Litecoin price sees bulls stepping in as bears break important support on Monday

- Litecoin price sank 6% on Monday in ASIA PAC trading.

- LTC bears broke below the supportive 55-day SMA.

- Expect to see a quick turnaround in the coming US trading session with a bounce back to $92.

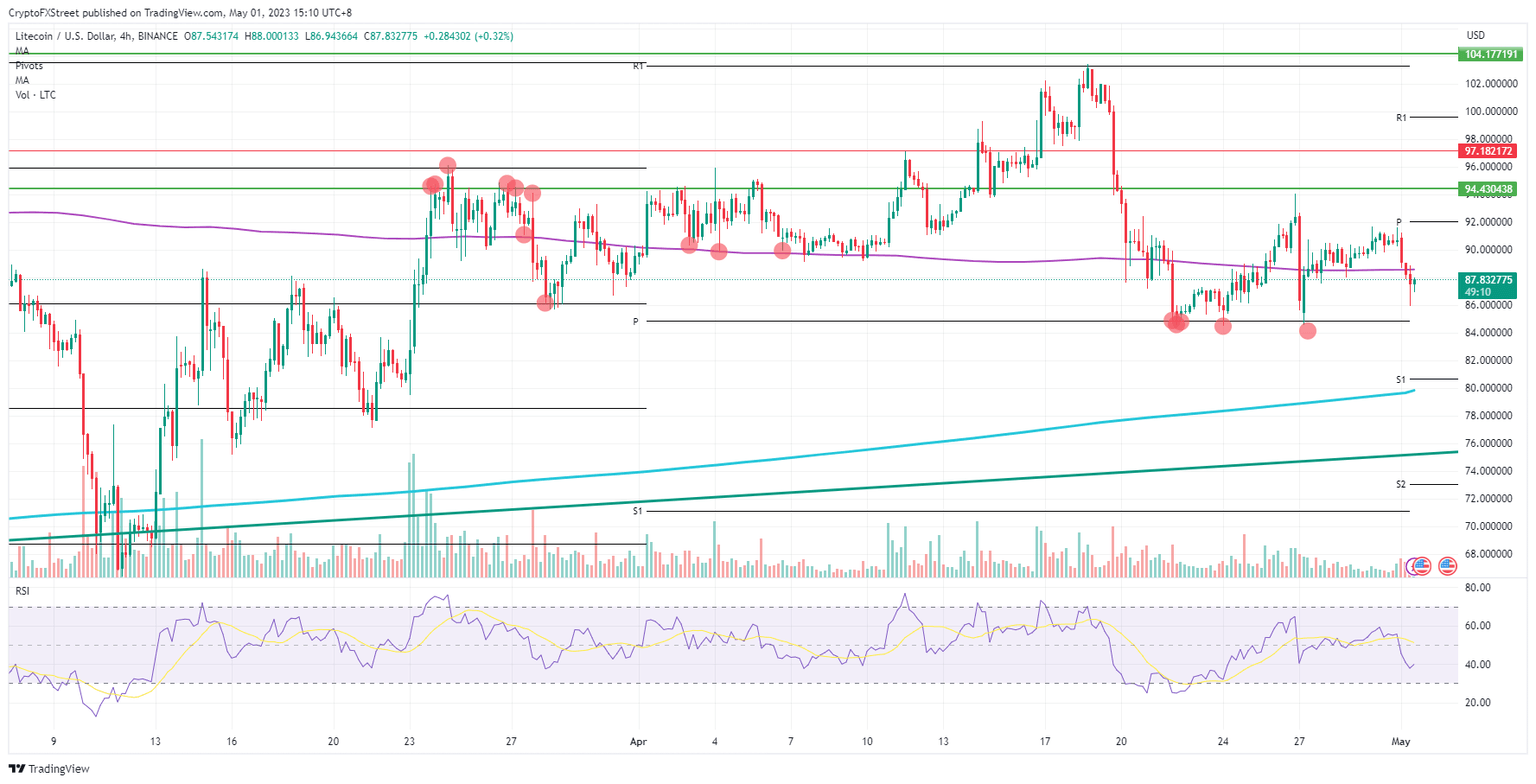

Litecoin (LTC) price slid lower on Monday once the ASIA PAC session occurred. The decline at one point bore nearly 6% measured from peak to trough. With the new month starting, new pivots have been plotted on the chart. The monthly pivot comes in as a cap at $92 and becomes the target to break to the upside.

Litecoin price has a new target to break as May gets underway

Litecoin price had a profitable weekend as price action slowly ground higher on Saturday and Sunday to close out April. Unfortunately, the ASIA PAC session came in quite hard and pushed price action quickly lower in just two candles. The 55-day Simple Moving Average (SMA) even got broken during the process, though bulls are currently trying to claw it back.

LTC should first test that same 55-day SMA around $88.50 in the hope that the support did not get turned into resistance. Should bulls be able to break above it, the next target level will be crucial. That monthly pivot for May comes in at $92 and was the high of the weekend before the sell-off started. It will be vital for the week that this area gets broken to the upside. A daily close above $92, would allow LTC to rally further this week.

LTC/USD 4H-chart

As one could read above, the risk to the downside comes with a possible rejection against the 55-day SMA. A firm rejection would see a leg lower toward $80 that breaks the triple bottom at $85 from the past few days. That means nearly a 10% loss needs to be factored in this week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.