Bitcoin trading above the 50-day simple moving average is a bullish indicator for the bitcoin price and many long-term holders are taking note.

As a retail trader or someone who just got started with bitcoin not long ago, you may be searching for clues about what to expect next with its price. A second opinion is also important for seasoned bitcoin investors to compare their own perspectives.

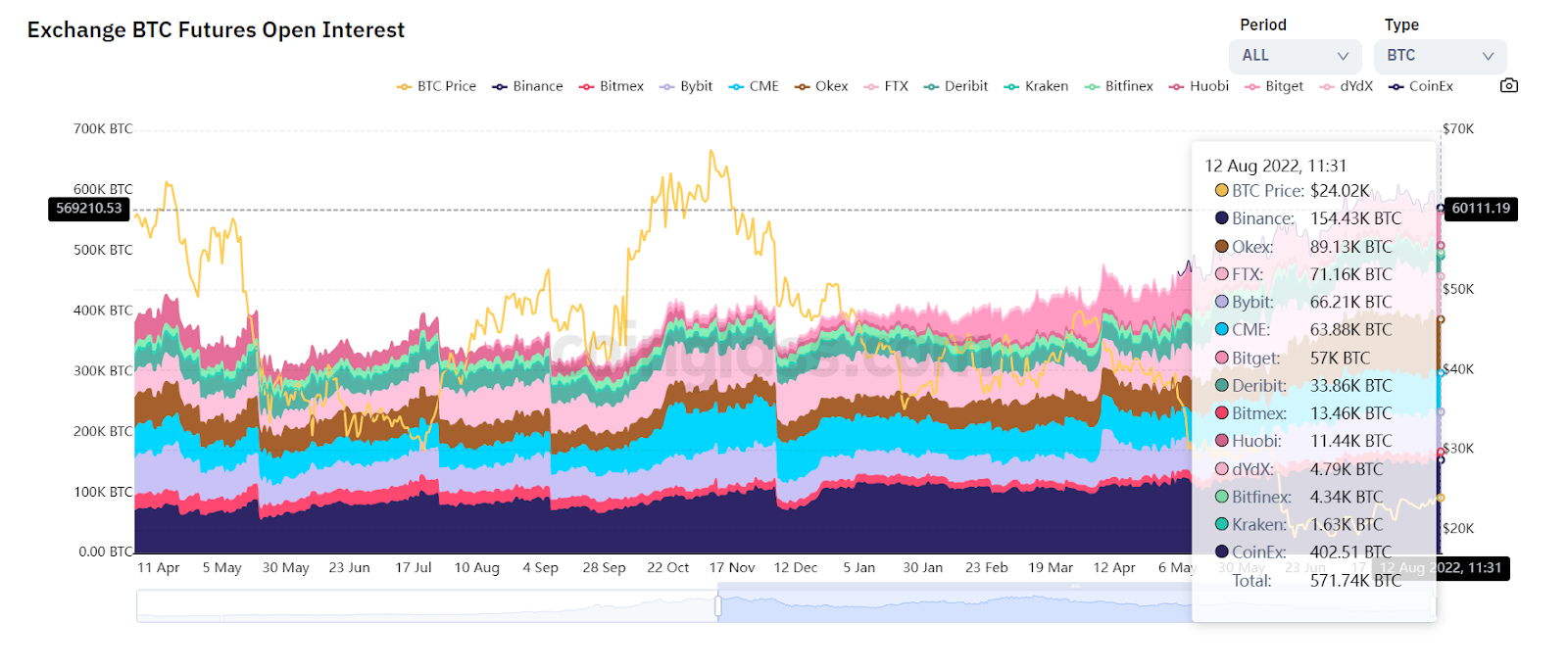

Analyzing BTC futures open interest

Bitcoin open interest provides insight into how much money is flowing into and out of the bitcoin derivatives market. Derivatives like bitcoin futures and perpetual swaps are used by traders to speculate on whether bitcoin's price will rise or fall without having to own the digital asset. A higher bitcoin open interest means more traders have opened positions, while a lower one means more traders have closed them.

As of writing, bitcoin-denominated open interest had increased to 571,000 BTC from around 350,000 BTC at the start of April 2022. A look at the bitcoin denomination can help isolate periods of increased leverage from price fluctuations.

Source: Coinglass.com

In USD terms, current open interest is $13.81 billion, which is relatively low, comparable to early bull market levels in January 2021 and June 2021 sell-off lows.

Whenever there is a large increase in open interest on a BTC basis, but not on a USD basis, that signals markets are taking on more BTC exposure, but still don't expect it to move much.

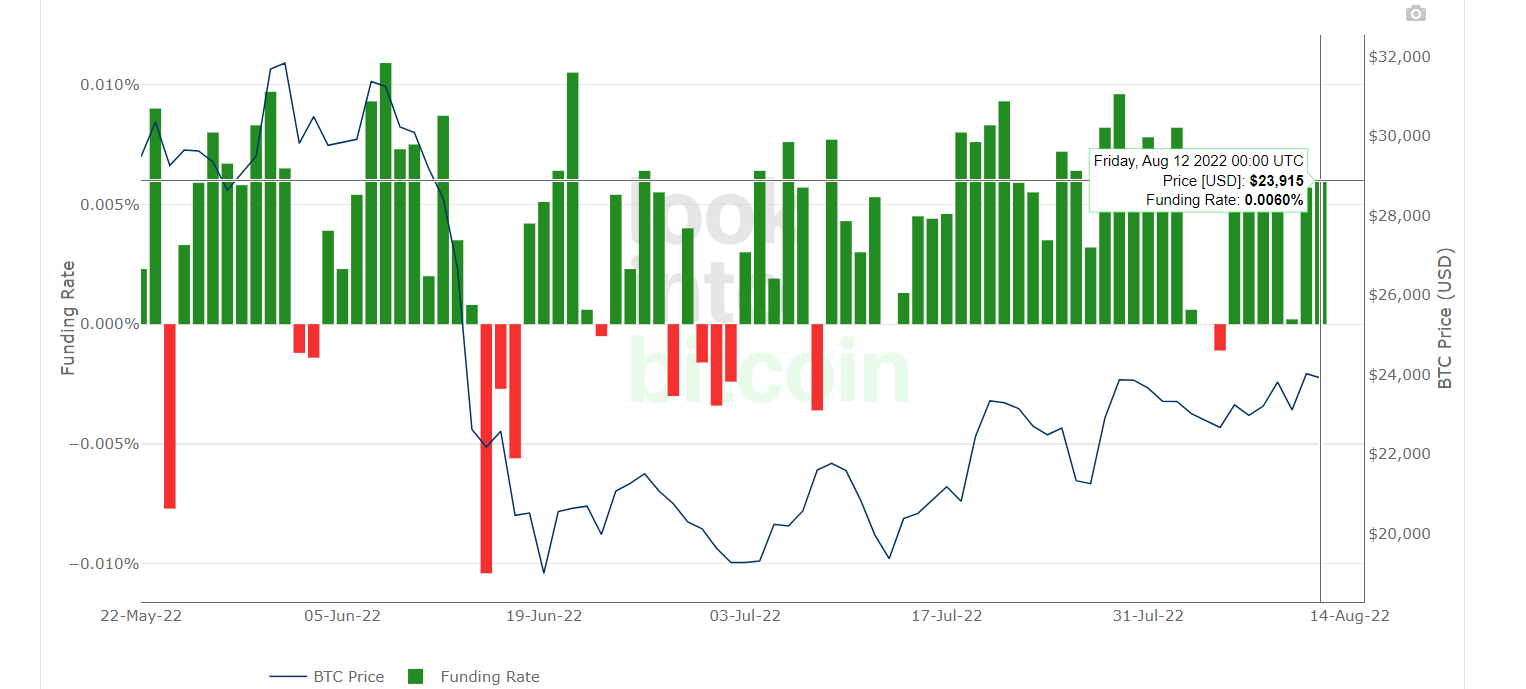

Funding rates rise for perpetual swaps

In order to understand how most traders are positioned in the market, we can look at funding rates used on perpetual swap contracts: derivative financial contracts unique to bitcoin and cryptocurrency that have no expiration date or settlement. They allow traders to use leverage — up to 100x — when betting on the price of bitcoin. A funding rate is a periodic payment made to or by a trader who is long or short based on the difference between the perpetual contract price and the spot price.

Generally, we can say that positive funding rates indicate traders are taking long positions and are generally bullish about the price moving upward, whereas negative funding rates indicate traders are usually taking short positions and are generally bearish, believing the price will move downward. Funding rates breaking above 0.005% signal increased speculative premium, a trend that is currently occurring.

Source: LookintoBitcoin

The Bitcoin price is above its 50-day simple moving average

Analysts like myself who use technical analysis charts and patterns to make investment decisions note that Bitcoin is currently trading above its 50-day simple moving average (SMA), an effective trend indicator, for the first time since mid-July. This confirms that underlying momentum may be building.

Source: TradingView

Long-term holders see Bitcoin as an appealing risk/reward investment

Below is another chart that visualizes how long-term BTC holders feel about bitcoin relative to its price. Bitcoin's long-term holders are generally better at identifying the best time to buy and sell bitcoin. This is not surprising, since they have more experience in the field than newcomers who are just getting started. It is important to recognize when they are confident that the number one cryptocurrency will rise in price in the future.

Source: LookintoBitcoin.com

The reserve risk chart is currently in the green zone, meaning a high level of confidence combined with a low price, making bitcoin an attractive risk/reward investment. Investors who invest during green reserve risk have historically enjoyed high returns over time.

Conclusion

Market perceptions of various savvy market participants, who have traditionally been smart in making their investment decisions, show that they are increasingly confident about the future of bitcoin price and are willing to take on more price risk. There is a cautious upward bias in bitcoin derivatives markets and long-term investors appear to be fairly confident. The bitcoin price is also showing signs of improvement based on technical indicators.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637959018712845972.png)