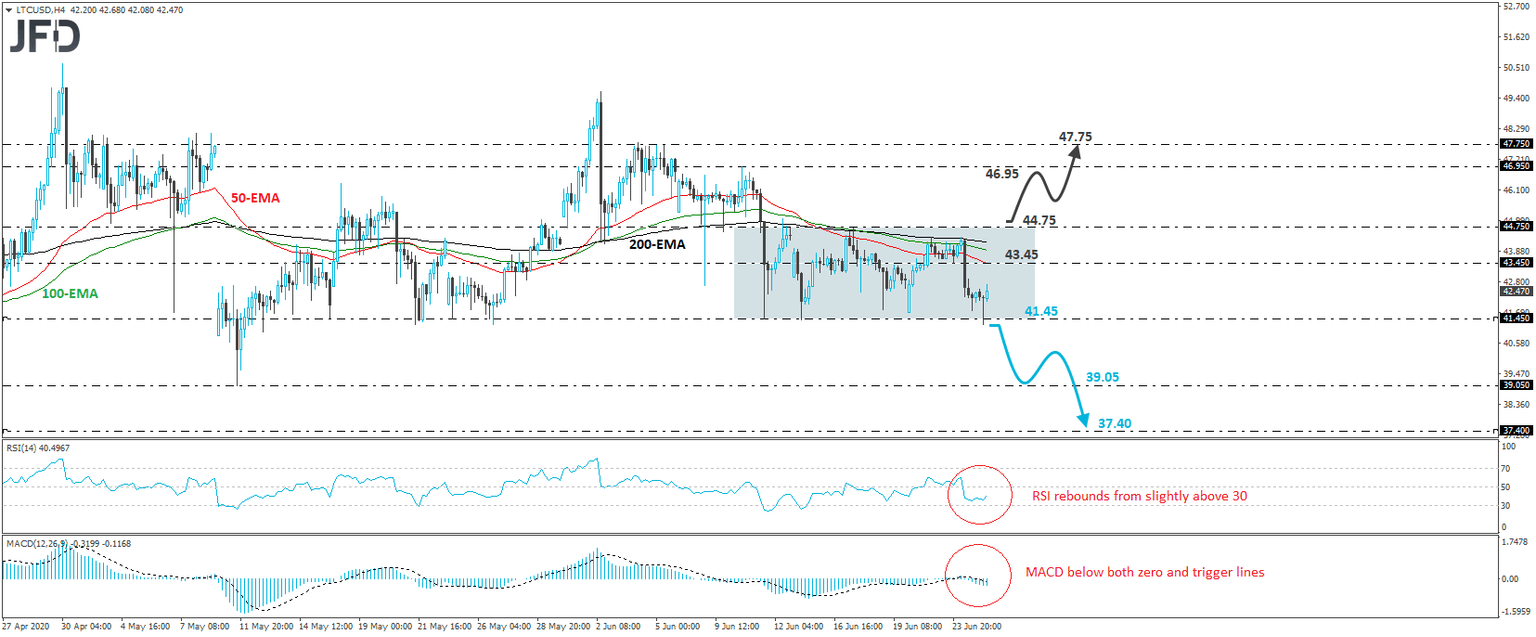

Litecoin trades in a sideways manner

LTC/USD traded somewhat higher on Thursday, after it hit support slightly below the 41.45 level, which has been acting as the lower boundary of the sideways range, the crypto has been trading within since June 11th. The upper end of that range is seen at around 44.75. With that in mind, as long as the price oscillates between those barriers, we prefer to stay sidelined.

What could open the door to a large round of declines may be a decisive dip below 41.45, the lower end of the range. Such a move would confirm a forthcoming lower low and may encourage the bears to shoot for the low of May 11th, at 39.05. If they are not willing to give up around that area, a break lower may trigger extensions towards the low of April 16th, at 37.40.

Turning our gaze to our short-term momentum studies, we see that the RSI stands below 50, while the MACD lies below both its zero and trigger lines. Both indicators detect negative momentum, but the RSI has turned up after it hit support slightly above 30. This enhances our choice to stay flat, as there is decent chance for Litecoin to trade for a while more within the sideways range before its traders decide through which side they should exit.

If the bulls prove stronger than the bears, and manage to push the action above 44.75, the range’s upper end, the gate towards the peak of June 10th, at 46.95, may be opened. A test and, eventually, a break of that hurdle could be the greenlight for climbing slightly higher, perhaps near the 47.75 zone, which provided strong resistance on June 4th and 5th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD