Litecoin “Silver to Bitcoin's Gold”

Litecoin is considered one of the earliest alternative cryptocurrencies to Bitcoin and is sometimes referred to as "silver to Bitcoin's gold." Litecoin is a peer-to-peer cryptocurrency created in October 2011 by Charlie Lee, a former Google engineer, and designed to improve upon some of the limitations of Bitcoin, providing a faster and more efficient cryptocurrency.

Litecoin has consistently been one of the top cryptocurrencies by market capitalization. While it has faced competition from numerous other cryptocurrencies over the years, it has maintained its position as one of the prominent altcoins.

Faster block generation

Litecoin is based on the open-source Bitcoin protocol but has several technical differences. One notable difference is the hashing algorithm used for mining. While Bitcoin uses SHA-256, Litecoin uses a different algorithm called Scrypt, allowing faster block generation.

Thus, it has a faster block generation time compared to Bitcoin. While Bitcoin's average block time is around 10 minutes, Litecoin has a target block time of 2.5 minutes. This faster block time enables quicker transaction confirmations. The total supply of Litecoin is capped at 84 million coins, four times the supply of Bitcoin, which, as is known, has a maximum limit of 21 million. Why 84 and not 21 million? Because in 10 minutes, four blocks of Litecoin come out instead of one of Bitcoin.

Mining

The mining process in Litecoin, as in other cryptocurrencies, is crucial in maintaining network security and achieving consensus. Miners compete to find valid hashes, and once a block is mined and added to the blockchain, it becomes part of the immutable ledger. Mining in Litecoin follows a similar concept to Bitcoin mining but as already mentioned, uses a different hashing algorithm called Scrypt, which is more memory-intensive than Bitcoin's SHA-256 algorithm.

The Litecoin network adjusts the mining difficulty level every 2016 blocks (approximately every 3.5 days) to maintain an average block generation time of around 2.5 minutes. If blocks are being mined too quickly, the difficulty increases, making it harder to find a valid hash. Conversely, the difficulty decreases if blocks are mined too slowly, making it easier to find a valid hash.

When miners successfully mine a new block, they are rewarded with a certain number of Litecoins as a block reward. Initially, the block reward was 50 Litecoins, but it reduces by half through a process called halving. As of the most recent halving in August 2019, the block reward stands at 12.5 Litecoins per block. This reward serves as an incentive for miners to contribute their computational power to secure the network.

Halving in Litecoin

Halving in Litecoin occurs every 840,000 blocks, which is roughly equivalent to four years based on the target block time of 2.5 minutes. The first Litecoin halving took place on August 25, 2015, and subsequent halving occurred on August 5, 2019, while in a few weeks, on August 04, 2023, we will once again have the halving phenomenon.

The primary purpose of halving is to control the issuance rate of new Litecoins and manage inflation. By reducing the block reward, halving gradually decreases the rate at which new Litecoins are introduced into circulation, ultimately leading to a maximum supply of 84 million Litecoins.

Expectations for Litecoin

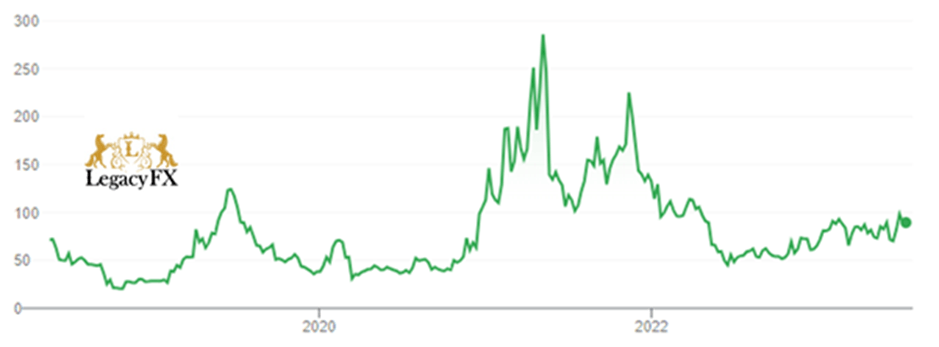

Halving events often generate interest and anticipation in the cryptocurrency community, as they are seen as significant milestones. The reduction in the rate of new Litecoin issuance, coupled with the increasing demand, can potentially lead to scarcity, which, in turn, may positively impact Litecoin's price.

This, coupled with data from on-chain analytics company Santiment, which shows that the total number of large Litecoin wallets, i.e. Litecoin addresses with at least 10,000 coins, has increased in recent months, is likely to attest to Litecoin's upward trend. It is also noteworthy that 64% of Litecoin holders are profitable, as on-chain data shows.

All of the above may suggest that the upward slope of the past few months may develop into a strong uptrend that is likely just around the corner.

Author

Nikolaos Akkizidis

LegacyFX

Mr Nikolaos Akkizidis is an economist, with 20+ years of experience in multiple roles in the financial sector.