- Litecoin price tumbled below the $100 mark on Thursday, as crypto strategic reserve discussions dominate market discourse.

- With $38 million LTC short leverage far outpacing the $11 million active long positions, bears could exert further downward pressure.

- Technical indicators suggest LTC’s next support level now lies at $85.

Litecoin price dipped below the $100 mark on Thursday, losing 22% in the past week as markets reacted to updates to US trade tariffs and speculation surrounding White House Crypto Summit to be held on Friday. With LTC traders mounting additional short leverage positions, LTC faces further downside risks.

Litecoin (LTC) falls behind ADA, XRP ahead of White House crypto summit

Litecoin’s price trajectory has turned bearish, losing momentum after an initial surge in February, when optimism surrounding a potential Litecoin ETF approval had propelled it into the ranks of top-performing assets.

However, the LTC price momentum swung downward following former President Donald Trump’s March 2 announcement of a U.S. Crypto Strategic Reserve, which prioritized five specific layer-1 blockchain assets—excluding Litecoin.

Litecoin price action, March 7

LTC price has underperformed the broader crypto market, declining in four of the consecutive trading sessions since the crypto strategic reserve announcement.

As depicted above, the persistent LTC selloff, saw price plunging to a new 30-day low of $98 on Thursday.

This breach of the critical $100 psychological support level could embolden bears in the near term.

LTC Bears deploy $38M leverage as White House confirms Ripple CEO’s attendance

Litecoin’s absence from the U.S. Crypto Strategic Reserve has prompted traders to take an aggressively bearish stance on the asset, with a notable increase in short positioning. The upcoming White House Crypto Summit—set to take place on Friday—is further accelerating this shift in market sentiment, as investors increasingly focus on assets that align with the Trump administration’s crypto policies.

FOX reports confirmed that Ripple CEO Brad Garlinghouse will attend the summit, emphasizing Ripple’s strategic importance to the administration’s crypto agenda.

The event, other high-profile figures scheduled for attendance are Coinbase CEO Brian Armstrong and Strategy’s Michael Saylor.

With discussions expected to revolve around regulatory clarity and the expansion of the U.S. Crypto strategic reserve, LTC bear traders are seeking to exert further influence.

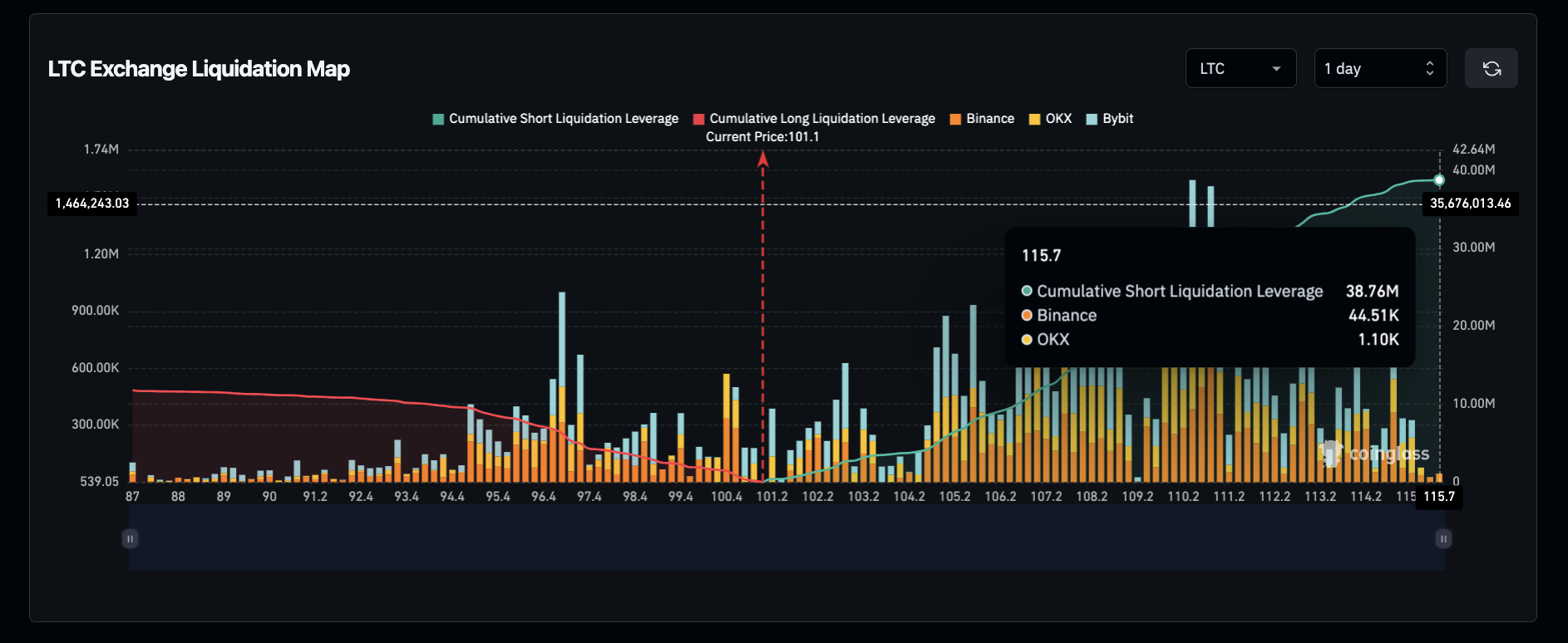

Litecoin (LTC) Liquidation Map | Source: Coinglass

Data from Coinglass liquidation maps reveals a widening gap between Litecoin’s short and long positions.

Currently, $38 million in short futures positions significantly outweighs the $11 million in leveraged long contracts, signaling strong bearish dominance.

This disparity reinforces the narrative that traders are capitalizing on Litecoin’s exclusion from key policy discussions as a short-selling opportunity.

While hopes for a Litecoin ETF approval remain intact, the White House summit and the upcoming U.S. Non-Farm Payrolls (NFP) reports are likely to dominate market sentiment in the coming days.

With LTC no longer holding above $100, the asset is now vulnerable to further downside risks.

Litecoin price forecast: Bears eye $85 retest amid extended selloff

Litecoin price has declined sharply, breaching the key psychological support at $100, as bearish momentum intensifies.

The Bollinger Bands suggest heightened volatility, with LTC currently trading near the lower band at $99.77, signaling oversold conditions.

The four-day decline erased 22.40% of Litecoin’s value, with volume rising to 7.35 million, reinforcing sustained selling pressure.

If bulls fail to reclaim support at $100, bears could extend control toward the next major support at $85, aligning with historical demand zones.

The Relative Strength Index (RSI) at 37.62 indicates that Litecoin is approaching oversold territory, but a decisive bounce remains elusive.

The RSI’s downward trajectory suggests weak buying interest, while its positioning below the 50-midpoint favors further downside.

If RSI slips below 30, Litecoin could enter a deep oversold phase, triggering a potential relief rally. However, the continued failure of the RSI to hold above its moving average at 47.60 underscores persistent bearish sentiment.

A bullish recovery hinges on a reclaim of $105, where the 20-day moving average (120.57) aligns with resistance.

If bulls regain momentum, a short squeeze could force liquidations, accelerating LTC toward $120. However, sustained selling, particularly from leveraged traders, could drive Litecoin toward $85, confirming a deeper bearish phase.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.