LUNA almost invalidates a 229% rally as “extreme fear” latches on to the market

- In the last four months since its launch, the response to Terra LUNA 2.0 has improved, but the lack of users continues to be an issue.

- During the week ending September 19, South Korean authorities even asked Interpol to issue a red notice against LUNA founder Do Kwon.

- Persisting fear in the market has slowed down the recovery, leaving LUNA to fall to $2.68.

The Terra ecosystem, which at its peak was the second biggest Decentralised Finance (DeFi) network in the world, shook the crypto market after its collapse. Since then, despite being revived, Terra LUNA 2.0 has been unable to recapture even a fraction of the market it once held.

LUNA goes down

After achieving an almost 230% rally over the course of three days, LUNA began slipping back down on the charts. Within ten days, LUNA trickled down from trading at $6 to trading at $2.7 at the time of writing. This 54.41% decline singlehandedly wiped out most of the growth noted towards mid-September.

But this is not where LUNA would draw the line as the price indicators are actively highlighting further price drawdown. The MACD, which executed a bearish crossover in the same duration as the price fall, is currently heavily bearish, as noted by the red bars.

The conditions are similar on the Squeeze Momentum Indicator, where LUNA being in an active squeeze is noting similar bearishness.

The reason behind this can attribute to two factors. Particular to Terra itself, the first being its co-founder, Do Kwon. Recently, South Korean authorities requested Interpol to issue a red notice against the founder following a refusal to cooperate with the investigation of the Terra ecosystem collapse.

In response to the same, Do Kwon recently tweeted that the allegations weren’t accurate as he was being cooperative.

I am not “on the run” or anything similar - for any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide

— Do Kwon (@stablekwon) September 17, 2022

The market sees no out

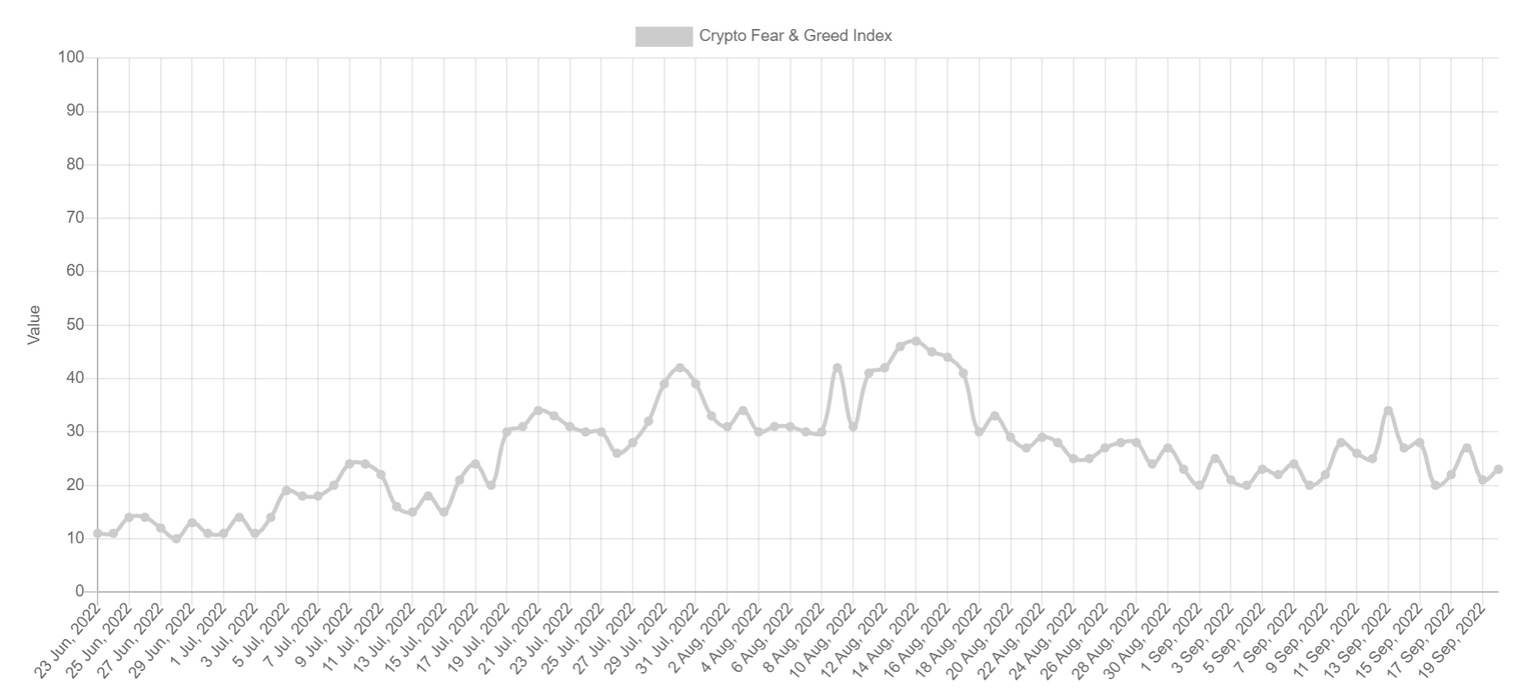

The second and equally critical factor is the “extreme fear” that has been at the core of the crypto market for approximately a month now. The Crypto Fear and Greed Index shows that attempts to escape this zone have not been successful, leaving investors unsure of where the market could be headed, sustaining the Fear.

Since this Fear also has an impact on the broader market, LUNA could start rising again once the said Fear dissipates.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.