- LUNA 2.0 price has made a comeback from its recent slump and started a recovery overnight.

- Do Kwon could face civil penalties, fines from regulators and lawsuits, instead of prison time.

- Analysts identify rising channel formation in LUNA 2.0 price chart, predict a continuation of Terra’s uptrend.

LUNA 2.0 price started its recovery after the bloodbath as Korean authorities revealed prison time may be unlikely for Do Kwon. The Terraform Labs CEO could instead be hit by fines and penalties from regulators and lawsuits from investors, on account of the colossal UST and LUNC (previously LUNA) crash.

Also read: These are the top investors that remain bullish on Terra’s LUNA 2.0 price

LUNA 2.0 price initiates recovery

LUNA 2.0 price has bounced back, posting over 3% gains overnight. Since its debut on May 28, LUNA price witnessed wild swings across exchange platforms Kraken, OKX and Binance. Despite the volatility in LUNA 2.0 price, the new Terra token has started its recovery.

The volatility in Terra’s new token and the lack of liquidity were the two key factors driving LUNA price lower. However, LUNA 2.0 is on track to recover.

@FatManTerra, a whistleblower from the Terra community forum recently told his 62,600 followers,

Feel free to make money on LUNA 2 - I have a bunch of LUNA 2 - I'm not stopping you - all I'm doing is posting information about the Terra project that I believe the public (and investigators) deserve to know.

The whistleblower holds the new Terra token and believes in LUNA 2.0, while raising questions and concerns on the colossal crash of TerraUSD (UST) and LUNC (previously LUNA).

Do Kwon may not face jail time, hit by penalties

The Terra community demanded prison time for Do Kwon, after UST’s de-peg and the crash of sister tokens LUNA and TerraUSD. Discord and Reddit forums were filled with outrage from LUNC and UST holders asking for justice and jail time for Do Kwon.

South Korean authorities have continued their investigation into Do Kwon’s activities. The 30-year-old South Korean was the founder of the algorithmic stablecoin project that imploded and wiped out nearly $40 billion in market value.

In the United States, Federal prosecutors and ex-senior counsel for the Securities & Exchange Commission told CNBC that it may be challenging to press criminal charges on Do Kwon. Proving intent to defraud is a challenge, however, Do Kwon is likely to face civil penalties, fines from regulators and authorities and lawsuits from investors. The collapse of UST was Kwon’s second failed attempt at launching an algorithmic stablecoin, his first attempt resulted in losses in the range of tens of millions of dollars, in Basis Cash.

Do Kwon could be hit by penalties like injunctions, disgorgement (returning gains), or fines based on the amount of the loss. This could imply Kwon pays fines in tens of billions of dollars that were wiped out in the de-peg and the market crash that followed. Kwon has a complicated history with the US SEC as the Terraform Labs CEO has dodged a few subpoenas and filed a motion opposing the regulatory body.

Binance, Kraken, FTX supported LUNA 2.0, Terra revival plan

While experts argue that success of LUNA 2.0 means there is a chance for institutional and retail investors to recoup their losses, there was no backstop from the Federal Deposit Insurance Corporation (FDIC). The only chance at redemption for holders of LUNC and UST is LUNA 2.0 airdrop.

Lightspeed Venture Partners, Coinbase Ventures, Three Arrows Capital and Jump Crypto, the major backers of Terraform Labs, bought into LUNA 2.0. Changpeng Zhao (CZ), CEO of the world’s largest cryptocurrency exchange and Jesse Powell, CEO of Kraken have also put their weight behind LUNA 2.0.

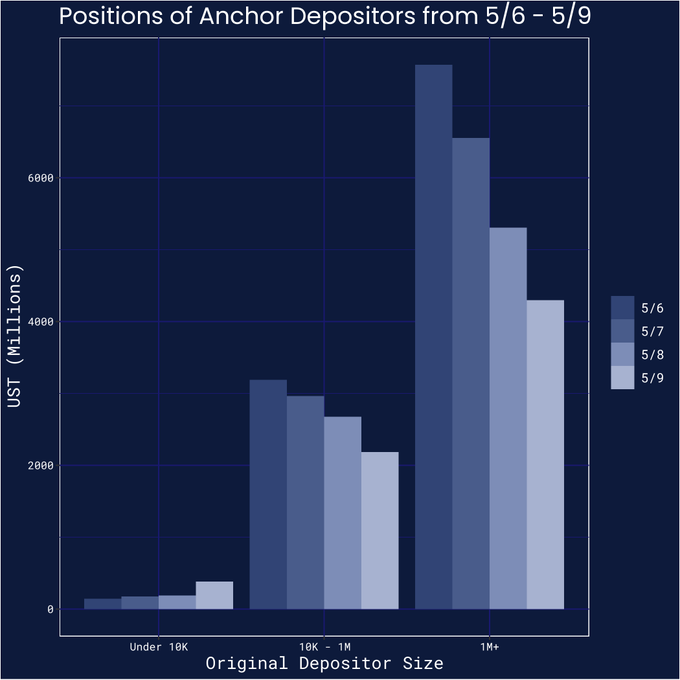

Jump Crypto finally completed the ongoing investigation in the UST de-peg and revealed insights of the crash. Retail investors were left holding massive bags of UST while large depositors and Terraform Labs withdrew liquidity from the UST/3CRV pool on May 7.

5/ Large depositors disproportionately drove the outflows. In fact, small depositors increased their exposure during this episode. pic.twitter.com/xTPXp9b7YW

— jump_crypto (@jump_) June 3, 2022

Positions of Anchor Depositors from 5/6 to 5/9

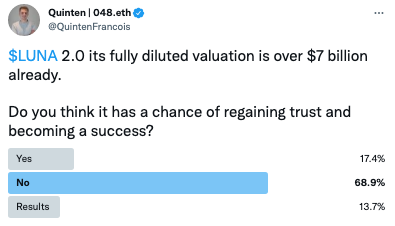

Quinten Francois, a crypto investor and advisor, turned to Twitter to ask his 78,500 followers if Terra has a chance of regaining trust and becoming a success after LUNA 2.0 crossed nearly $7 billion in fully diluted valuation. Nearly 69% respondents believe it is unlikely for Terra to regain trust in the crypto community with LUNA 2.0.

LUNA 2.0 poll

Analysts predict uptrend in LUNA 2.0 price

Cryptocurrency analysts at PUMPMaps have evaluated the LUNA 2.0 price trend and noted that the token has broken the triangle up. LUNA 2.0 price is forming a rising channel. Terra price may correct from the upper border of the channel, it is likely to continue its uptrend.

LUNA/USDT chart

Akash Girimath, leading cryptocurrency analyst at FXStreet, believes it is a good bet to buy LUNA 2.0 token after its airdrop. For more information on LUNA 2.0 bullish potential watch this video:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.