thank you everyone for your kind support and trust in us.❤ pic.twitter.com/HSI3ikDm5C

Luna Classic bulls target $0.000194

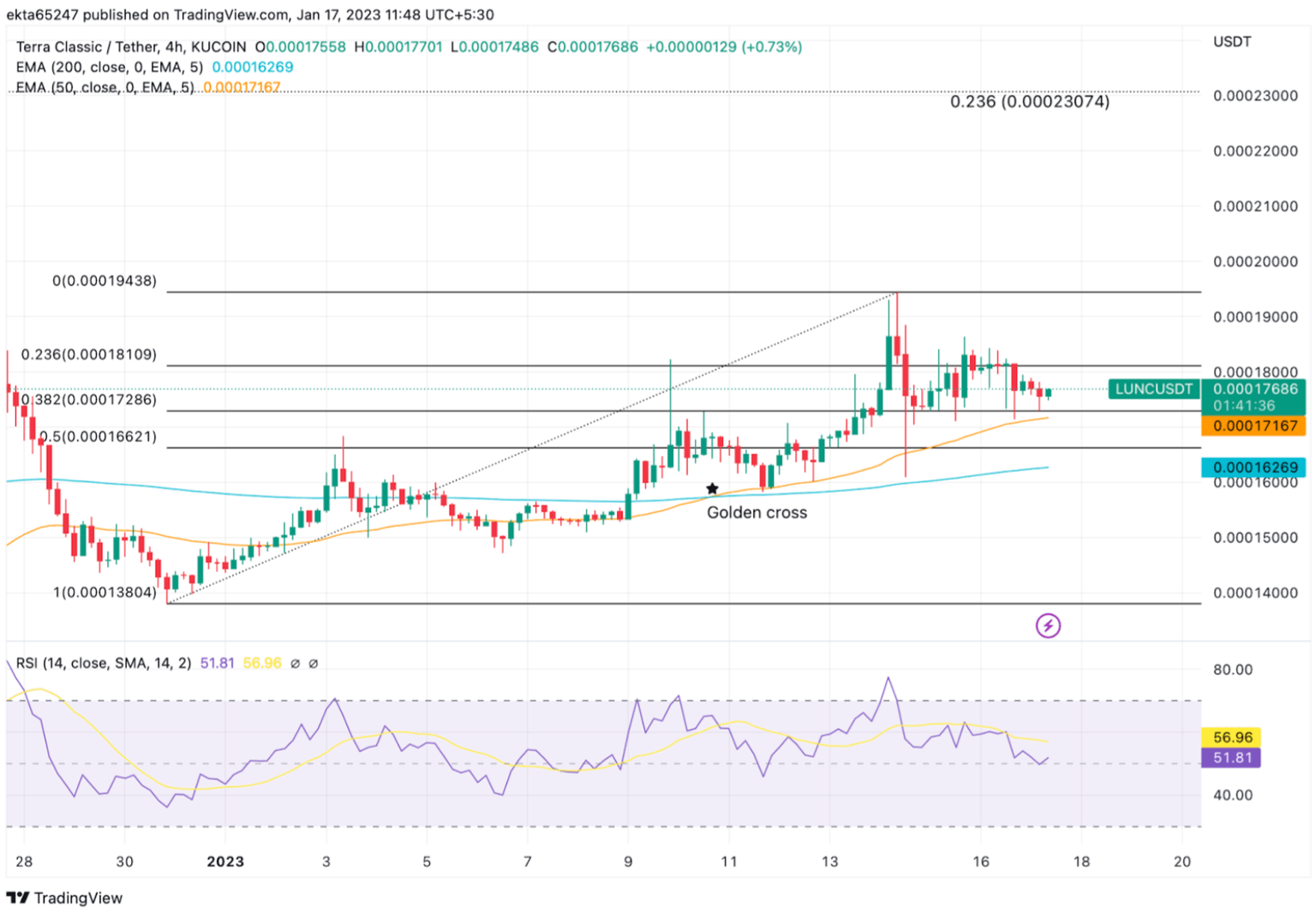

Luna Classic is currently in a long-term downtrend. On the 4H chart, the native token of the Terra ecosystem started an uptrend on January 3. LUNC price failed to bounce back from the 23.6% Fibonacci retracement level at $0.000181 and the token is expected to recover from support at 38.2% Fib retracement $0.000172.

As seen in the chart below, a recovery from this level could push LUNC on the path to its $0.000194 target.

LUNC/USDT price chart

The Relative Strength Index (RSI), a momentum indicator, is currently at 51.81, as seen in the chart above. The asset is in the neutral zone and there is room for recovery. The downtrend lacks underlying strength, coupled with the recent appearance of a “Golden Cross” on LUNC price chart, this could be a bullish sign for the token. A Golden Cross occurs when the 50-day Exponential Moving Average crosses above the 200-day EMA.

A decline below the 38.2% Fib retracement could invalidate the bullish thesis for LUNC price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.