LTC holders' loyalty prevails even as Litecoin price loses key support level

- Litecoin price has declined by more than 10% in the last four days, missing the opportunity to reclaim $100.

- LTC holders are still bullish on the altcoin as instead of offloading to prevent losses, they have held on to the point where they have joined the mid-term holder cohort.

- This bullishness is mostly led by retail investors who have been conducting more transactions than whales since recovery began.

Litecoin price is amongst the biggest losers at the moment as the market seems to be correcting, with Bitcoin losing the support of $30,000. LTC, however, has been declining for a while now, which raised some concerns regarding potential selling at the hands of its investors. Surprisingly, they had quite the opposite reaction.

Litecoin price dips significantly

Litecoin price trading at $82 is down by nearly 7% in the last 24 hours, with many other altcoins following suit. While most of the cryptocurrencies were moving sideways for the last few days, LTC was declining slowly but surely. In the span of four days, this silver to Bitcoin's gold ended up falling by over 10%.

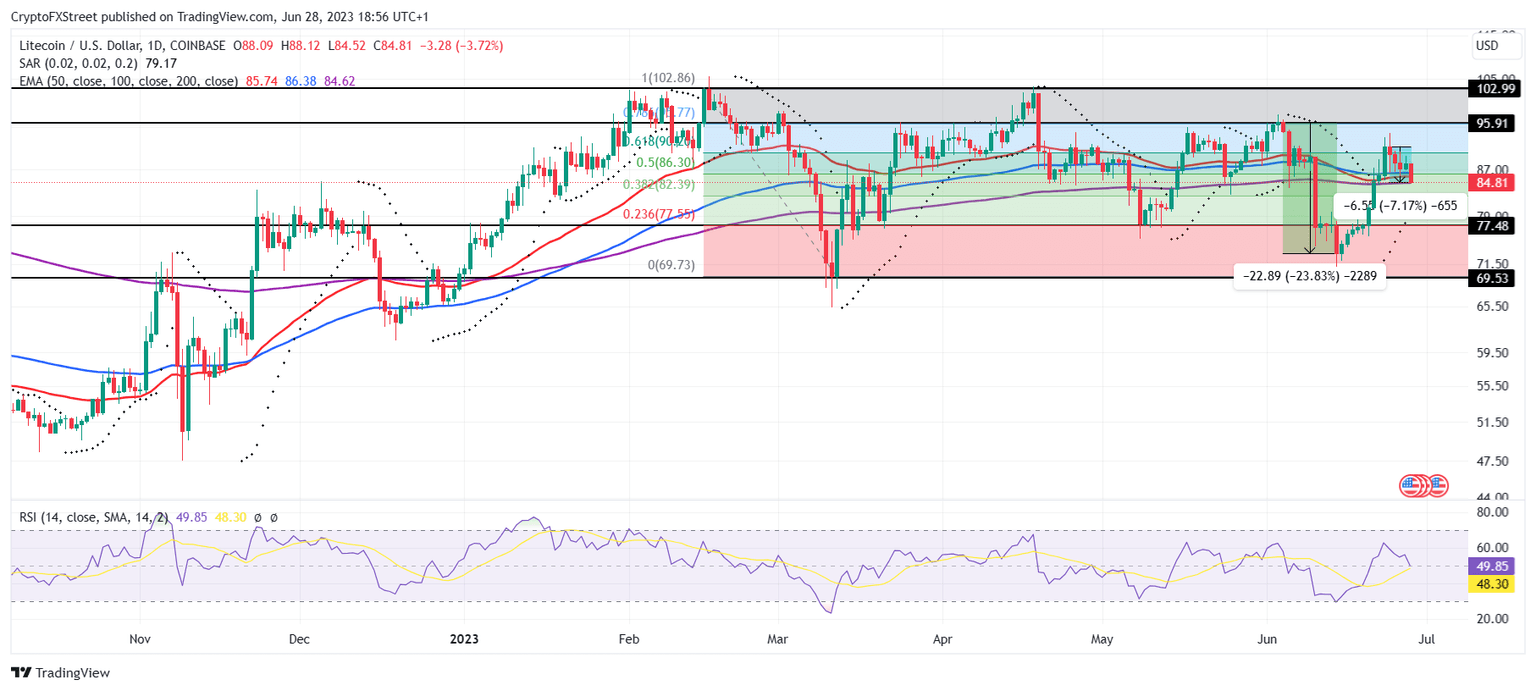

This decline pulled Litecoin price back from reclaiming the $100 mark, which is not only a critical psychological support level but also the bounce pad for LTC to register new 2023 highs of $104. The drawdown over the last few hours further led to the altcoin losing the support of the 200-day Exponential Moving Average (EMA) after having already lost the 50- and 100-day EMAs.

LTC/USD 1-day chart

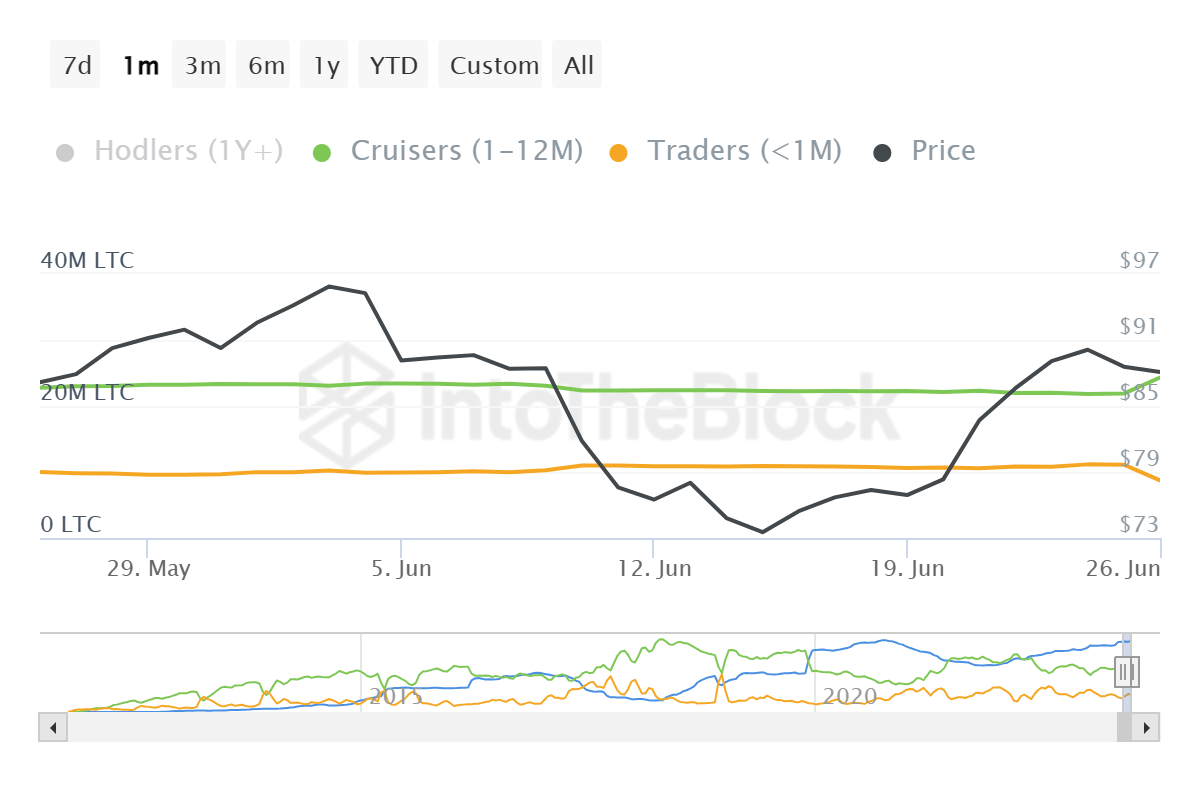

Interestingly, none of this triggered the investors to safeguard their investment and sell for whatever profit they could after the initial red candlestick. Instead, they chose to hold on to the point where over 3 million LTC shifted from the hands of short-term holders to mid-term holders.

This means that the investors that bought these 3 million LTC have been undeterred for the past month and will most likely stay that way until they make some solid profits. Hence their reluctance to let go.

Litecoin supply distribution

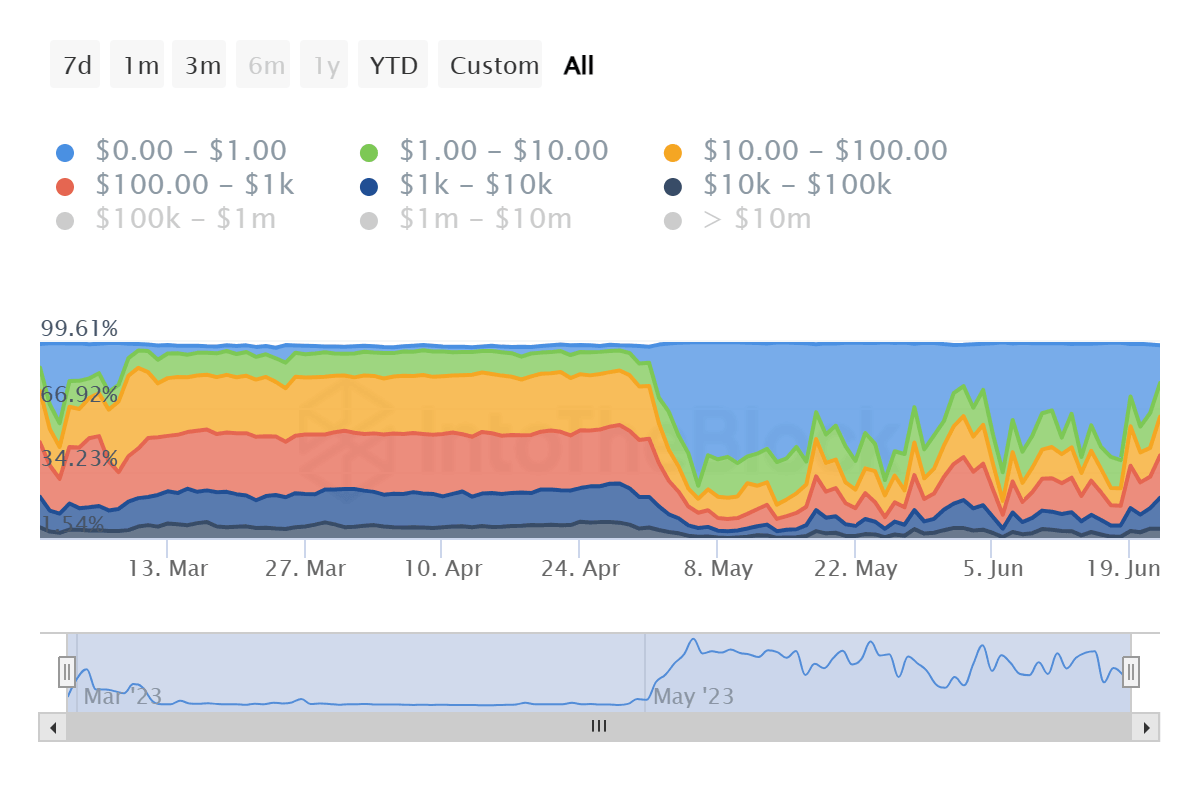

Moreso, this HODLing is sincere and will remain this way until LTC hits a new high, as it comes from retailers and not whales or large wallet holders. The distribution of transaction value indicates that since Litecoin price began recovering on June 15, transactions worth $10 to $10,000 noted the most increase.

Litecoin transactions by amount

Their collective contribution to the market rose from 22% to 58% at the time of writing. Thus, if Litecoin price has an opportunity to bounce back, it would only be possible with the support of the retail investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.