Litecoin price rises 20% in a week, $92.67 comes in sight as LTC loyalists show resilience

- Litecoin price is up 20% since the June 14 lows at around $70.75.

- LTC could rise an additional 10% as buyer momentum grows.

- On-chain metrics show it is the work of hodlers and cruisers, not day traders, that’s keeping the altcoin on course.

- Invalidation of the bullish thesis will occur upon a daily candlestick close below $76.15.

Litecoin (LTC) price is trading with a bullish bias, featuring among the tokens that have benefited the most from the latest Bitcoin (BTC) rally. Originally designed to address developer concerns that Bitcoin was becoming too centrally controlled, the token has recorded eight consecutive green bars with more ground to cover before traders can scream ‘overbought.’

Also Read: Bitcoin Cash, Litecoin, and Ethereum Classic reap gains from Bitcoin rally

Litecoin price eyes 10% gains if investor resilience holds

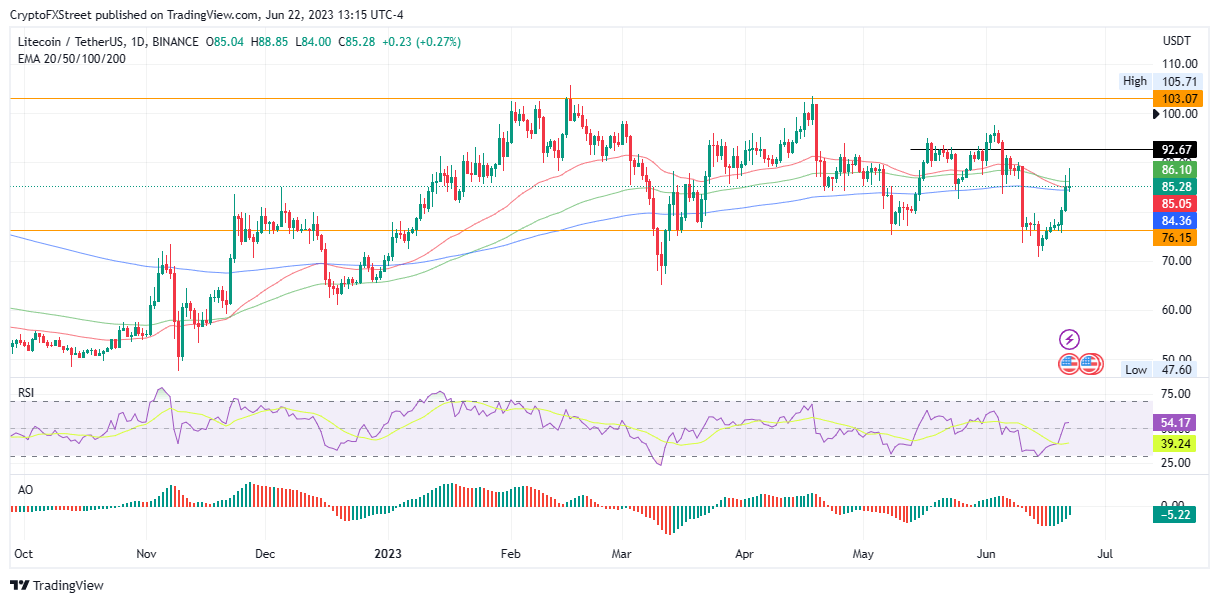

Litecoin (LTC) price is up 20% since the June 14 low of $70.75. The token shows signs of a continued rally despite facing resistance from the Exponential Moving Averages (EMA).

For more gains, Litecoin price requires buyer momentum to increase, facilitating a decisive break above the 200-, 100-, and 50-day EMA at $84.36, $85.05, and $86.10, respectively. The current market value of $85.28 comes after a premature break above these roadblocks, but LTC requires more momentum to sustain the move.

Nevertheless, the Relative Strength Index (RSI) position above 50 shows that bulls are still in control. With more ground to cover before the overbought zone at 70, there was still more room north for Litecoin price.

Similarly, the Awesome Oscillator (AO) has edged toward the midline, flashing green as bulls lead the market. A sustained bullish accumulation pattern would see the AO flip to the positive zone, bolstering the uptrend for Litecoin price.

LTC/USDT 1-Day Chart

On-chain metric, addresses by time held

Data from IntoTheBlock, specifically the ‘Addresses by Time Held’ metric, shows that long-term hodlers and cruisers are the ones responsible for Litecoin’s sustained uptrend. Between June 12 and June 22, the percentage of long-term investor addresses, composed of hodlers and cruisers, increased from 48.14% to 48.68% and 41.93% to 42.21%, respectively. Notably, this cohort of addresses has retained their coins for more than 1 year.

Long-term holders provide stability as it reduces the frequency of large sell-offs and, therefore, sudden price drops. Stability attracts more Litecoin adoption as a potential store of value.

Meanwhile, the percentage of short-term holder addresses that have held their addresses for less than one month reduced from 11.63% to 9.11%.

Conversely, If bears overpower the bulls, Litecoin price could succumb to selling pressure from the supplier congestion zone presented by the 50- and 100-day EMA. This could see LTC lose the support offered by the 200-day EMA at $84.36.

In a dire case, Litecoin price could revisit the June 20 lows around $76.15. A decisive daily candlestick close below this level would invalidate the bearish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.