Loopring (LRC) and yEearn Finance (YFI) surge after Coinbase listing, before facing bearish correction

- YFI’s Coinbase listing has given it great credibility among the investors.

- LRC faces strong resistance levels and lacks healthy support, so further price drop is expected.

Coinbase Pro, the professionally-oriented arm of Coinbase exchange, has announced the listing of Loopring (LRC) and yEarn Finance (YFI) tokens.

yEarn Finance

YFI, the yEarn Finance token, will list on Coinbase Pro, with trading scheduled to begin on September 15. The very fact that YFI was even enlisted has given it some unprecedented credibility. Since July, Coinbase has been on a DeFi listing spree. Coins like Band, Kava, UMA, etc., have all been recently listed on Coinbase.

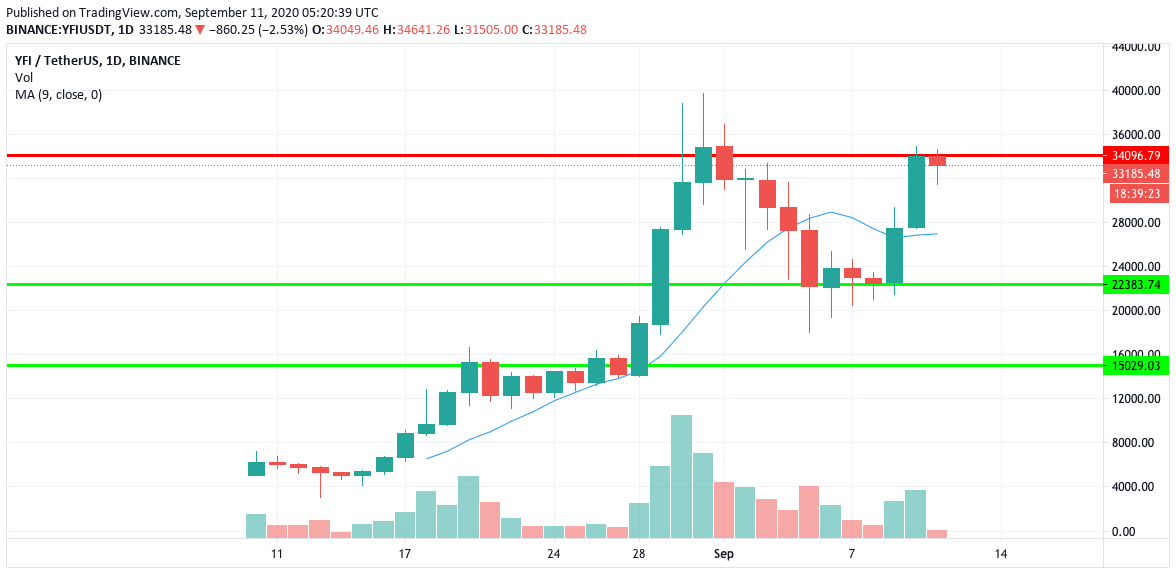

YFI/USD daily chart

Following the listing, YFI/USDT went up from 27,468.27 to 34,096.79. Since then, the bears have stepped back in the early hours of Friday to take the price down to 33,045.88. The 21,622 support level needs to hold strong to prevent any potential price crash.

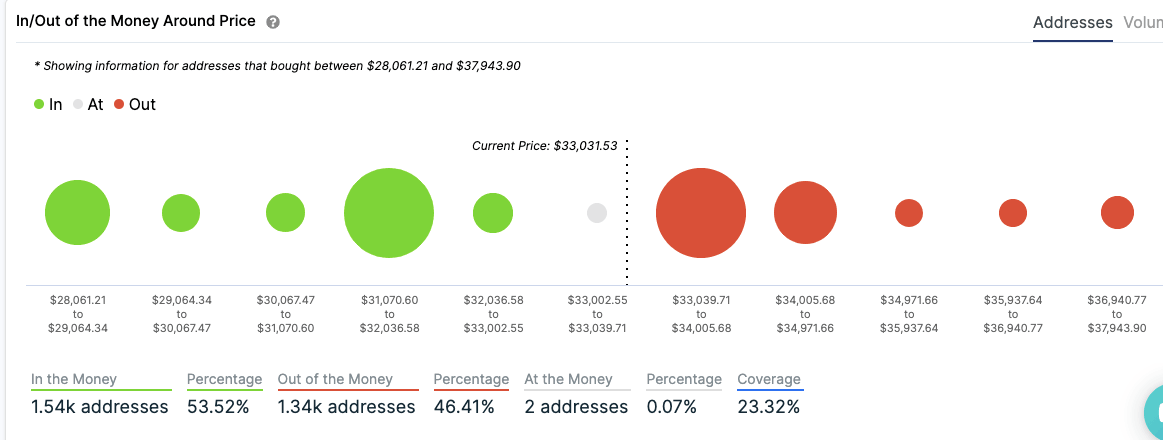

YFI IOMAP

YFI can drop to 32,036.58 before it encounters healthy support. On the upside, the price only has the space to go up to 33,039.70 before it encounters strong resistance.

Loopring

Coinbase Pro will start accepting inbound transfers of LRC on September 14, triggering the first step of its traditional four-step listing process. Loopring is a Shanghai-based exchange that allows users to send ERC20 tokens on the Ethereum blockchain via zkRollup – a layer-two scalability technique.

LRC/USDT daily chart

Following the listing news, LRC/USDT went up from 0.2063 to 0.2552 this Thursday. The bears have currently corrected the price to 0.237 as it sits on top of the 0.2366 support line. In the process, the price has re-entered the 20-day Bollinger band, showing that it’s no longer overvalued.

LRC IOMAP

The IOMAP paints a pretty bleak picture for LRC. There are no healthy support levels so LRC can potentially crash to $0.1979. The price has no room to grow on the upside as it immediately faces a strong resistance level.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637353998784013102.png&w=1536&q=95)